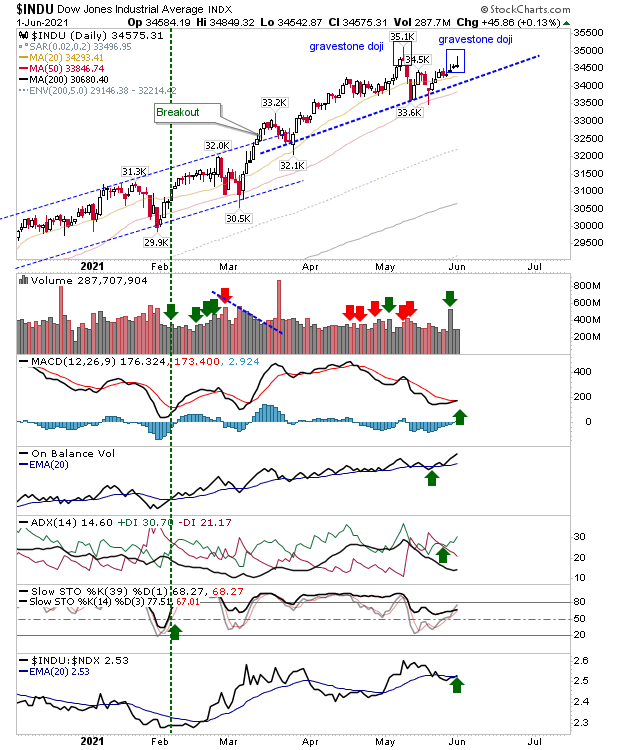

It was a bit of a mixed bag for the indices. The Dow Jones Industrial Average posted a second gravestone doji following the earlier one at the start of May.

The index was still above trendline support, lead moving averages (20-day, 50-day and 200-day MA) and technicals were net positive—including relative performance—but two gravestone doji at a peak are a potential concern.

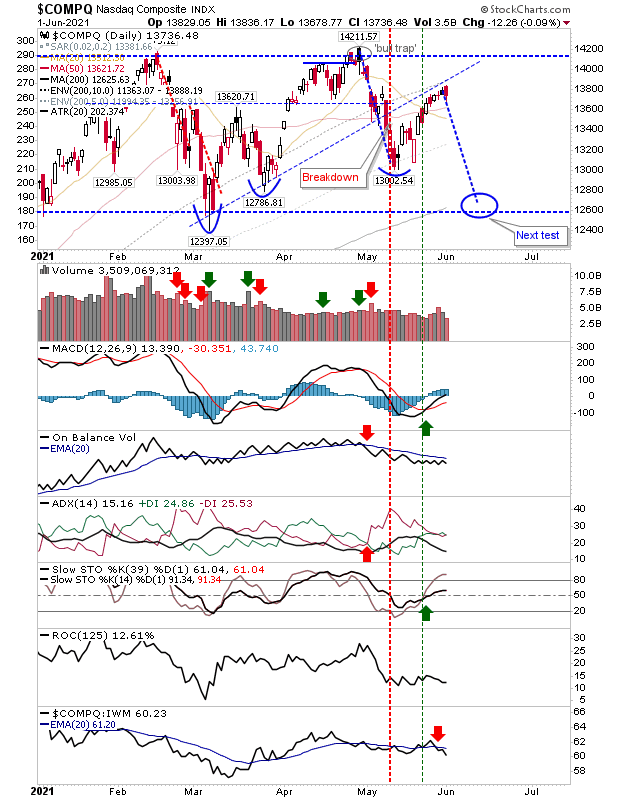

The NASDAQ didn't do a whole lot Tuesday, but it remained below resistance. Technicals were mixed and yesterday could have been considered a bearish engulfing pattern, but it didn't occur on overbought stochastics.

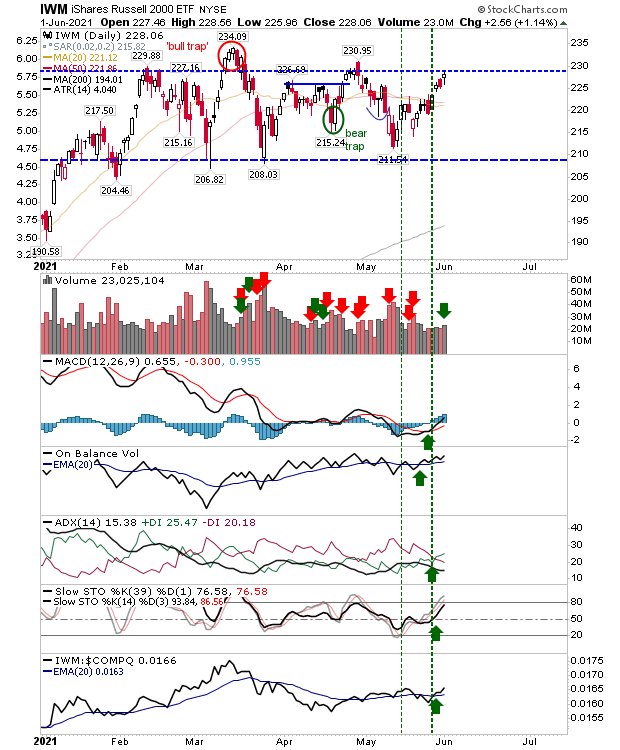

The Russell 2000 was working towards a challenge of the March 'bull trap,' but it's not there yet. Technicals were net bullish but the index was still inside its trading range.

For today, we will be looking for further losses in the Dow Industrials and a pending breakout in the Russell 2000; one, both (or neither) of these events may happen—but that's what's in play at the moment.