When investing in cryptos it's important to remember what really matters.

A wise investor knows that erratic price movements are mere noise that sometimes interferes with the underlying story, which is the development of blockchain technology.

This morning, Microsoft (NASDAQ:MSFT) has announced a unique use-case that they look to implement into their systems. It will use the network powers of Bitcoin, Ethereum, Litecoin, and possibly others to manage the identity of their users.

Another day to day use-case is now being implemented by Walmart (NYSE:WMT) as they use blockchain to track produce from farm to store. In a simulated test, Walmart was able to trace the origin of a bag of mangos in 2.2 seconds. The same process on the old system took almost a week, in which time the company would have had to pull a massive amount of products off the shelf.

Of course, we need to remember that all cryptocurrencies are still in the experimental phase. Though some cryptos will likely rise in value exponentially, many will fail. So please make sure to diversify yourself so that risky assets only take up a small portion of your overall portfolio.

Today's Highlights

Reasons to Fear

Watch the Bonds

Scaling Up Ethereum

Please note: All data, figures & graphs are valid as of February 13th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

The S&P500 has just put up it's best two-day session of the last 18 months. But while many on Wall Street are declaring that the sell-off is over, there are still many reasons to remain cautious on stocks.

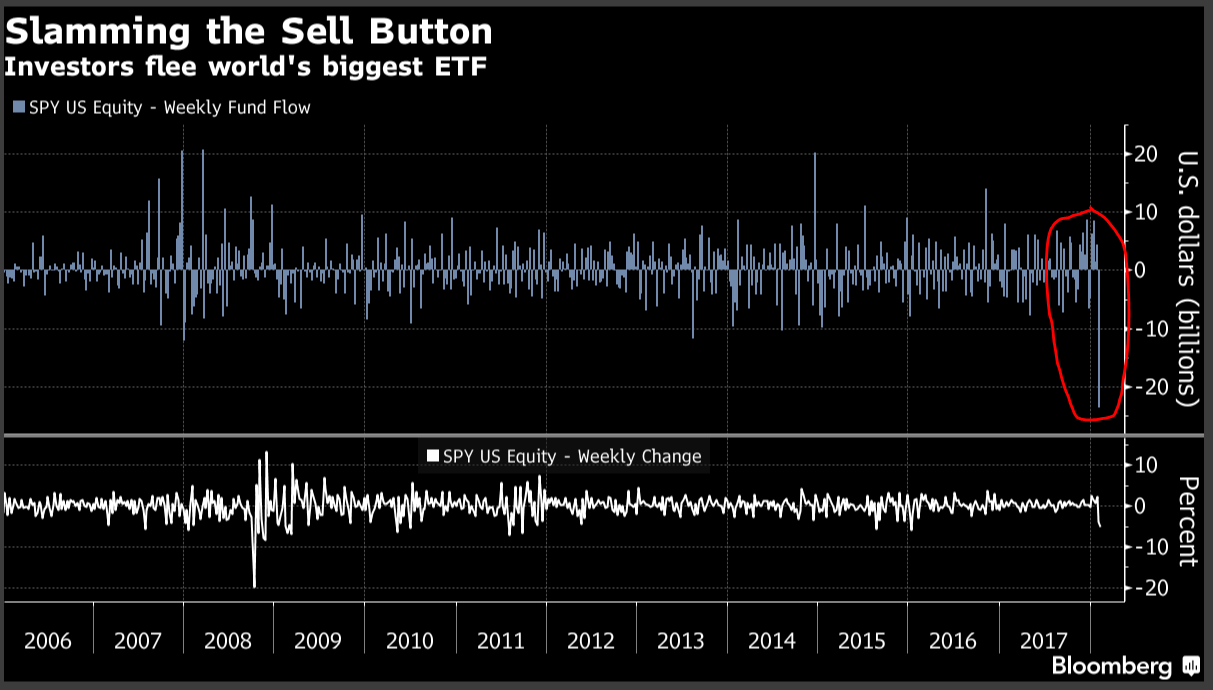

The world's largest passive fund, the SPY (NYSE:SPY), has just seen $23.6 Billion come off the table, it's biggest outflow since August of 2010.

This may just signal the end of a long cycle where investors preferred passively managed funds to actively managed ones.

