Investing.com’s stocks of the week

Summary

The sector rotation has once again turned more "end of cycle."

There was a lot of technical damage on the two-month charts.

There was a lot of technical damage on the six-month charts.

Over the last few months, sector rotation has fluctuated between an end-of-the-cycle orientation (where utilities, healthcare, and consumer staples lead) and a more bullish earlier-cycle orientation (where industrials and basic materials issues lead). The former is a natural development for a market that is probably nearing the end of a long rally. The latter is caused by fundamental developments, most notably the completion of new trade deals.

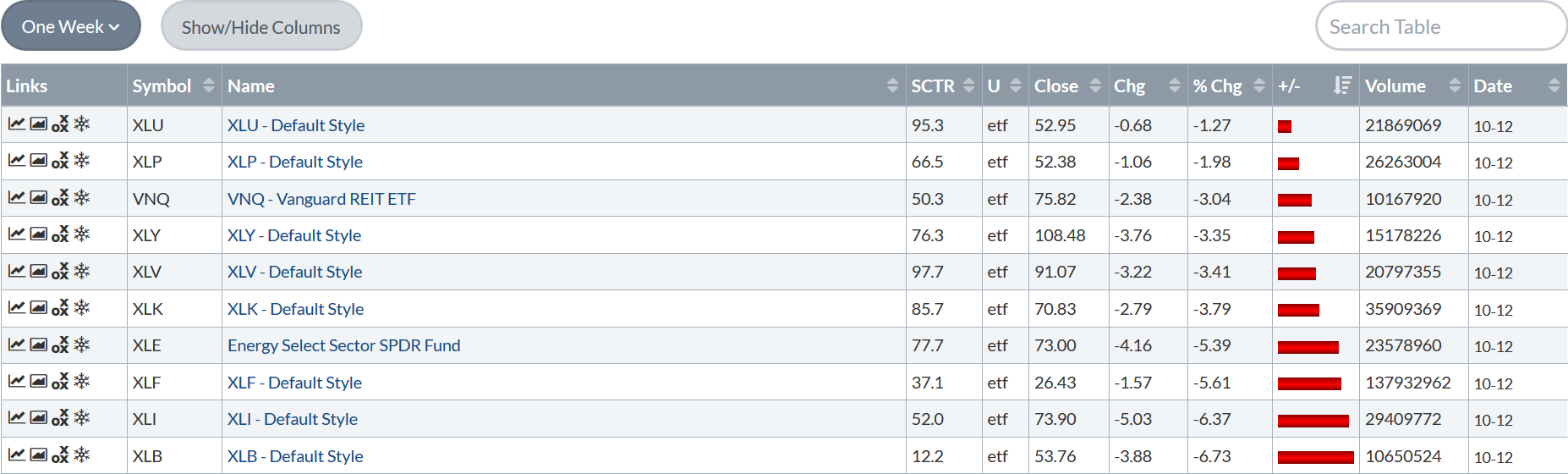

Let's begin, as always, with the weekly performance numbers:

First, this is not a great table; all sectors were down last week. With the exception of real estate (which is oddly the third worst-performing sector), this is a classic late-cycle orientation, with utilities and staples at the top of the list. Consumer discretionary is fourth and healthcare is fifth. Industrials and basic materials issues are at the bottom; both are down over 6%. These two groups had rallied in reaction to news of a new trade deal.

