It’s going to be a very rainy day here in the Bay Area, so why not relax with some ETF charts (OK, that makes no sense, but I can’t think of an introduction).

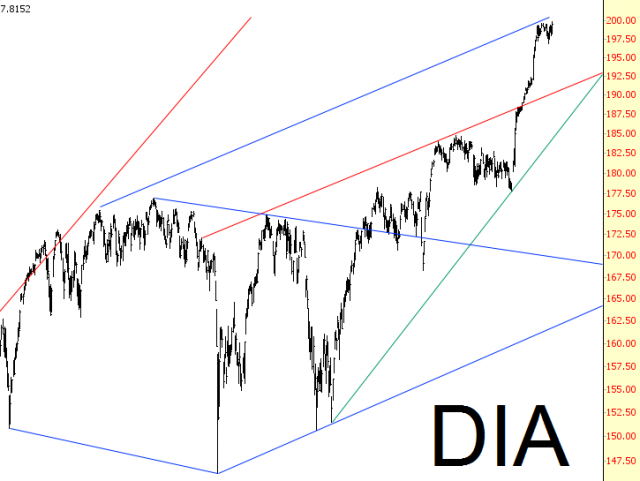

The “diamonds’ remain in a DNAAB (Desperately Need An Ass-Beating) pattern. (pronounced ‘de-nab’).

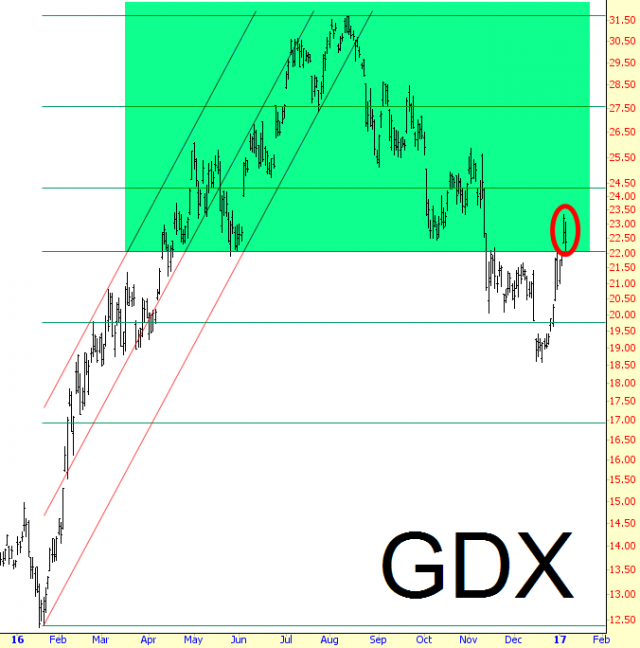

The miners, which I am very short by way of Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST), had an amazingly clear top (green tint) that was somewhat mucked up with Thursday’s surge. We’ll see it we can break below that neckline again come Monday.

VanEck Vectors Gold Miners (NYSE:GDX), of course, will be the arbiter of that outcome. It seems to me completely plausible that we could sink back down to that red support line at around $109. If it does, DUST is going to do great.

The small caps (iShares Russell 2000 (NYSE:IWM)) share the same DNAAB pattern that the Dow does.

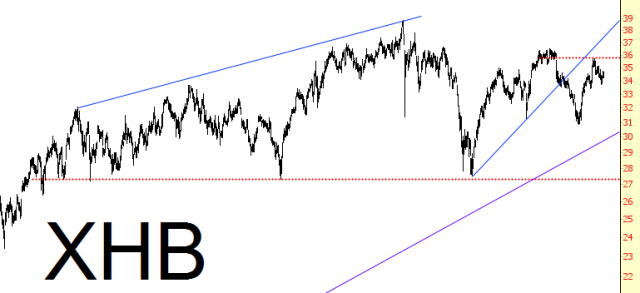

Homebuilders (SPDR S&P Homebuilders (NYSE:XHB)) are squeaky-clean, but the long-term pattern looks like a sector that’s running out of gas.

Hey, look, another DNAAB pattern! Financials (Financial Select Sector SPDR (NYSE:XLF))…….

Lastly, Brazil (iShares MSCI Brazil Capped (NYSE:EWZ)) is a pretty cool setup, since it did an almost perfect gap-fill last week.