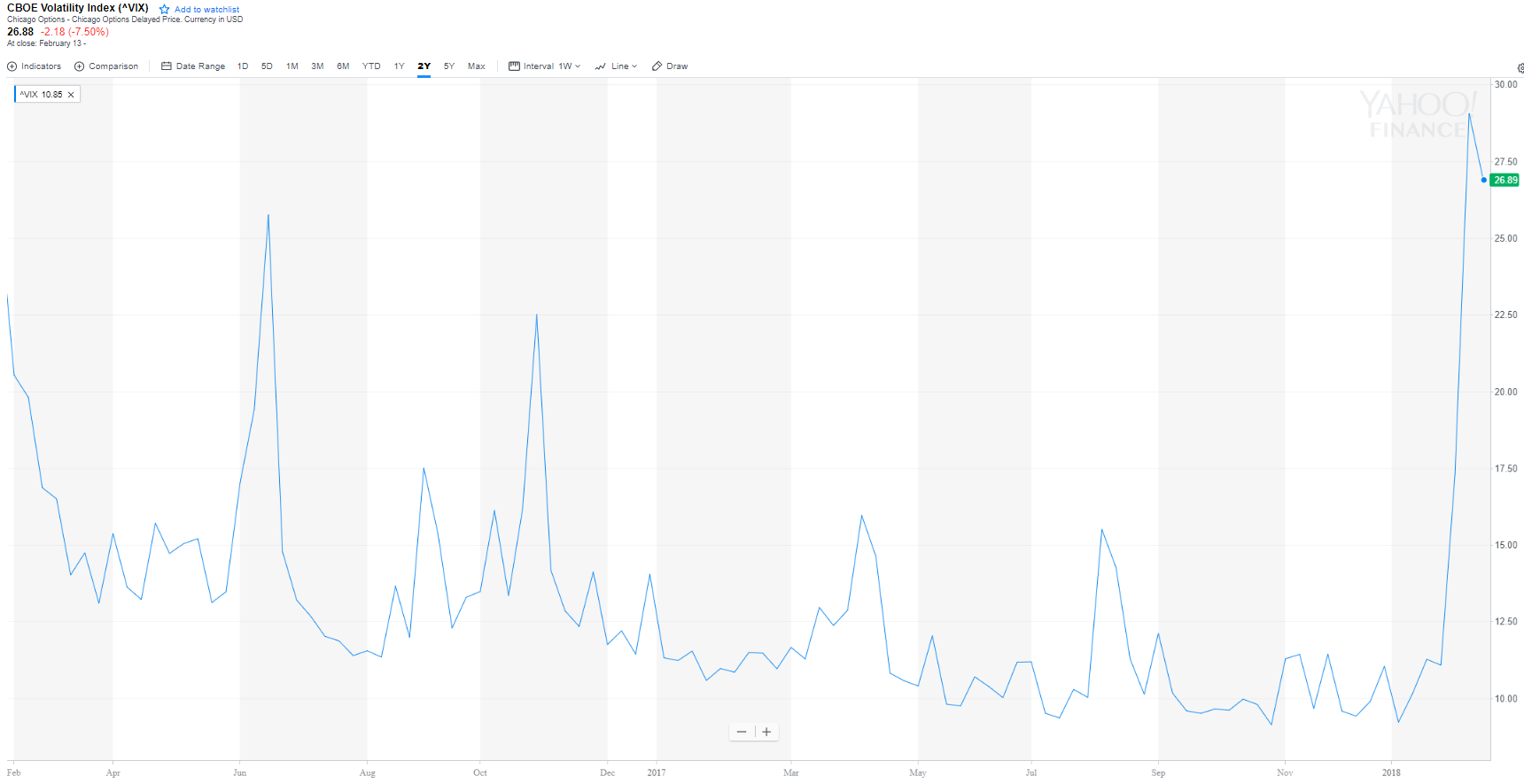

Volatility has come down a bit from the highs of last week but still remains rather elevated. The VIX is still as high as it's been in the last two years.

Furthermore, the short-term charts on stock indexes like the Dow Jones still look bearish with the highs getting lower since the peak on January 30th (yellow).

The thing we need to keep an eye on is the 10 Year Bond Yields in the US. The spike in these yields at the beginning of the month was the first indication that something was amiss.

As you can see, they have not come down as of yet.