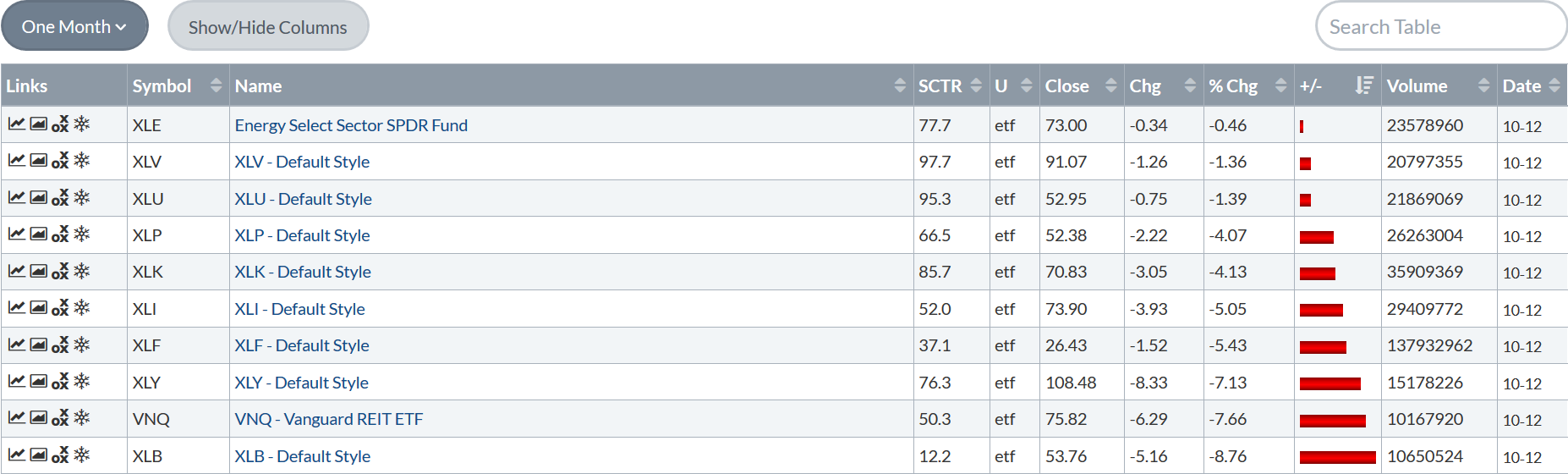

Again note that all sectors fell over the last month and in some cases sharply. Basic materials were off nearly 9% while real estate declined nearly 8%. Turning to the top, energy was the leader, rising in conjunction with a recent increase in oil prices. The number 2, 3, and 4 spots are populated by defensive sectors: healthcare, utilities, and staples.

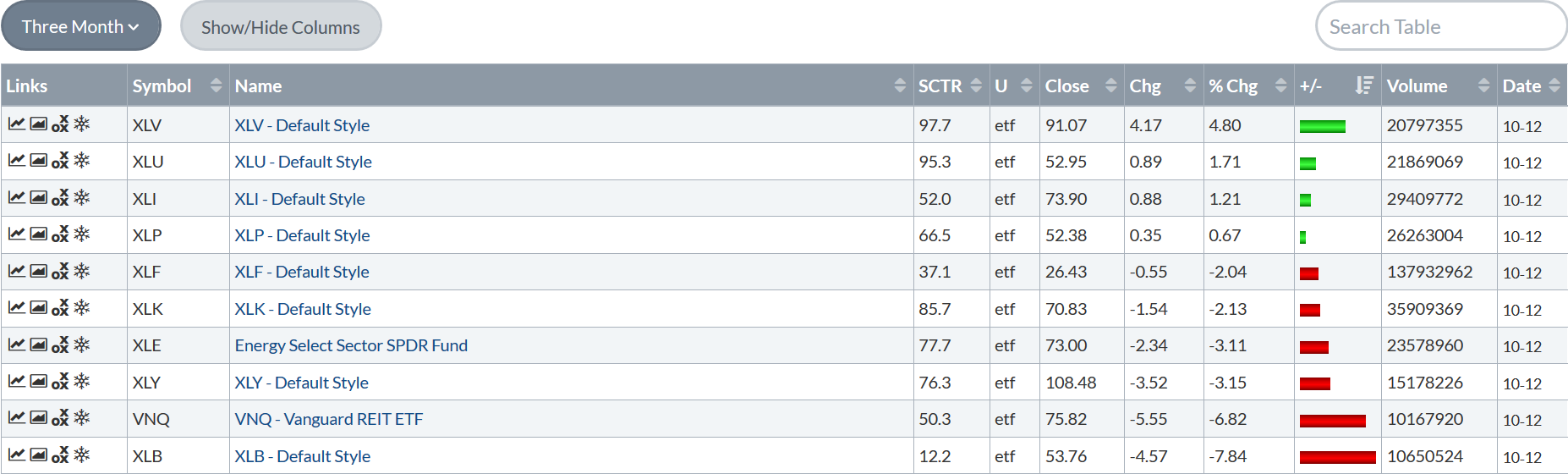

And finally, we have the three-month table, where the 1, 2, and 4 slots are populated by healthcare, utilities, and staples. Industrials issues are number 3, but as previously mentioned, this is a "special situation" caused by one-time events.

