Summary

- All sectors rose this week.

- Defensive sectors underperformed on a one-month basis.

- Although the industrial sector ETF is rising on a relative performance basis, the fundamentals don't support moving into this sector.

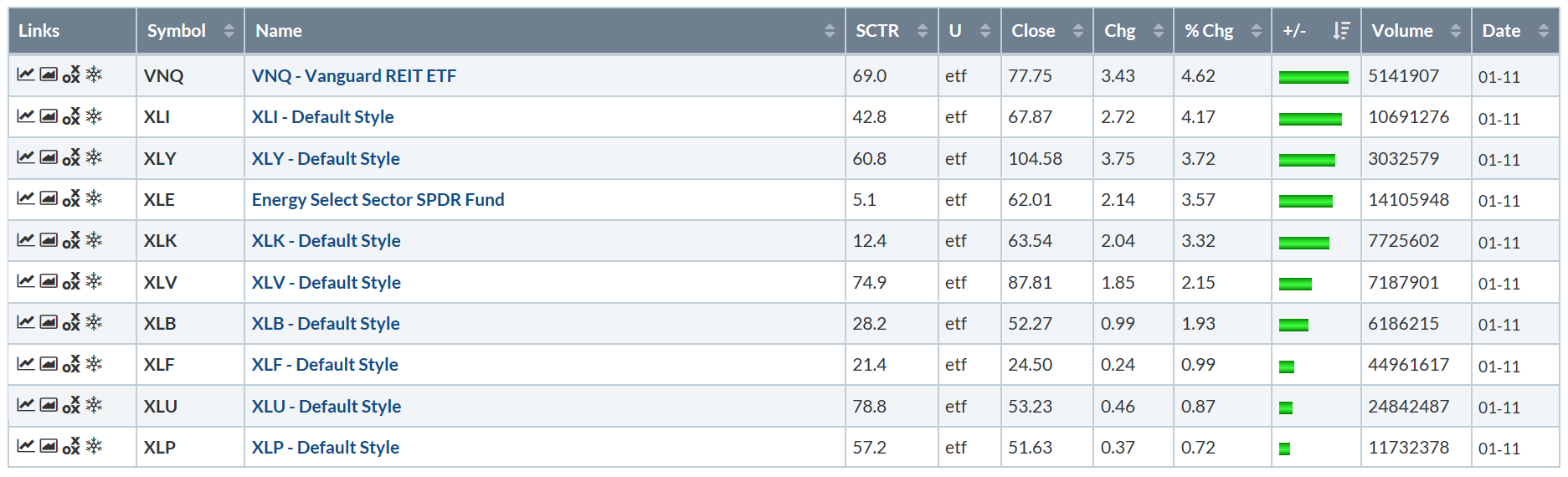

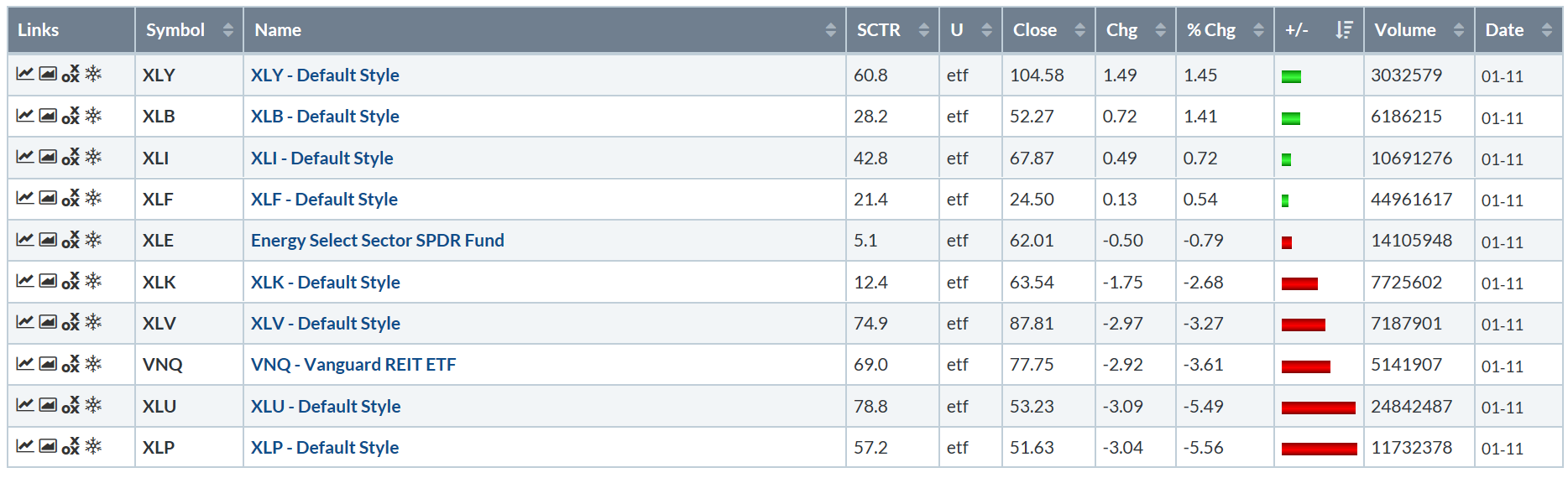

Let's start where we always do: performance tables

First of all, everybody rose; the only difference is degree. A more dovish Fed tone hoisted real estate into the top position. But industrials and consumer discretionary were the second and third best-performing ETFs. At the bottom of the list are two defensive sectors - utilities and staples. Technology - the largest component sector of both {{525|SPY}} and QQQ - were up 3.32%.

The monthly chart has a very interesting development: the defensive sectors were not only the worst performers, but they also lost money. In contrast, consumer discretionary and basic materials - two early-cycle sectors - were up, even if only modestly.

The three-month table has a classic defensive orientation to it. However, the under-performance of these sectors in the one-week and one-month time frame could lead to them underperforming in the coming weeks.