A speech today from the Fed's Lorretta Mester could prove significant but as we mentioned yesterday, the market remains focused on the inflation data coming out tomorrow.

Cryptos

Though we're seeing some serious signs of stabilization, we're still not out of the woods just yet.

For now, Bitcoin is in a tight range from $8.000 to $9,000 and has yet to snap the bearish trendline..

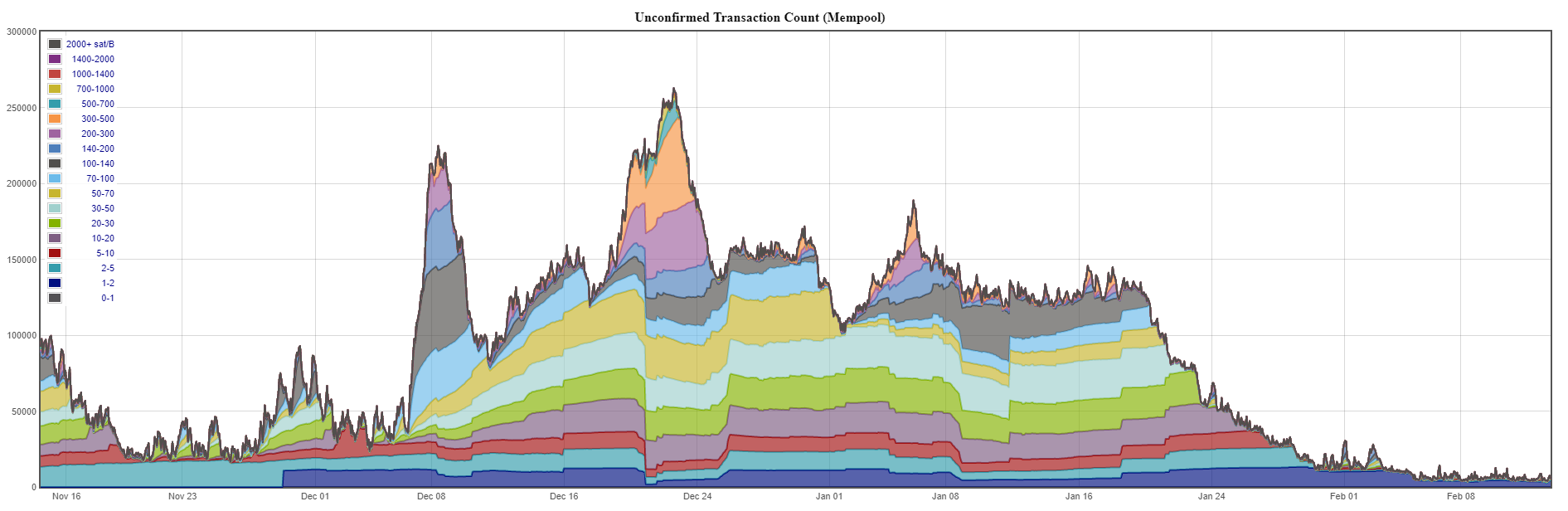

The number of unconfirmed transactions on the bitcoin network has finally come down to a normal level of 8,500 and has been holding these levels for about a week.

This is thanks in large part to the adoption of off-chain solutions like SegWit and Lightening but also because there are simply fewer transactions happening on the network.

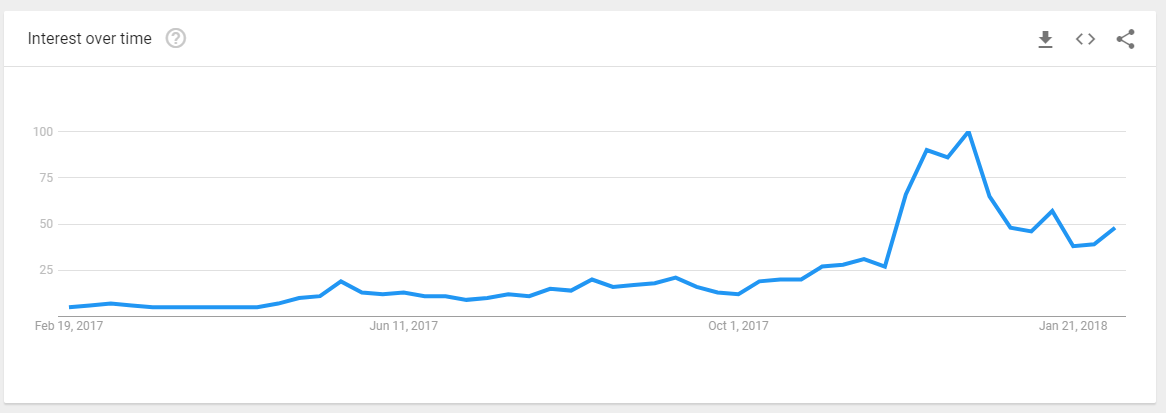

As interest in bitcoin has declined in the last couple months...

