Systemic risk build, USD lower in G10

The sell-off in equity markets accelerated in the Asian session, increasing the potential for systemic risk. China’s Shanghai Composite is now down -8.48%, dragging the rest of global stock markets with it. Heavy losses in Shanghai A-share market has been driven by fears that growth will underperformance markets expectations of 7.0% in 2015. Fridays July PMI showed the index declining from 49.4 to 48.2 (15-month low) and June industrial profits growing only 0.3% were a significant disappointments. The problem is the lack of export demand which is punishing Asia, commodities and commodity producing economies. In addition, the US 2Q earning season has so far underwhelmed as falling oil prices has also prompted heavy cuts in energy investments undermining the forward earnings outlook. Traders will be watching for a solid US durable goods order to help support equity prices (potentially reverse bearish trend). USD is broadly lower as the EUR rose to 1.1113 on a strong German IFO read. Gold has been given a temporary reprieve trading up to $1105.17, yet this is more likely short covering rather than correlation to risk off sentiment. With commodity prices expected to remain weak, watch for AUD, NZD, CAD and NOK to further underperform.

US: Important week to come

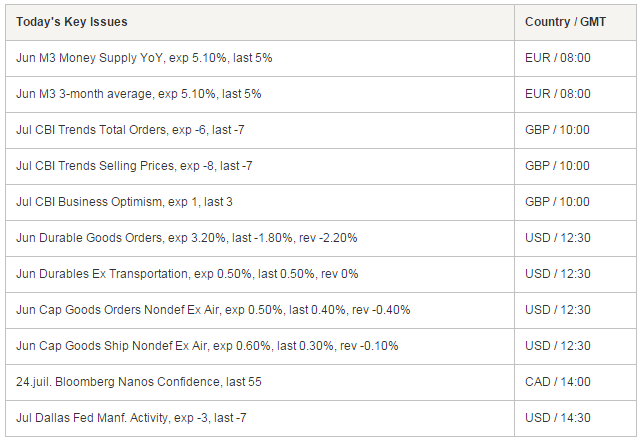

This week is very important for the US and especially for the Fed. FOMC will meet on Wednesday and the Q2 GDP figure will come in a day later on Thursday. All eyes will then be focused on the US as September lift-off remains a true concern. Indeed, the Federal Reserve has prepared markets for a rate tightening this year, but surprisingly Janet Yellen, in her speech held in Cleveland earlier this month, did not appear so optimistic about the US recovery. However, she mentioned that a first rate hike will happen at some point later in the year and that will be the starting point of a normalizing monetary policy. Despite such comments, mostly made not to fear markets, we think that the low inflation, which printed for June at 0.3% q/q while it remains quasi flat at 0.1% year-on-year, will prevent the Fed to raise rates. Indeed, wages are pressured down and this brings more difficulties for households to repay their debts and mortgages. Data are not fully supporting a rate hike in September. Last US New Homes Sales printed last Friday well below expectations at 482K vs 548. However Existing Home Sales data, which would correspond to a secondary market data, printed way above expectations at 3.2% increase vs 0.9%. We could assume that most people are now more looking to more affordable goods and are less willing to pay more for new things. This is definitely not a signal of a strong economy Furthermore, Federal Reserve Chair Janet Yellen kept on saying that low interest rates are very dangerous as no rooms would be left for lowering them further in case inflation is not heading to the forecasted target range of 2%. Hiking the rate for lowering them again may be something the Fed is trying to do. Traders will carefully watch FOMC statement to support this view. Q2 GDP that will come in a day later will likely end the discussion of a September rate hike in case of a disappointing data. EUR/USD price action which is coming back above 1.1000 is now driven by this intensive US week. We expect the pair to target 1.1100 on a Fed dovish statement.

The Risk Today

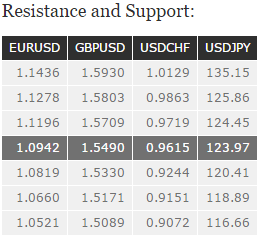

EUR/USD has increased sharply above 1.1100. Hourly resistance lies at 1.1278 (29/06/2015 high). Stronger resistance lies at 1.1436 (18/06/2015 high). Support can be found at 1.0660 (21/04/2015 low). Over the last month, the pair is setting lower highs therefore we remain bearish. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD is now consolidating. Hourly resistance is given at 1.5803 (24/06/2015 high). Support is given at the 38.2% Fibonacci retracement at 1.5409. Stronger support is given at 1.5330 (08/07/2015 low). We expect the pair to decrease again within the next few days. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is heading lower. Stronger resistance still lies at 135.15 (14-year high). Hourly support is given by the 38.2% Fibonacci retracement at 122.04. Stronger support is given at 120.41 (08/07/2015 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF is still in a short-term upside momentum. Hourly support can be found at 0.9151 (18/06/2015 low). The road is still wide open for the pair to challenge stronger resistance at 0.9719 (23/04/2015 high). The pair is gaining momentum to challenge this resistance. In the long-term, there is no sign to suggest the end of the current downtrend. After failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).