Once all the dust settled, the Dow Jones closed up six points. In any case, let’s stroll through some ETFs. I’ve tried to order and group these in a sensible fashion.

The commodities markets have been strong; I’ve drawn a resistance line, but frankly, it’ll probably get taken out with the continuing strength in crude oil.

Oil has been up almost daily since Christmas. There’s very little standing in its way. Please note an OPEC meeting is going to close out this week.

Home construction recently cut above its resistance (now support), so this could gain strength from present price levels.

The Dow has a failed bullish breakout, although the long-promised trade deal could right this ship; for the moment, there’s been no follow-through to the breakout.

The Transports remain historically weaker than the Industrials and have yet to push past the price gap (noted with the horizontal line)

Small caps are much farther away from lifetime highs than, for example, the S&P 500, but they were much stronger on Wednesday than most other indexes

The bank sector remains weak, with a consistent series of lower highs.

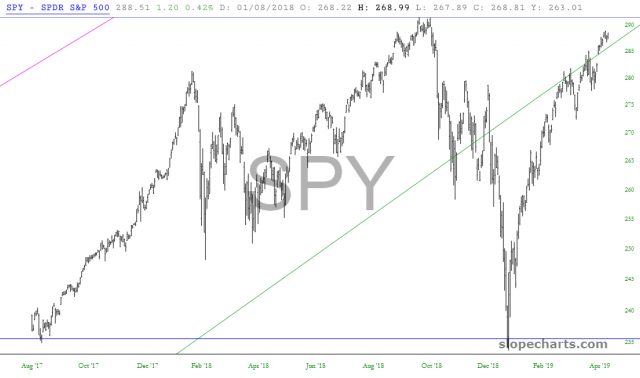

The S&P 500 is quite close to lifetime highs.

Emerging markets have completed a larger bullish base and could be in “launch” mode if they get past their horizontal (which is basically exactly where the price is now).

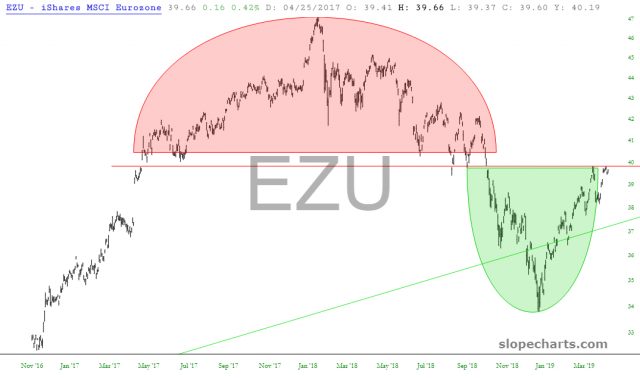

Outside of North America, equities are up against substantial resistance.

The same holds true here, with the bearish and bullish patterns in a stand-off.

China has a cup-with-handle pattern (bullish).

Gold looks prone to weakness, although I don’t think it has far to fall.

Miners are just beneath their price gap and prone to slippage of about a dollar.

Finally, junior miners are sporting the same price gap and are at risk of a modest sell-off.