.. so has the transaction rate...

...plummeting from a peak of 4.8 TPS (transactions per second) all the way down to a low of 2.1.

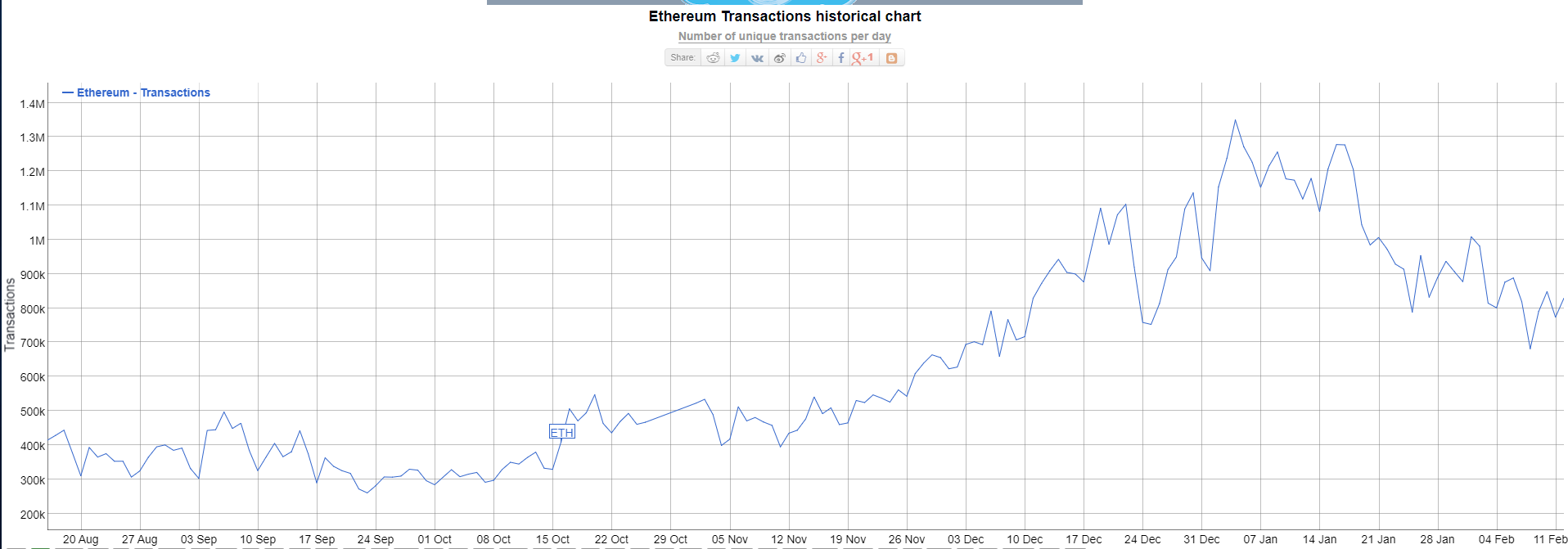

The transaction rate of Ethereum has also come down in the last few weeks, but not by nearly as much as bitcoin (in percentage terms).

The peak here was 15 TPS and has come down to about 9.5.

Of course, this is all short-term data. Keeping our eyes on the long term narrative we can see the scaling progress accelerating for Ethereum. This morning, one of the key developers has released this blog, which outlines several paths that the network may take in order to bring the TPS capacity from 15 to where it needs to be in order to become a global force.

Because Ethereum is decentralized, this post should be seen as a point of view and some clarity into the future steps that may be taken by the network rather than a unilateral top-down decision from the leaders.

A true visionary must learn to see through the noise to get a good outline of the multitude of possibilities that the future holds.

Wishing you an awesome day!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.