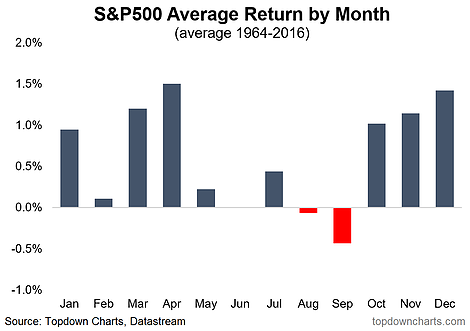

For southern hemisphere dwellers such as myself, September brings spring, but for the S&P 500 September brings sinister seasonal statistics. Over the period 1964-2016 September has been the month with the worst average return (average -0.4% m/m) and the lowest probability of a positive return (returns were positive for the month 'only' 45% of the time). With a long list of potential concerns e.g. North Korea, government shutdown, super storms, high valuations, low cash holdings, low implied correlations, euphoric sentiment readings, and monetary policy normalization... it's quite straightforward to make a case for a bearish or cautious bias short-term, even without seasonality. So while seasonality doesn't work all of the time, when it lines up with other factors it tends to make you pay attention.

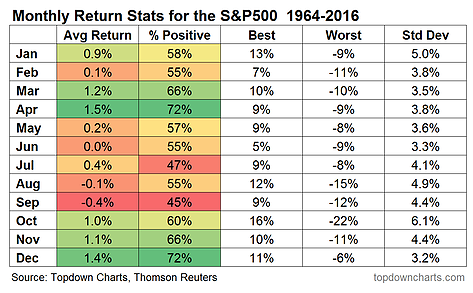

Looking across the 1964-2016 period, September has seen the worst average monthly price performance.

Delving into some of the statistics, September also sees the lowest probability or proportion of positive returns across the months - and from a seasonal standpoint is typically the climax of a cluster of weaker months in that "sell in May" period.