After a brief period of excitement in the market, when it sold off 1% yesterday, the S&P 500 is back to its boring ways from the past few weeks and now trading in a very narrow, intraday range that is leaving traders with little to talk about.

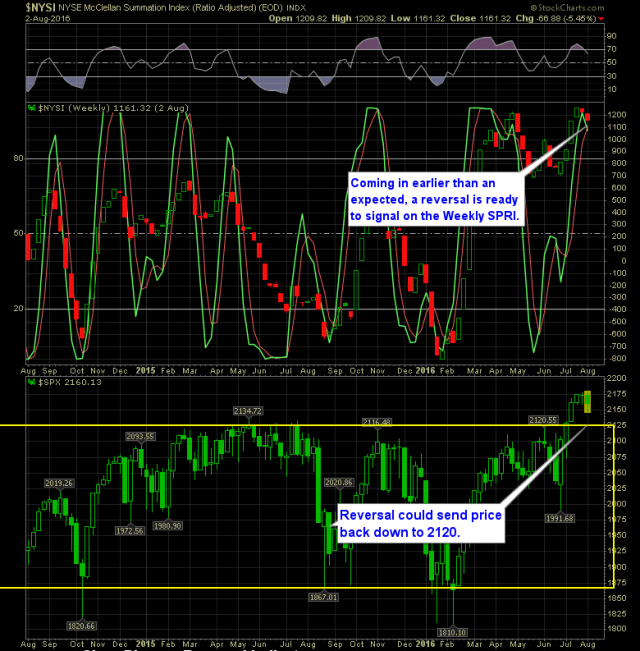

I personally want to see how this one shakes out, because we now have firm reversals forming in the weekly and daily SharePlanner Reversal Indicators that suggest some kind of pullback should be in order here.

However, if you've been trading this market for any length of time, you know that weakness can never be assumed and that the bulls can find nearly any reason in the world to rally. A movie critic coming out and saying Sharknado 4 is a "two thumbs up" kind of flick, would be enough to goose SPX up another 20 points.

So while I have a short position that I initiated on the SPDR S&P 500 (NYSE:SPY) today, I also have a couple of long positions in my portfolio too, while I wait to see what this market really wants to do here in the month of August.

For now, know that the weekly SPRI is giving off some bearish signals here, and that getting heavily long at this point won't be a good move until there is a little bit more clarity for this market showing us that it wants to do exactly that.

Here's the SPRI: