Taking a step back, it feels like US indices have crammed an entire stock market cycle into just the last three months. Since early March, stock traders have gone from pricing in continued prosperity, to recession, to depression, to a potential economic recovery, to a full return back to continued prosperity (with elevated daily volatility throughout).

In particular, the last couple of weeks have shown signs of the “euphoria” phase that marks late-stage bull markets. Anecdotes abound about millennial traders making thousands in less than 24 hours, amateur day traders proclaiming their superiority to “washed up” Warren Buffett, experienced investors hashtagging their tweets with unsolicited #StockTextsFromCousin, and companies like Hertz (NYSE:HTZ) rallying 1500% despite being forced to delist from exchanges after declaring bankruptcy. If you were looking for a more textbook example of the proverbial late cycle “shoeshine boy giving stock tips,” you could hardly find a period with better examples.

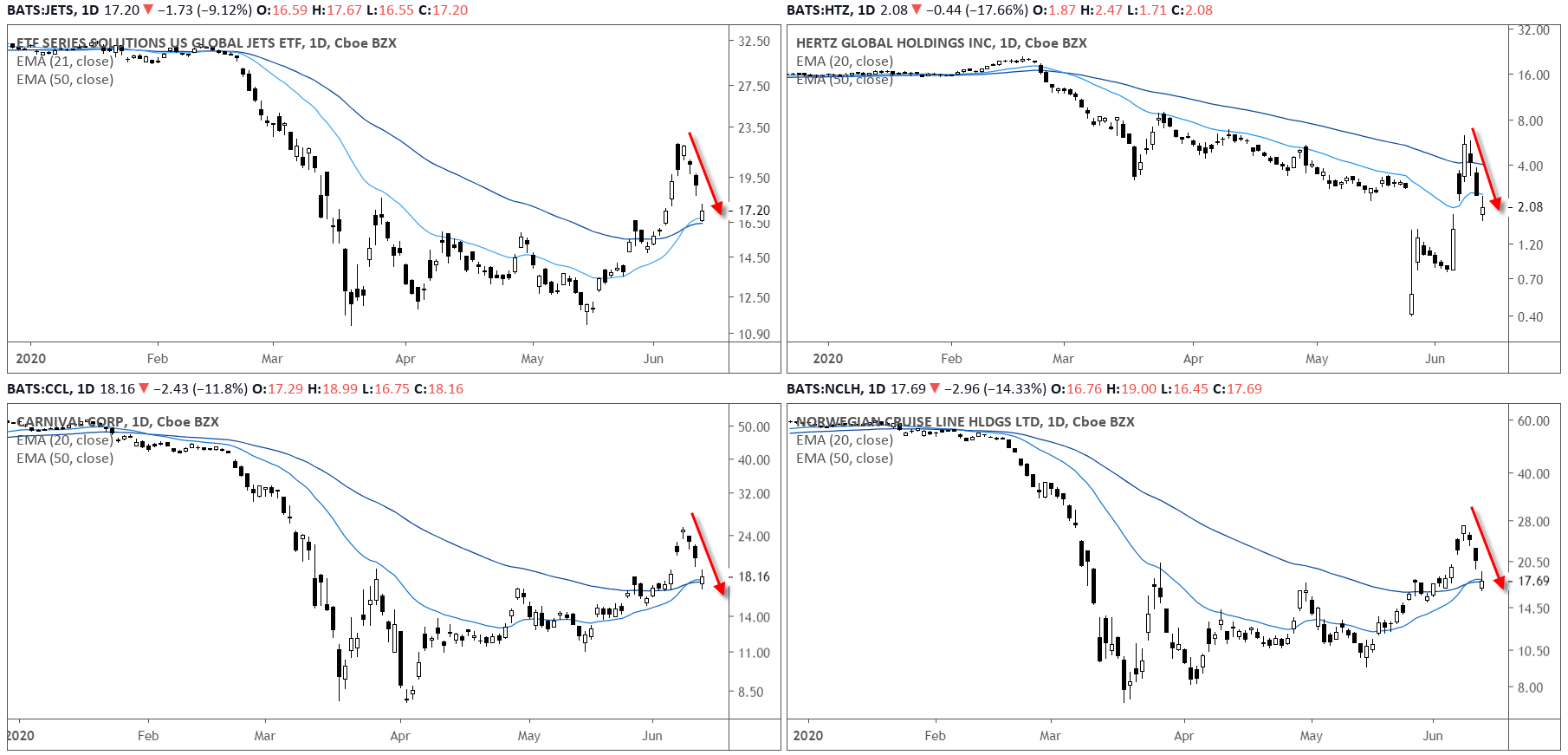

At least yesterday, that market euphoria was in sharp retreat with the widely-followed Dow Jones Industrial Average trading lower by more than 1,000 points at one point. The smaller, lower-quality names that have been surging in recent days (and that retail traders have been buying in droves) are seeing even worse performance that the broader indices:

- The popular Jets ETF (NYSE:JETS) of airline stocks is dumping -12% yesterday alone to trade back near its 50-day MA

- Bankrupt darling Hertz shed -18%.

- Cruise lines including Carnival (NYSE:CCL) and Norwegian (NYSE:NCLH) were both off by at least -15%.

That said, we’d be remiss if we didn’t note that some highly speculative names are still holding up relatively well, including beaten-down Chesapeake Energy (NYSE:CHK) (+16%), recent electric car company IPO Nikola (NKLA, +2%), and the granddaddy of high-growth speculative stocks, Tesla (NASDAQ:TSLA) (-2%) but still holding above $1,000 for the second consecutive day).

Does this mean that the retail-driven “dash to trash” euphoria is over?

It’s impossible to say definitively, but both the quantitative and anecdotal evidence suggests that the bull run may have gotten ahead of itself in recent days. There are still legitimate concerns around the global pandemic, massive civil unrest, unprecedented experiments in monetary/fiscal policy, and the simple fact that stocks have seen among their fastest, most relentless 10-week rally in history. Any of these issues (and plenty we’re not mentioning) could be the catalyst for a short-term pullback (at the minimum).

Readers who are buying the “unwinding euphoria” thesis could certainly look for short opportunities in the broader stock market indices, but the best “pure play” on this theme could be to focus bearish trades on the junkiest, most indebted companies that have seen the largest rallies in recent weeks, including JETS, HTZ, CCL, and NCLH, as we noted above.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI