It seemed the markets wanted to make a point to alert us that volatility may be here to stay very early in trading this week. After a fairly flat overnight session with very little price volatility, the markets opened up to a moderately large price rotation (first downward, then back higher) before settling into a broader downside move in the early afternoon in New York. The interesting facet of this move is that it seemed to be related to price valuations and expectations in certain sectors.

As we’ve been suggesting for many weeks and months, we are not out of the woods quite yet. The U.S. markets may be subject to more price volatility than we have considered while the continued Capital Shift (foreign capital pouring into the U.S. markets) may also be shifting. One thing is certain, now is not the time to try to set up positional trades in the market expecting longer-term price trends to set up and run over the next few months. This appears to be a traders market where skilled technical traders will shine by finding opportunities and executing very skilled and targeted trades for profits.

Many months ago we authored an article about the U.S. Presidential election cycle and how that event plays into market uncertainty and price activity. We are currently entering the prime span of time where price rotation and volatility because of this election event should take place. This “price malaise” typically happens about 16 months before the election date. As we move closer to the elections, the markets typically become much more volatile and enter a period where the price tends to consolidate near recent lows or establish moderate new lows as attention shifts away from the economy and towards the election news.

If you are serious about trading, this is when you want to pay very close attention to the various market sectors and understand that opportunities may be very short and sweet for profits.

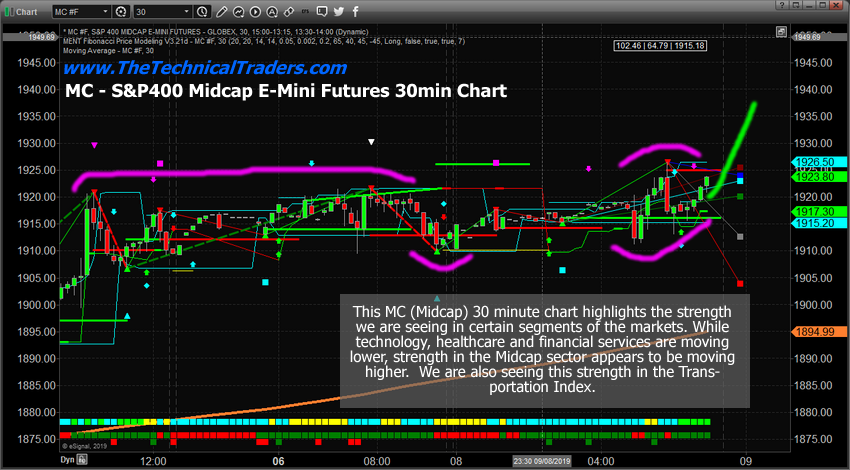

Mid Cap Stock Index 30 Minute Chart Pattern

This first chart is the MC (S&P Midcap 400) which shows how price strength in this sector moved against the overall price trend of the ES, YM, and others. From the start of trading, the MC appeared to have a stronger upside price bias than the other U.S. major market sectors.

This may mean that traders are finding real value in the Midcap sector and are stepping back into this sector thinking it may have some real opportunity for growth.

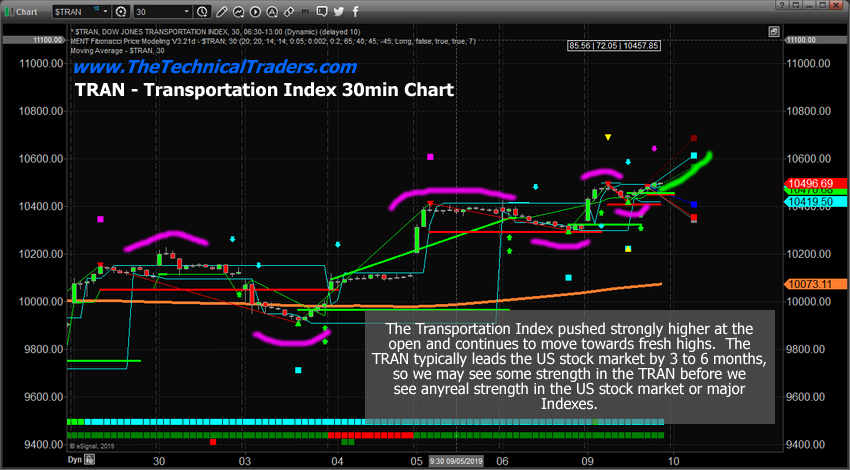

Transportation Index – 30 Minute Chart

Additionally, the Transportation Index moved higher in a similar structure. The Transportation Index typically leads the U.S. stock market by 3 to 6 months as an indicator of future price expectations related to the need for trucks, rail, shipping, and other economic-related activities. More need for shipping/transportation solutions means a more active economy. A more active economy means more buying and selling of goods, services, and other items. Thus, if the Transportation Index can break recent high levels and begin a new upside price move, it would be a very clear sign that the U.S. economy is strengthening and that the U.S. major indexes may begin a new upside price move soon.

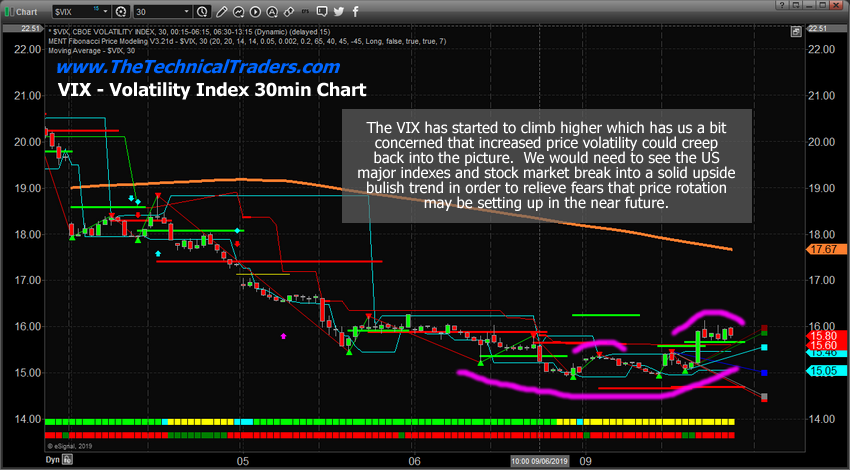

VIX – Volatility Index 30 Minute Chart

The VIX, on the other hand, is still showing us that price volatility has not vanished quite yet. The VIX started moving higher early in trading and continues to push a bit higher right now. If the VIX moves back above 18 or 19 quickly, the we are likely going to see increased volatility in certain sectors of the market which could present real problems for traders. As long as the VIX stays below 18, then the volatility may stay a bit muted going forward.

Pay attention to the VIX and what happens to the major stock indexes over the next 2+ weeks. Trade accordingly. This is not your simple, safe trending market any longer. This is larger volatility with increased risks.

If you are not a very skilled technical trader that understands risks and position sizing, then this market is probably not for you. This is where you will likely chew through your account trying to run longer-term setups in a very choppy market environment.

Volatility is key. Until the VIX settles back down below 12, we are going to continue to experience bigger, more volatile price rotations. Some may be as large as 2% or 3% as news hits. This is why we must understand the risks that are at play here and how to protect our assets from losses. Remember, you don’t have to be in a trade all the time in order to profit from the markets. Watch for the proper setups and wait for the proper entry point before this market chews you up and spits you out.