As traders and portfolio managers its our job to manage risk. That risk is often associated with downside declines in major asset classes, however we most often discuss the drops in equities. Josh Brown recently wrote a post outlining how market declines are healthy and are often followed by rebounds. The point Josh makes is a good one and is something most (if not all) investors should listen to: sticking to long-term investing with the understanding that you’ll likely experience short-term swings.

‘Healthy’ Corrections vs. Large Declines in Equities

What got me thinking was something Josh said about the inability to know if a decline in the equity markets is going to be a small correction or full blown bear market. Again, Josh is correct that we can’t know for sure what’s coming in the financial markets. But I began to wonder if there’s any commonalities among more protracted declines that aren’t present before small “healthy” corrections. One tool that I often refer to on the blog and on Twitter (NYSE:TWTR) is breadth, specifically the Advance-Decline Line. I focus so much on this indicator because understanding the level (or lack there of) of market participation can be a great resource in understanding the financial markets… at least that’s my opinion!

Back in late July I wrote a post called The Greatest Risk of Market Peak since 2007. In this post I share the chart (among many) of the S&P 500 and the NYSE Advance-Decline Line, noting the divergence that had been created, meaning the A-D Line began declining before the equity market eventually peaked. This turned out to be a great signal of the forthcoming volatility in stocks and the 10+% decline in U.S. equities.

It’s been a while since we’ve seen such a divergence but as Ryan Detrick notes, it’s much more common to experience 10% corrections. In fact, we’ve experienced 30 of them since 1960 as Ryan points out.

So is there a way to separate common corrections from larger declines?

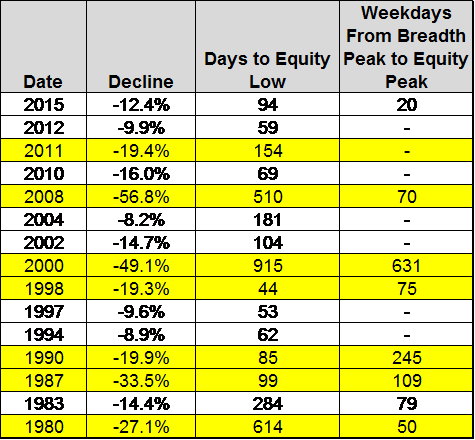

Using the Advance-Decline Line may be one way, but like all tools…it’s not perfect. Below is a table showing market declines going back to 1980. I used the data from Yardeni for the decline amounts and the number of days the declines lasted. The rows highlighted in yellow are the periods that saw greater than 19% drops, as you can see we’ve experienced seven of them since 1980. Of those seven, all but one experienced a negative divergence between the S&P 500 and the NYSE Advance-Decline Line. While the ‘healthy’ single digit to small double digit moves, like we saw in 2010 and 2012, did not see a divergence in breadth.

2011 was the only >19% drop that was not preceded by a peak in breadth. I’d also like to point out that there was in fact a drop in market participation before the 1983 14% decline.

Now does this mean that every time the NYSE Advance-Decline peaks before price we are in for a bear market? No. But what does have me concerned is that when participation of individual stocks in an up trend does peak before the major indices and prices then begin to fall it has typically (at least since 1980) led to a larger correction than what many would deem ‘healthy’ and what we have experienced so far this year.

How I View This

I do not view this type of data with blinders on. I take it as an input into my bias on the market. I recognize we are about to enter the bullish period of seasonality and that there are some bullish pieces of market data such as positive divergences in momentum and potential double bottoms in equity prices. October is also one of the historically strongest months for stocks since the start of this bull market. But if the August low does break, I know in the back of my mind that breadth was weak coming into this and we could be in for more pain than many traders expect. But I hope we don’t see lower prices, I’d much rather see equities rise and the party keep going – it’s much healthier to be optimist, but I refuse to be a blind optimist.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.