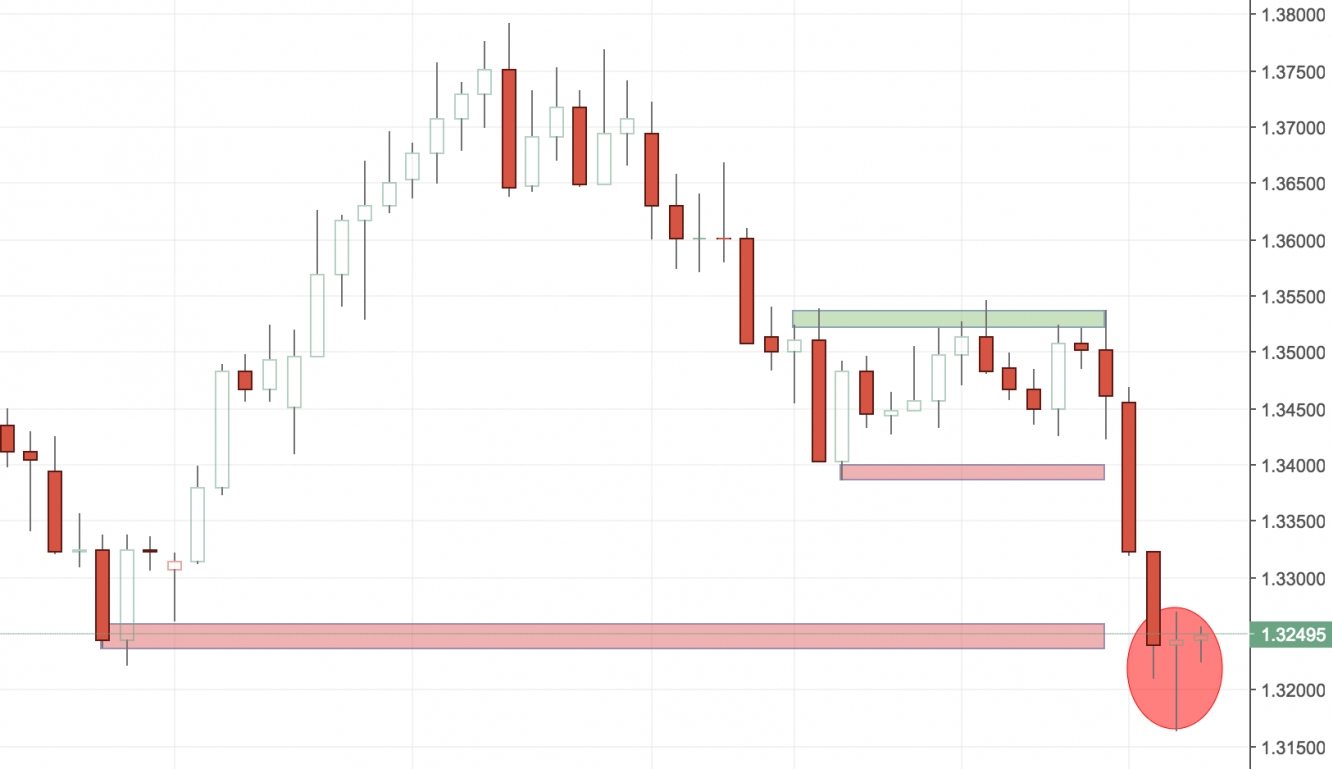

It looks like the USD/CAD is having some hard time breaking below the 1.3250 support level. There is a doji-like hesitance-implying daily candle, which is giving further indication of the general market direction. Directionless or bullish? It looks like we can see the price bouncing back to the 1.3400 area. In case we see a break below the 1.3170 level, we might see a free-fall down to 1.3000.

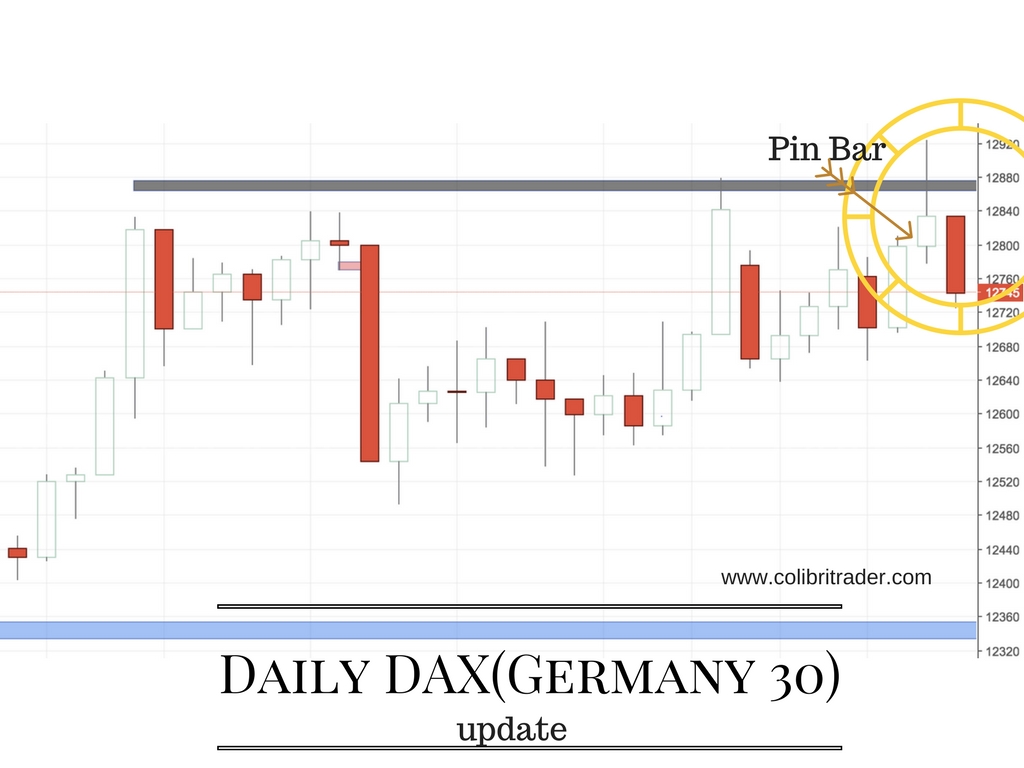

There is a bearish engulfing pattern on the DAX 4H chart. It looks like we might have hit a stronger resistance area than expected. Beware of the daily pinbar, as well. The sell-off has started already. Let’s see how far it can go.

The way I see it is that this move can extend down to 12,500-12,350. We might see a small correction before that happens. Another possible scenario is if the price breaks above 12,920, then we could see a potential rise next to the next psychological level at 13,000. Nevertheless, seems like price action is more prone to favour a more bearish scenario and send DAX down to 12,500.

Happy Trading,

Colibri Trader