Investing.com’s stocks of the week

When Barack Obama was elected president over eight years ago, many investors sold their holdings in gun manufacturers like Sturm Ruger & Company Inc (NYSE:RGR) and Smith & Wesson (since rebranded to American Outdoor Brands, NASDAQ:AOBC), fearing that the Democrat would be far more strict on gun control and could even work to outlaw certain types of firearms.

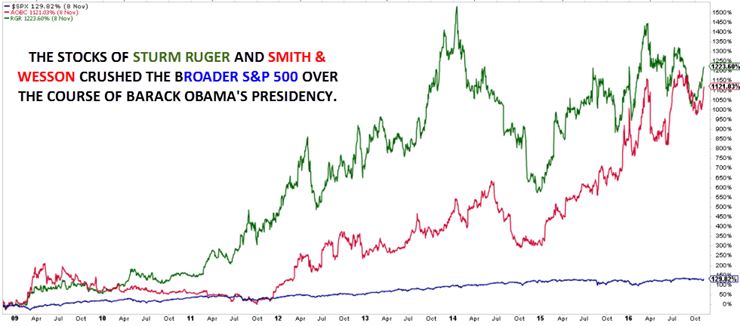

To capitalize on the world's most obvious pun, those investors definitely "shot themselves in the foot" with that maneuver. Over the course of Obama's presidency, RGR and AOBC were two of the best-performing stocks, with each rising by more than 1100% in eight years to crush the 130% return on the S&P 500. In essence, concerns about gun bans (especially immediately in the wake of the all-too-frequent mass shootings across the country over the last decade) lent a sense of urgency to certain consumers to "stock up" on firearms.

It's worth noting that since the election of an ostensibly pro-gun-rights Republican to the presidency, both RGR and AOBC have trailed the overall market substantially.

To put it lightly, the complex interactions between politics and markets often leads to counterintuitive trends.

The most obvious current example of this phenomenon is in healthcare stocks. Worries that President Trump and Congressional Republicans would finally be able to follow-through on their promise to "repeal and replace" the Affordable Care Act ("Obamacare") caused healthcare stocks to lag behind the broader market following the election.

Just as President Obama found with his efforts to impose stricter regulations on gun purchases, the health care industry is loaded with political bombshells and entrenched special interest groups that prefer to see the status quo continue indefinitely. As it's become increasingly clear that healthcare reform legislation will be watered down (if it passes at all), healthcare stocks have come storming back with a vengeance, led by the pharmaceutical industry. On an absolute basis, the healthcare ETF, (NYSE:XLV), closed last week at a record high, up nearly 25% from the post-election lows:

On a relative basis, the outlook for the sector is just as strong. Compared to the S&P 500, XLV has just broken a key relative resistance level near .33 to hit its highest relative level since the presidential election:

So will the outlook for the healthcare sector remain healthy moving forward? As we all know, health can change on a dime, but with the prospects of imminent reform fading into the background and a clear uptrend in place, healthcare stocks could continue to rally into 2018.