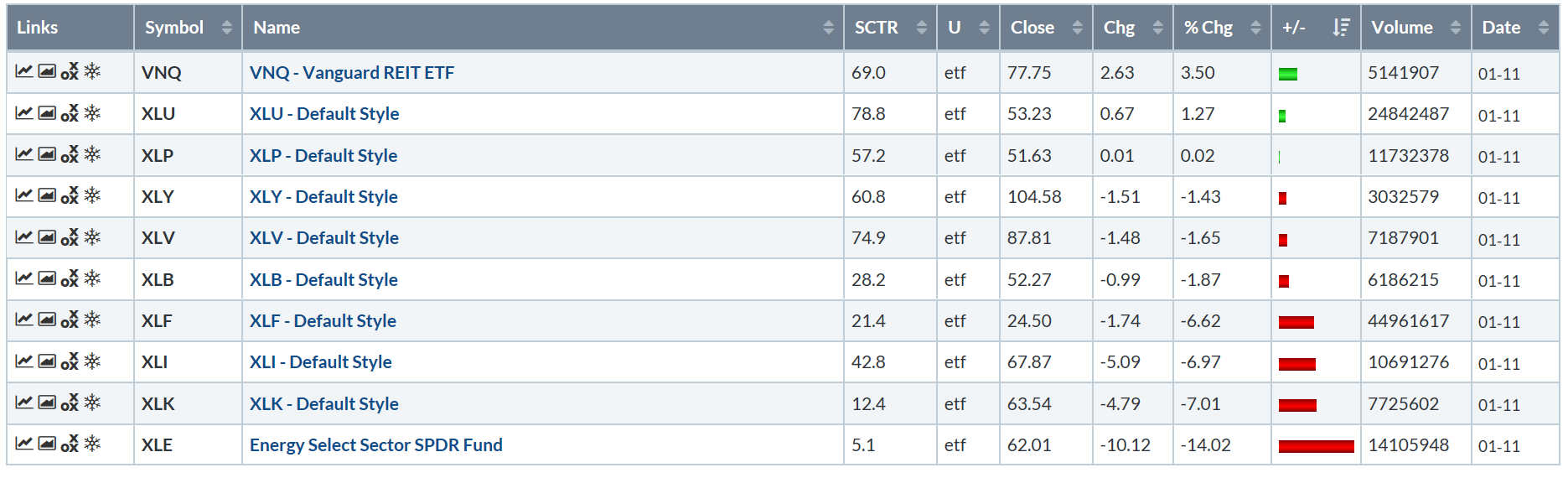

Defensive sectors are still leading the market. But all four sectors continue to move lower; healthcare and staples are close to shifting to the weakening sector. Industrials, financials, and basic materials continue to inch closer to leading the market.

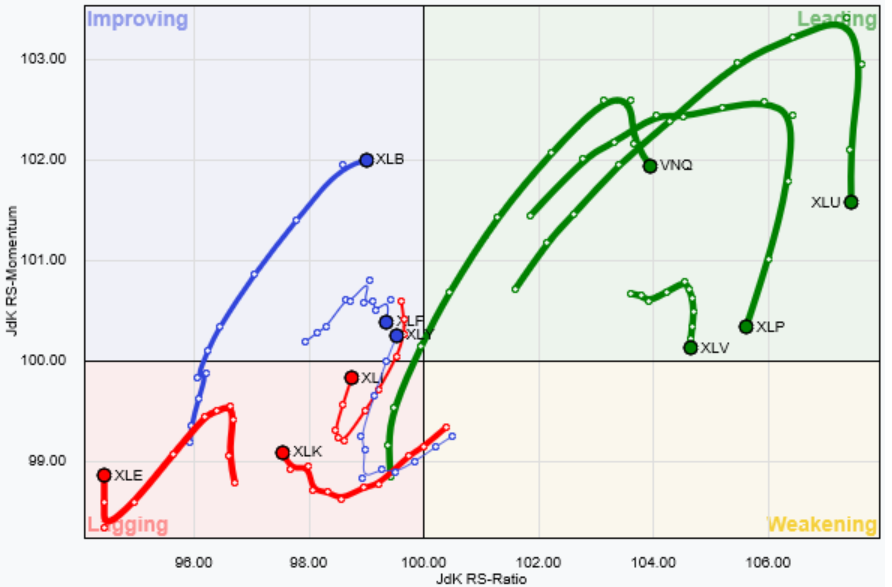

Let's turn our attention to the industrial sector, starting with the two-month charts:

Most of the charts contain conflicting signals. The 20- and 50-day EMA for all is moving lower, indicating a longer-term downtrend. But seven have sharp rallies since the beginning of the year. These moves higher have shifted prices above one or both of the EMAs, which is a bullish development. It's this recent rally that is obviously responsible for the change in XLI's position relative to SPY (NYSE:SPY).

But the six-month charts are still decidedly bearish, with the shorter-term rally occurring within a broader move lower.

That doesn't mean there aren't some compelling opportunities.