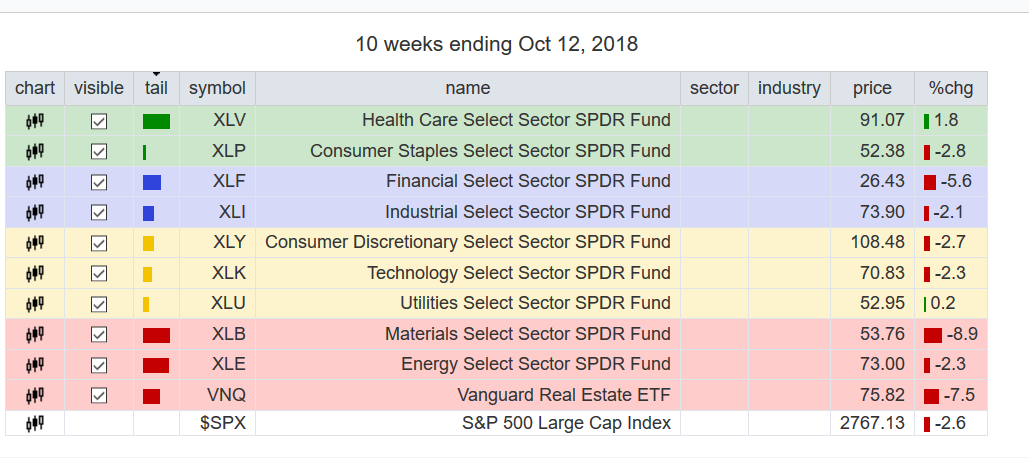

Over a 10-month time frame, the markets are still taking a late-cycle orientation, with healthcare and staples leading the pack.

This week, sector performance returned to a more "classic" end-of-cycle orientation with more conservative sectors "leading" the markets. Especially given the severity of this week's selloff, this should not be a surprising development. Traders and investors will naturally take a more defensive posture during a sell-off. Going forward, the question is "will this trend continue?"

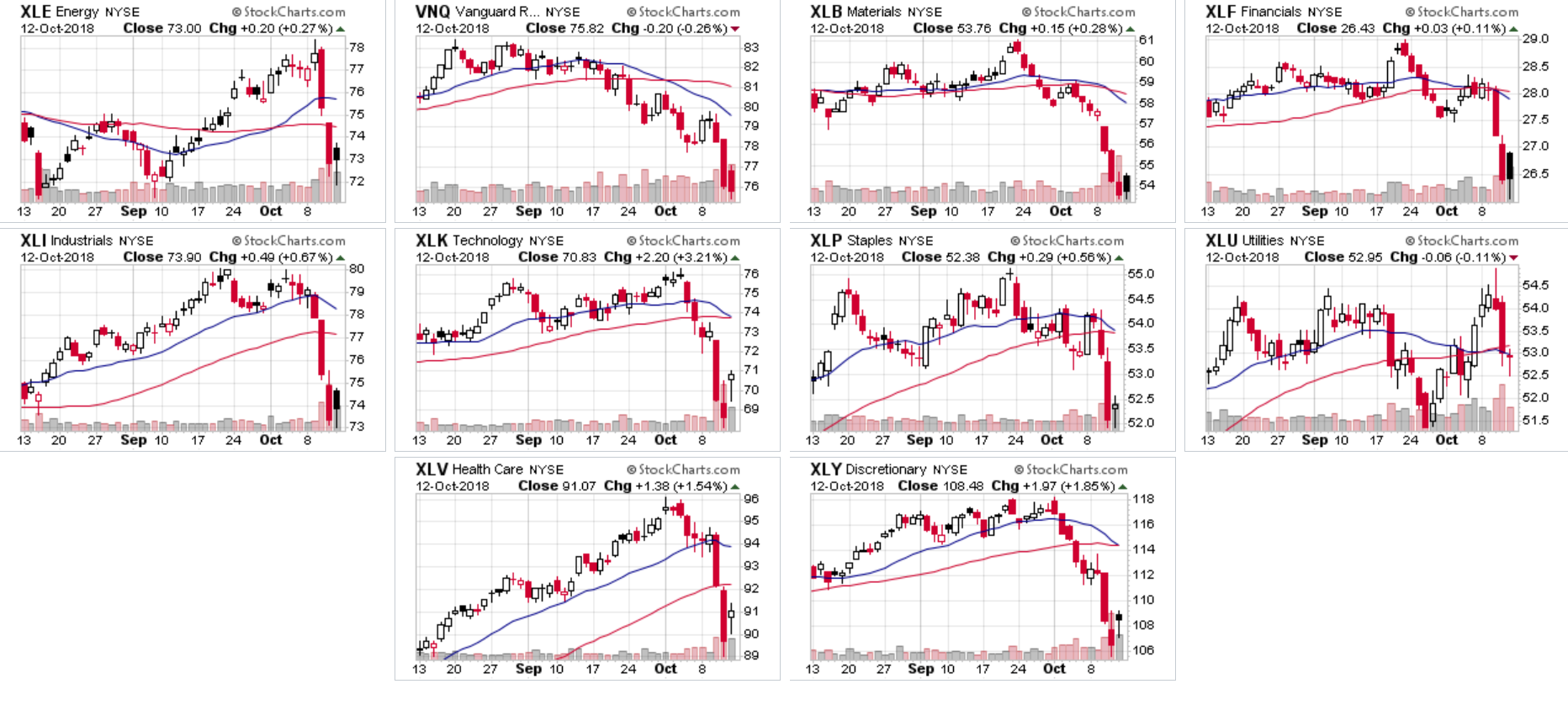

Let's now turn to some charts, starting with a group of 2-month charts of the major ETFs:

Let's begin with the most obvious observation: no sector is currently rallying. Industrials, technology, healthcare, and consumer discretionary were all moving higher, but that ended this week. The technology sell-off is especially concerning. It comprises over 26% of the S&P 500 and has been a primary contributor to the recent rally. Nine sectors are near or at two-month lows and most of the moving averages are bearish. This week's sell-off did a lot of technical damage.

