European oil giant Royal Dutch Shell (LON:RDSa) plc’s RDS.A subsidiary The Shell Petroleum Development Company recently commenced production from the second phase of its key gas project, Gbaran-Ubie in Nigeria’s Niger Delta region. The Phase 2 project is an expansion of the Phase 1 Gbaran-Ubie project which was commissioned in June 2010.

Between Kolo Creek and Soku, which connects the Gbaran-Ubie central processing facility to the Soku non-associated gas plant, till date 18 wells have been drilled and a new pipeline constructed.The facilities came online in July. The peak production capacity of the project is estimated to be 175,000 barrels of oil equivalent per day in 2019.

The project is a joint venture between the state-owned Nigerian National Petroleum Corporation, Total E&P Nigeria Ltd., subsidiary of TOTAL S.A. (NYSE:TOT) , Nigerian Agip Oil Company Limited, subsidiary of Eni S.p.A. (NYSE:E) , and Shell Petroleum Development. Shell Petroleum Development is the chef operator of the project with 30% stake. Nigerian National Petroleum, Total E&P Nigeria and Nigerian Agip Oil hold 55%, 10% and 5% interests in the project, respectively.

Shell, which boasts a strong and diversified portfolio of global energy businesses, started its operations in Nigeria in 1958. Plummeting oil prices along with rising militantism has lowered the production and revenues of the country and posed risk to Shell’s operations in the region. However, the ongoing government peace talks have eased the situation to certain extent.

The development projects in Nigeria are expected to help volume growth and offer growth opportunities to Shell in the long run. The project is likely to boost oil output and enhance exports.

Nigeria currently produces1.7 million barrels of oil per day (Bpd) which is expected to rise to 2.2 million Bpd by 2018 and 4 million Bpd by 2020. In a bid to bolster its reserves, production and daily revenues, Nigeria is currently focusing on inking deals with foreign companies to develop oil fields. In August, Nigerian National Petroleum signed two development project deals with oil majors Chevron Corporation (NYSE:CVX) and Shell. The projects are expected to generate revenues of around $16 billion within the assets’ lifecycle. The increase in exploration activities will not only boost employment opportunities and gas supply but will also uplift the industrial capacity utilization of Nigeria.

While the deal with Shell will accelerate the upstream production of various oil fields in Niger Delta region, the deal with Chevron is expected to add 211 million barrels of oil and 1.9 trillion Cubic feet of gas to Nigerian reserves with a potential output of 30,000 b/d of oil equivalent. In late June, Nigerian National Petroleum inked a $700 million tripartite deal with First E&P and Schlumberger Limited to develop two shallow water fields which is likely to add 50,000 barrels of crude per day to Nigeria's output.

Zacks Rank

Headquartered in Netherlands, Shell is one of the largest integrated energy companies and is engaged in production, refining, distribution and marketing of oil and natural gas. The company currently carries a Zacks Rank #3(Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

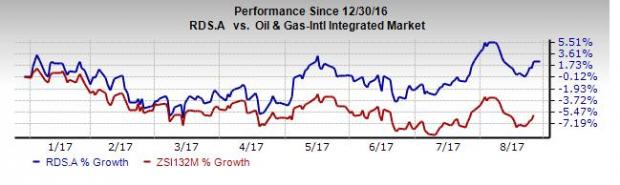

Shell’s stock has gained around 2.5% year to date, substantially outperforming the 6% decline of the industry it belongs to.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Chevron Corporation (CVX): Free Stock Analysis Report

TotalFinaElf, S.A. (TOT): Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

ENI (MI:ENI) S.p.A. (E): Free Stock Analysis Report

Original post