When investors consider buying telecom stocks, the U.S.-based giants AT&T (NYSE:T) and Verizon (NYSE:VZ) typically come to mind. There is good reason for this, as both stocks offer strong dividend yields. However, investors should not forget about Canadian monthly dividend stocks, such as high-yield telecom giant Shaw Communications (TO:SJRb) (SJR).

Shaw Communications has a slightly higher dividend yield than Verizon right now (although Shaw yields less than AT&T). Shaw has another advantage over its industry peers, which is that it pays dividends on a monthly basis. Most U.S. stocks pay dividends on a quarterly, semi-annual, or annual basis. Offering monthly dividends provides investors with more frequent dividend payments than any other schedule. And, it allows shareholder who reinvest dividends to compound their wealth at a slightly faster rate.

Shaw is a high-quality company with many competitive advantages. With a high dividend yield and a secure payout, Shaw is an attractive monthly Canadian dividend stock.

Strategic Turnaround Pays Off

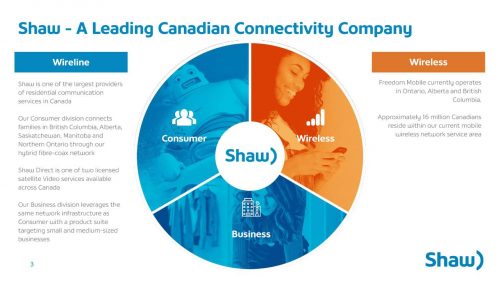

Shaw Communications was founded in 1966 as the Capital Cable Television Company. It has since grown to become Western Canada’s leading content and network provider, catering to both consumers and businesses. The company produces about $4 billion in annual revenue, and the stock has a market capitalization of $10.5 billion.

Shaw has engineered an impressive turnaround in recent years, including a major restructuring of the company’s business profile and strategic direction. The recent portfolio transformation included over $5 billion of transactions, including acquisitions and asset sales.

For example, Shaw acquired Freedom Mobile (formerly WIND Mobile) in 2016 for over $1.2 billion. Shaw also sold its media arm to Corus Entertainment for approximately $2 billion. The proceeds helped finance Shaw’s 2017 acquisition of 700 MHz and 2500 MHz wireless spectrum licenses from Quebecor, which it purchased for roughly $325 million. Shaw then sold ViaWest on 8/1/2017 for approximately $1.27 billion.

These transactions were undertaken to reposition the company toward future growth. The result is that Shaw now has a significant network advantage over its competition, and is a leading service provider across wireless, wireline, and enterprise services.

Source: Earnings Presentation

Shaw reported excellent results for the fiscal 2019 first quarter. Revenue grew 9% for the quarter, thanks primarily to strong growth in its wireless business. Postpaid subscribers rose by more than 86,000 during the quarter while average revenue per user increased 12% year-over-year, to $41.99. In addition, the company saw a significant improvement in its postpaid churn rate to 1.28% in Q1, which is down from 1.64% in the year-ago period.

The combination of higher ARPU along with improved churn is a clean indication that the company’s services are popular, and consumers are willing to pay more for them. Shaw has invested heavily in recent years to capturing subscribers who want premium smartphones and big data plans. This investment has paid off, with impressive subscriber metrics.

Margins continue to improve for Shaw as well. Operating income rose 13.5% during Q1, and margin expansion helped fuel more than 60% earnings-per-share growth for the quarter. Free cash flow more than doubled this quarter.

Shaw has multiple catalysts for continued growth going forward. For example, Shaw is deploying its 700MHz spectrum, a process that is about 25% complete. This will provide wireless customers with farther-reaching coverage and better indoor reception. Second, Shaw completed the launch of 140 retail locations last quarter in partnership with Walmart (NYSE:WMT), taking the total to more than 600 retail locations with Walmart, Loblaws and Freedom Mobile combined. These partnerships will help secure long-term growth as the company grows its subscriber base.

The period of elevated investment spending is winding down, which will help boost cash flow. The company expects 2019 capital expenditures of approximately $910 million, down from nearly $1.1 billion last year. This will free up more cash for shareholder returns. Now that Shaw has returned to growth thanks to its successful transformation, the company can continue to reward shareholders with rising dividends.

Dividends On Speed Dial

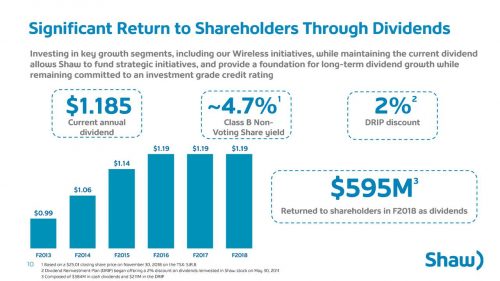

Shaw is a shareholder-friendly company. Management is committed to paying a competitive dividend yield. Even better, the company does its shareholders a favor by paying the dividend each month, which helps investors compound their dividends at a slightly faster rate than the more typical quarterly schedule.

In Canadian dollars, Shaw currently pays an annualized dividend of $1.185 per share. Investors should note the impact of currency translation when buying international stocks, including stocks based in Canada. The class B shares, which trade under the stock symbol SJR, currently pay a monthly dividend of $0.075 per share in U.S. dollars. On an annualized basis, this works out to roughly $0.90 per share at current exchange rates. With a recent share price of $20.53 per share, Shaw stock has a current dividend yield of 4.4%.

Another important consideration for U.S. investors buying international stocks is withholding taxes on dividend payments. Dividend withholding taxes can vary greatly by country. In this case, Canada imposes a 15% dividend withholding tax. However, the withholding tax is waived for U.S. investors who hold the stock in a qualified retirement account, such as a 401(k) or IRA. As a result, investors who buy the stock for a qualified retirement account will receive the full 4.4% dividend yield. This is a strong yield for income investors, as Shaw currently provides more than double the dividend yield of the S&P 500 Index.

Importantly, Shaw maintains a strong balance sheet, which helps protect its dividend. The company has a leverage ratio of 2.0x, which is within its target range of 2.0x to 2.5x. Shaw also has investment-grade credit ratings from the major credit ratings agencies Moody’s and Standard & Poor’s. Investment-grade credit ratings help the company raise capital on reasonable terms.

Final Thoughts

U.S. investors might overlook international stocks, but there are many stocks based outside the United States that are worthy of investment. Specifically, income investors looking for high yields and monthly payouts should take a closer look at Shaw Communications. The company’s strategic investment has fueled a turnaround and a return to growth. Plus, Shaw is an industry leader and the stock offers an attractive dividend yield of 4.4%. These qualities make Shaw appealing for income investors looking for geographic diversification.