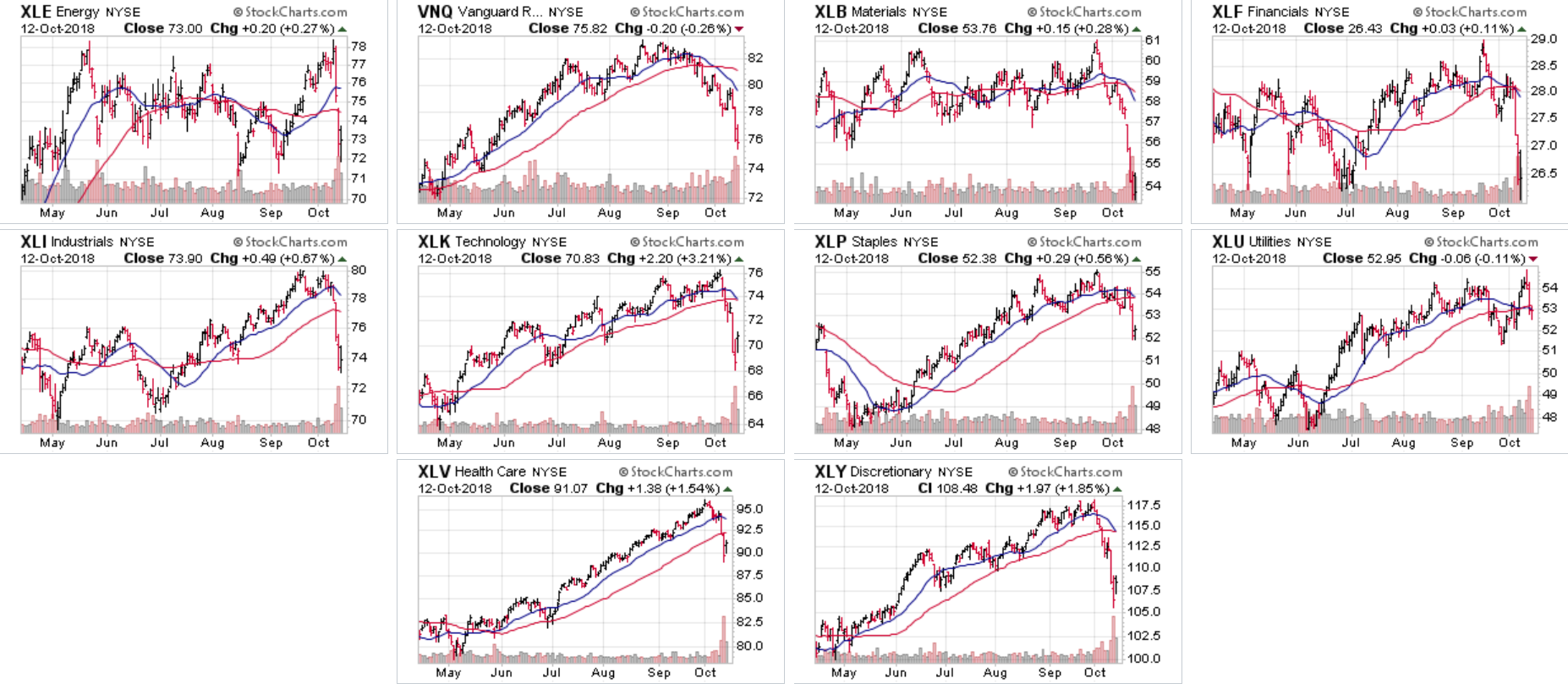

The six-month charts also show a tremendous amount of technical damage. Basic materials (top row, second from right) broke through supports and hit a six-month low in this week. Financials (top row, far right) did the same. Industrials and technology (middle row, two on the left) broke strong uptrends of this week. Staples (middle row, second from right) broke support. Healthcare (bottom row, left) also broke an uptrend this week as a consumer discretionary (bottom row, right). As with the two-month charts above, there is little positive news in the six-month charts.

The market has been overvalued for at least a year, sector rotation was turning bearish, and bond yields have been rising. The above sector ETF charts -both the two-month and six-month time frames - show fair amount of technical damage. While a return to more bullish sentiment and price action is possible, I don't think that'll happen this week.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.