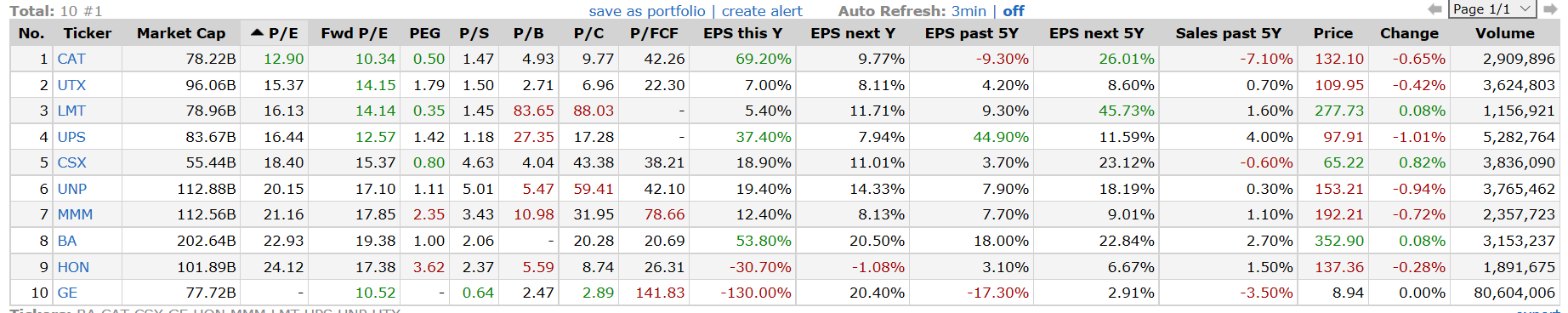

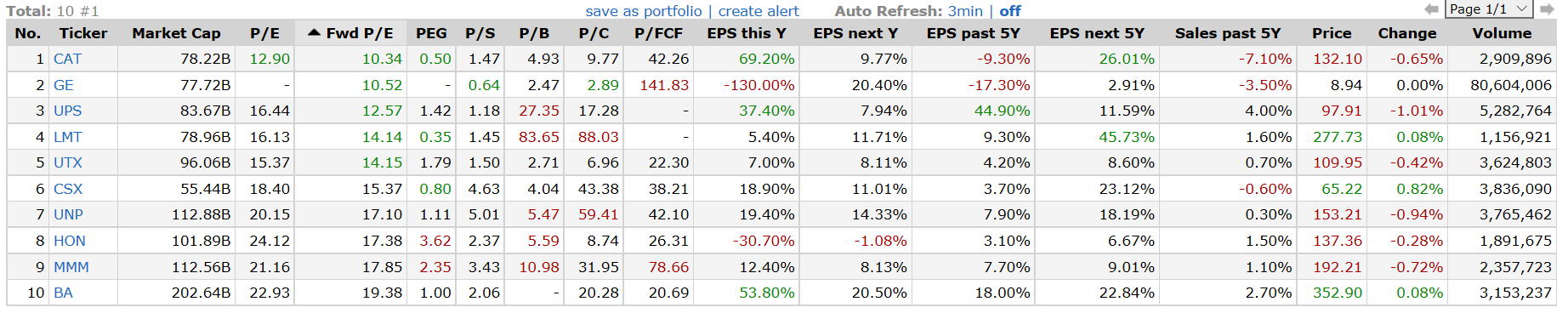

Caterpillar (NYSE:CAT), United Technologies (NYSE:UTX), and Lockheed Martin (NYSE:LMT) are fairly cheap from a PE perspective.

