The S&P 500 Index (SPX) has been assailing all-time highs, soaring above the round-number 3,000 level for the first time ever last week. However, retail investors have been hesitant to adopt a bullish stance, as evidenced by the latest American Association of Individual Investors (AAII) sentiment poll. In fact, AAII data just triggered a sentiment signal not seen since the 2016 presidential election. Below, we take a look at how stocks perform when this crowd becomes overly apathetic.

In the AAII weekly survey ending July 10, the percentage of self-identified bears fell 4.9 percentage points, to 27.5% of respondents. However, most of those polled didn't migrate to the bullish camp. In fact, AAII bulls increased by just 0.5 percentage point, to 33.6%, while those with a neutral outlook on the stock market over the next six months surged 4.4 percentage points, to a 38.9% majority.

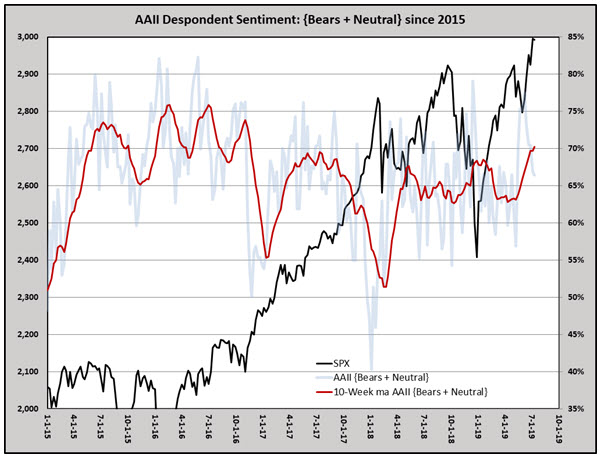

As such, the 10-week average of bears + neutral AAII respondents is now over 70% -- something we haven't seen since early November 2016, per Schaeffer's Quantitative Analyst Chris Prybal. Prior to that, you'd have to go back to October 2015 for a signal, which was the first of its kind since August 2012. Before that, this sentiment signal flashed in March-April 2009, what we now know was the post-financial crisis bottom.

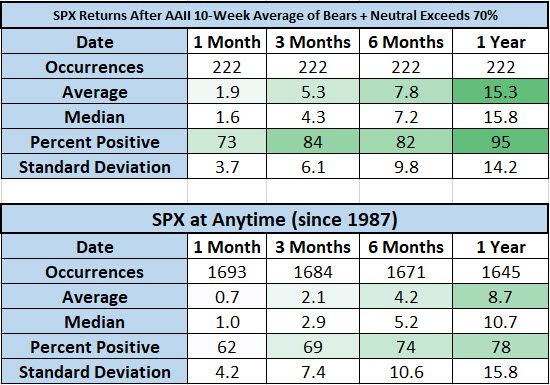

Since 1987, when the 10-week average of AAII bears + neutral respondents topped 70%, the stock market performed better than usual. Specifically, a month after these sentiment signals, the SPX was up an average of 1.9% -- more than twice its average anytime return of 0.7%. Three months later, the index was up 5.3% -- again more than double the norm -- with a positive rate of 84%.

Six months later, the broad-market barometer averaged a gain of 7.8%, and was higher 82% of the time. That's compared to an average anytime six-month return of 4.2%, with a win rate of just 74%. A year out, the S&P 500 was up 15.3%, on average, and higher nearly every time! For comparison, the index has averaged an annual return of 8.7% since 1987, and has been positive 78% of the time.

In conclusion, while several macro events could impact stocks -- the Fed being the biggest wildcard, per Schaeffer's Senior V.P. of Research Todd Salamone -- it seems we haven't yet hit the "euphoria" phase of the sentiment cycle that marks market tops. As such, contrarians can find comfort in the old adage that "markets advance on a wall of worry and decline on a slope of hope" -- a theory supported by the AAII data above.