Last week, we highlighted the "counterintuitive" bullish price action in the Healthcare sector and speculated that such stocks could be a leader on the next leg higher in the broader markets (see " Sector Showcase: Healthcare stocks look surprisingly healthy"). Another sector that traders have been watching for signs of life is perking up on a relative basis: materials.

Often seen as a proxy for budding inflation pressures, materials stocks have been particularly strong over the last month, with the Materials Select Sector SPDR (NYSE:XLB), the sector ETF, tacking on more than 5% over that period. With the most recent US Consumer Price Index (CPI) report beating expectations slightly, there are some nascent signs that the hard data is improving as well.

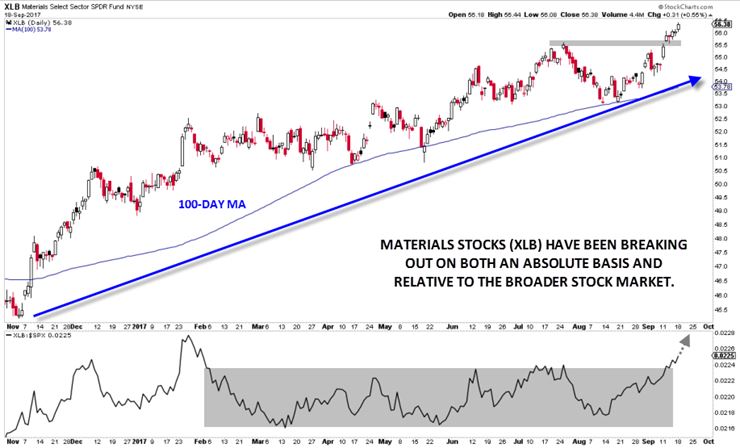

Technically speaking, XLB broke out to a new record high above 55.00 last week. More importantly, the sector has been showing strength compared to the broader market; as the lower panel below shows, materials stocks have broken to a seven-month high on a relative basis, showing that the sector is rotating into a leadership position:

Source: Stockcharts.com

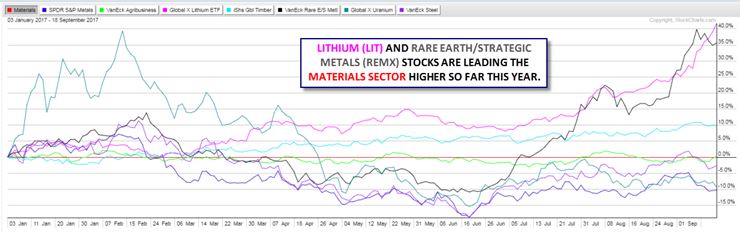

Of course, "materials" encompasses a broad spectrum of businesses, so we want to drill down a bit further to see what specific subsectors are driving XLB higher. Drilling down into some of the largest industry ETFs within the material sector, it's clear that two groups have been driving the outperformance of XLB. Both Lithium (Global X Lithium (NYSE:LIT)) and Rare Earth / Strategic Metals (VanEck Vectors Rare Earth/Strategic Metals (NYSE:REMX)) stocks have outperformed the materials ETF by 35% this year, logging total returns in excess of 50% in less than nine months:

Source: Stockcharts.com

For traders who prefer to drill down to the individual stock level, the largest holdings in LIT include FMC Corporation (NYSE:FMC), Sociedad Quimica Y Minera De Chile (NYSE:SQM), and Tesla (NASDAQ:TSLA), while the largest holdings in REMX include Tronox (NYSE:TROX), Pilbara Minerals (TO:PLS), and Iluka Resources (AX:ILU).

These little-known stocks in rarely-followed subsectors have seen staggering performance year-to-date, and based on the continued strength relative to both the materials sector and broader market, they could have further to run in the coming days.