Chinese President Xi Jinping refuses to join the global stock-market party. The Chinese market has had a strong second half of the year and since May, is up over 10%. But the last several months have been filled with indecision. Indeed, while we stuffed our faces with turkey on Thursday, the Shanghai Composite fell more than 2%. Sine them it has settled into the weekend, finishing the week down about 1%.

Moving Sideways

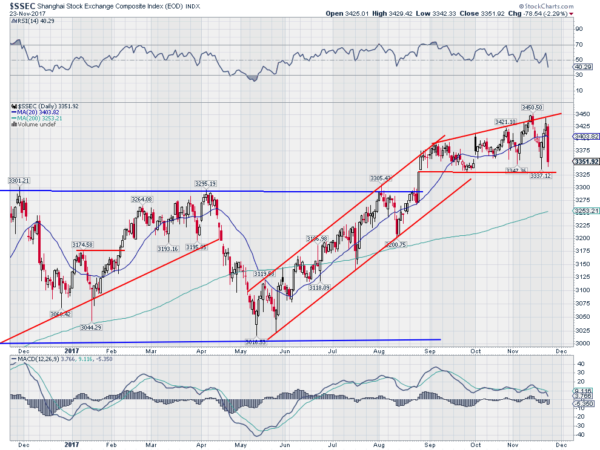

The chart below tells the broader story, though. After a 5-month move higher in a rising channel, the Shanghai Composite has spent the last 3 months mainly moving sideways. It has built an expanding wedge as it oscillates around its 20-day SMA. It had a failed break out of the wedge earlier in the month. Then on Wednesday, the price touched the top of the wedge, looking strong. But all that changed as America celebrated.

The strong move lower on Thursday took the composite back to the bottom of the wedge. As I said earlier, Friday (not pictured) saw it bounce, and finish 2 points higher – still in the wedge. But momentum took a big hit this week. The RSI is making another lower low at the lower edge of the bullish zone. The MACD failed to cross up and reversed lower, heading toward zero. Price remains above the prior 1-year broad channel, but is struggling. Is it just consolidation or a top?

Time will tell.