The latest results from the weekly surveys on Twitter showed some very interesting trends in investor sentiment towards both the bond market and the stock market. Below we look at some key charts from the survey as well as some data on fund flows and futures positioning and we discuss the possibility of another stock + bond selloff. If we get a repeat of the stock + bond selloff that we saw in January/February, it could well take investors by surprise, and our data show that it's equity traders who stand to bear the most pain if this happens.

The key takeaways from the stock + bond sentiment snapshot are:

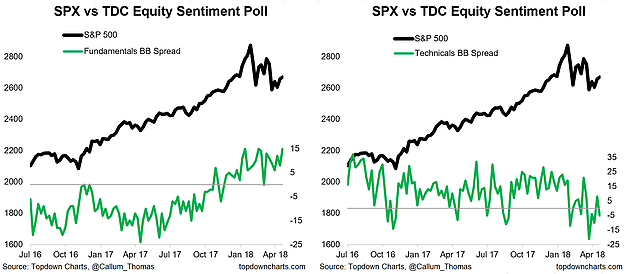

-Equity investors remain bullish on the fundamentals, yet remain cautious on the technicals.

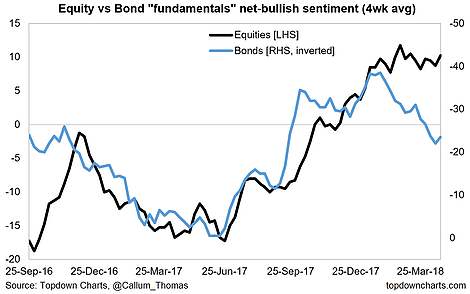

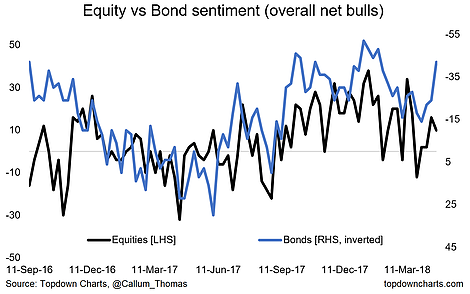

-While equity investors seem at odds with bond investors on the fundamentals outlook, it appears bond investors overall are more bearish on the outlook for bonds.

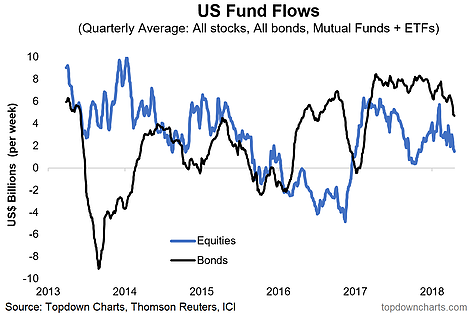

-With fund flows rolling over for both bonds and stocks it highlights the possibility of a stock + bond selloff.

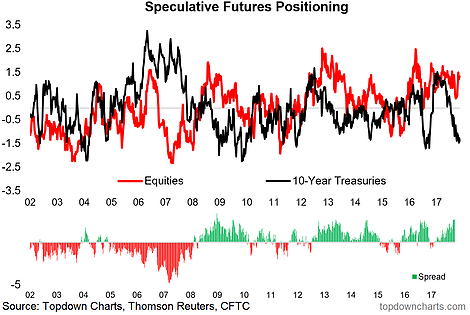

-Speculative futures positioning shows bond traders are set to profit from higher bond yields, and equity traders are anticipating higher stock prices.

1. Fundamental vs Technical Sentiment: The latest results showed an interesting rebound in "fundamentals" net-bullish sentiment, while technicals sentiment dropped off. If I had to guess the technicals sentiment may well be driven by the fact that the week's trading finished with what looked like a third successive lower high (see the latest Weekly S&P 500 #ChartStorm where I discussed this). As for fundamentals, it's hard to pin it on any one thing, but I would note on my metrics the overall pulse of the economic and earnings data remain sound.

2. Stocks vs. Bonds Fundamental Sentiment: Looking at the chart of smoothed fundamentals sentiment for bonds and stocks, there's the continued divergence between the two, albeit there is an interesting early sign that bonds could be the one to close the gap. Indeed, if investors redouble their bearishness on bonds due to the fundamental picture it could be the thing that drives yields towards my 3.5% target.

3. Stocks vs Bonds Overall Sentiment: On the overall sentiment picture, bond net-bearishness increased (note that bond sentiment is shown inverted), and it was the technicals sentiment driving that – clearly folk are focused on the nascent breakout in US 10-year bond yields. The divergence on this one could easily stay divergent if another push higher in bond yields results in a second round of bond+stock selling, like in late January when both stocks and bonds prices were falling.

4. US Fund Flows – Stocks vs Bonds: Looking at rolling quarterly fund flows for stocks and bonds, they both seem to be rolling over, which perhaps supports the notion that we might see another round of "sell everything". With the Fed steadily progressing down the path of quantitative tightening + rate hikes, it would be unsurprising to see higher volatility across asset markets as the new normal....

5. Futures Positioning – Stocks vs Bonds: Final chart shows speculative futures positioning for stocks and bonds. Basically investors are positioned for rising stocks and rising bond yields. If this scenario of a further fall in stocks + bonds does come to pass, it will be the bond shorts who win, and the equity longs who will be bearing the most pain and finding themselves most wrong-footed. My base case is that stocks do alright because the macro/earnings pulse is still supportive, and I don't think monetary policy has moved enough to scuttle stocks yet – but the risk scenario of a stock + bond selloff will inflict a lot of pain and could trigger off more selling than most expect.