China has long been a place that Western culture does not understand. Economically we talk of their economy as a series of made-up data points. We point to masses of empty housing units and ask how can this continue. Their one-child policy baffled us. It is this type of view, though, that may be standing in the way of great gains from China.

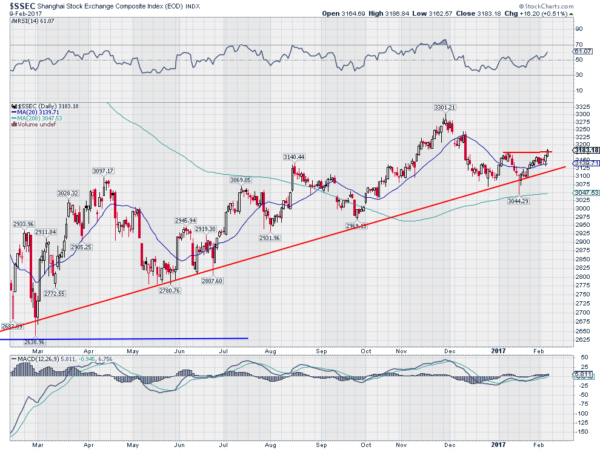

Don’t let that cloud your judgement. Instead look at their stock market. Sure there was an incredible run up from 2014 to 2015. And then the pullback to a low to start 2016. But look a little closer. Since the bottom at the start of 2016, the Shanghai Composite has been steadily marching higher.

The Shanghai has been rising along trend support for over a year now. Each time it's fallen back to touch that support line it has rebounded, making a higher low and a higher high. On Thursday, the Shanghai broke short-term resistance, setting up the next run to a higher high. That would be over 100 points higher. Longer term, it's trying to create some separation from the long-term resistance/support area from 3180 to 3180. If it succeeds this time, the Shanghai Composite could have a long way to run to the upside.