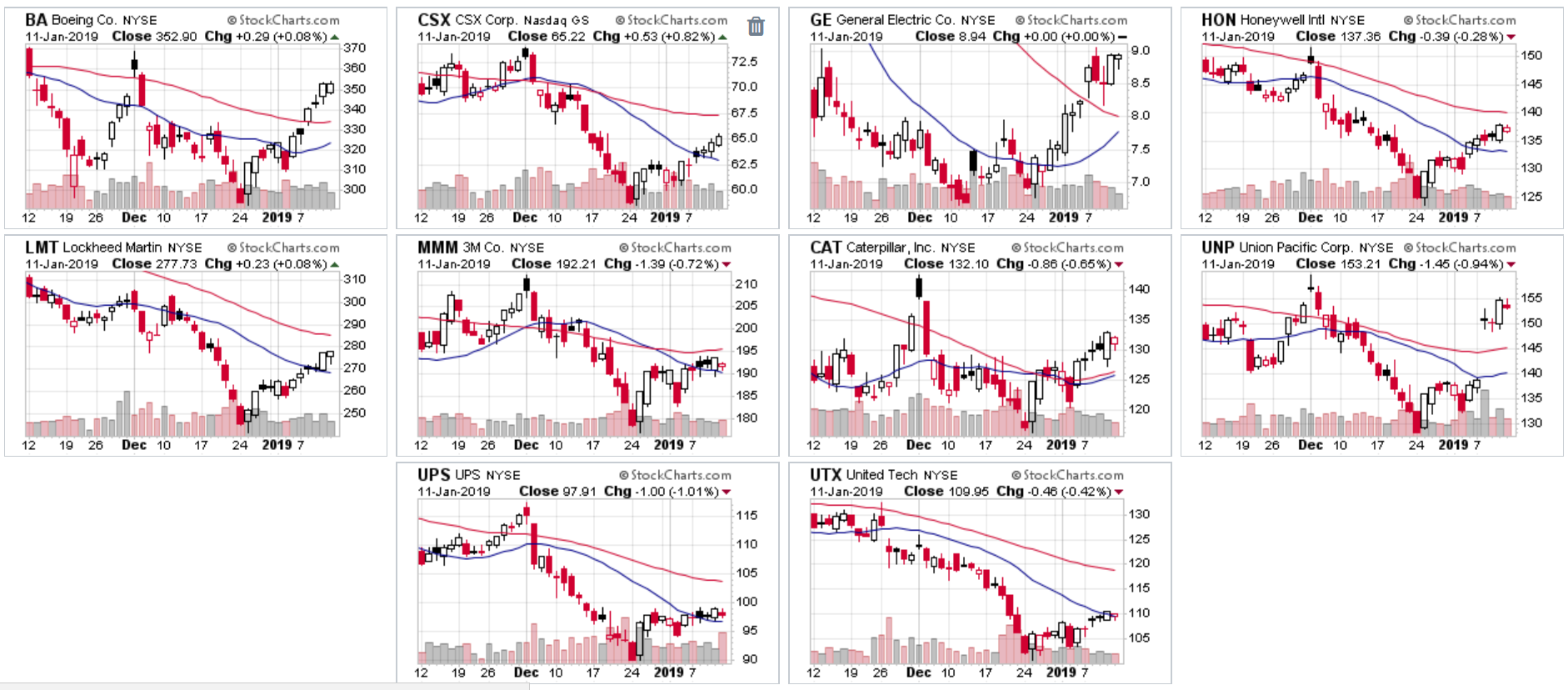

On a forward PE basis, there are five potential buys.

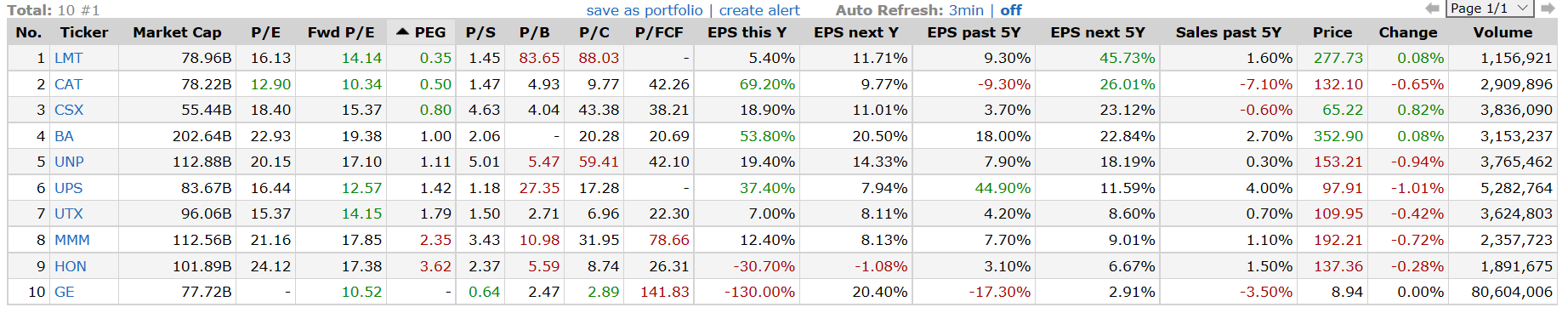

On a price/earnings growth basis, three are below 1.

