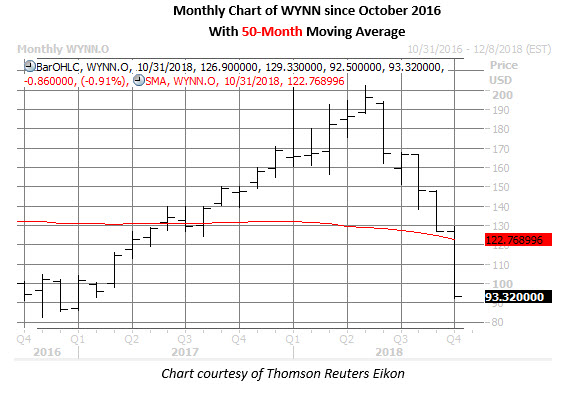

The shares of Wynn Resorts Limited (NASDAQ:WYNN) have taken a beating in October, down 26% so far to trade at $93.32. This would mark the casino stock's worst month since September 2015. The selling could be far from exhausted on WYNN stock, though, if history is any guide.

According to Schaeffer's Senior Quantitative Analyst Rocky White, the equity has been one of the worst stocks to own on the S&P 500 Index (SPX) in November, looking at data from the past 10 years. Specifically, WYNN stock has averaged a monthly loss of 3.85%, with just three of those returns positive.

What's more, Wynn Resorts is scheduled to report earnings the evening of Wednesday, Nov. 7. The shares have closed lower in the session after the casino reports in five of the last eight quarters, including the two most recent. On average, WYNN stock has averaged a single-session post-earnings move of 6.1% over the past two years, regardless of direction.

Should WYNN maintain its current downtrend, continued selling pressure from shorts could strengthen the headwinds. Short interest has more than doubled since its early August low to 5.54 million shares, though this represents just 5.7% of the stock's available float.

A round of negative analyst notes could weigh on the security. While eight of 13 analysts still maintain a "strong buy" rating on the underperformer, the average 12-month price target of $169.13 is an 80% premium to current trading levels.

Looking closer at the charts, Wynn Stocks has been trending lower since its mid-May peak near $198, and hit a 22-month low of $92.50 yesterday. What's more, the shares are on track to close below their 50-month moving average for the first time since August 2017.