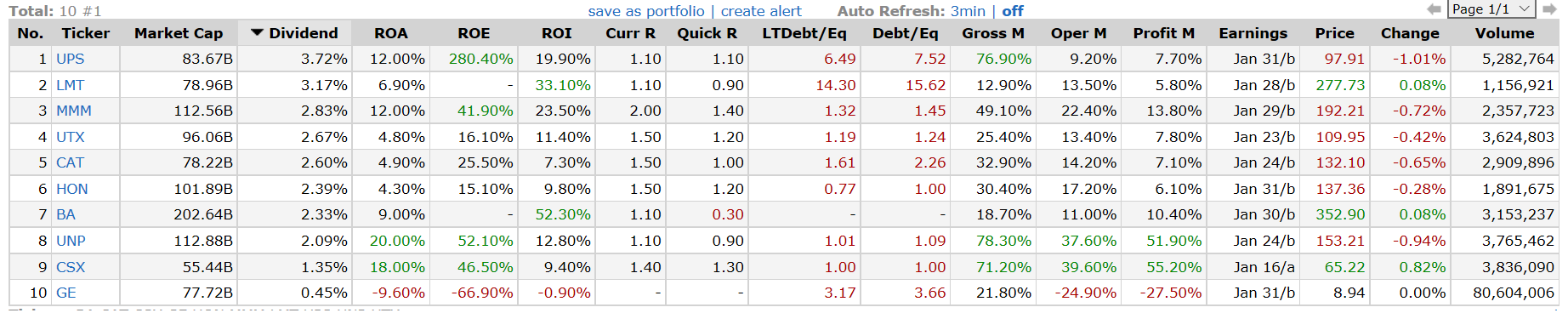

Two are yielding over 3%, and MMM is at 2.83.

Two names make three appearances in the top three positions of these tables. Lockheed Martin has a low current PE, a very low price/growth ratio, and a yield over 3.17% (51% payout ratio and 16 years of growth). It's in the defense industry, which was in favor over the last two legislative years. However, the Democrats are now in control of the House, which means defense appropriations might take a modest hit. And the company relies on international sales, which might be caught-up in trade issues going forward.

Caterpillar is high up on the PE, forward PE, and PEG list. However, it also has a very strong international presence and so is subject to the trade problems we're currently experiencing. Its product is expensive, which means companies must be willing to commit to longer-term payments. One of the company's biggest buyers - China - is currently slowing down. And steel tariffs will put pressure on its margins. Overall, the fundamental backdrop is weak.

Fundamental events explain the recent rise in the industrial sector. Over the last few months, we heard dribs and drabs of good news on the trade front, with China and the US both saying progress is being made. Furthermore, the Fed is now in "pause" mode, further easing pressure on the economy. This ripples through the global economy, as a less aggressive Fed, will lower the dollar, making U.S. exports cheaper. It will also ease some pressure on emerging economies that have borrowed in dollars.

However, as I noted in this week's Technically Speaking, European industrial production has taken a sharp hit over the last few months. And according to the latest global PMI, we can probably expect continued subdued performance (emphasis added):

The global manufacturing sector continued to register a subdued performance at the close of 2018. Output growth remained weak, while rates of expansion in new orders and employment both slowed. The trend in international trade flows also remained weak, with new export business declining for the fourth straight month.

The J.P. Morgan Global Manufacturing PMI™ - a composite index1 produced by J.P. Morgan and IHS Markit in association with ISM and IFPSM - fell to a 27-month low of 51.5 in December, down from 52.0 in November. The average reading over the fourth quarter (51.8) was the lowest since quarter three of 2016.

What we're witnessing right now is a news-based rally, where a headline will spark a short-term buying binge. But the underlying fundamentals don't support the idea of moving into this area of the market.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.