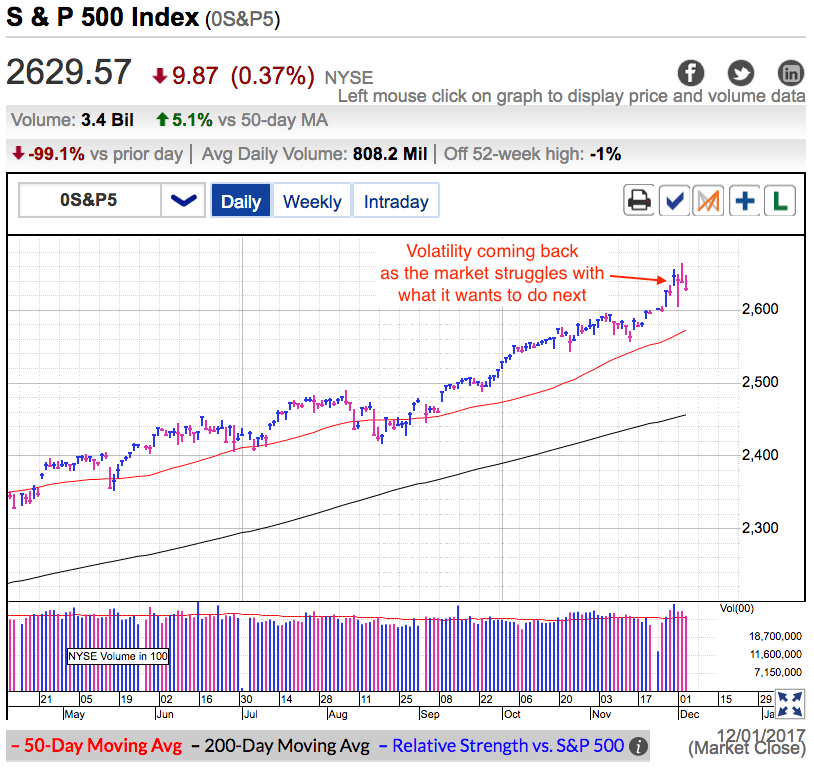

It’s been four trading days since my last free blog post and what a ride it’s been. Volatility has come back with a vengeance as breakouts fizzle and breakdowns rebound. The S&P 500 continues hovering near all-time highs, but the market is anything but certain about what it wants to do next.

Republicans are marching toward the most significant Tax Reform in decades. At this point it is more a question of when, not if it will happen. There is a lot of agreement between the Senate and House bills and it is simply a matter of resolving those minor differences.

The reason the market has not reacted strongly to Republicans making further progress toward tax cuts is by this point most traders have started assuming this is going to happen. When the crowd believes something will happen, then it becomes priced in even if the event hasn’t occurred yet. Those who wanted to buy the Tax Reform pop have already bought and anyone waiting for the news to becomes official will be too late.

That said, the market has become increasingly volatilite over recent days. Last week we surged to record highs. Then Friday’s intraday price-action produced some epic gyrations, briefly erasing the entire week’s gains. And then Monday’s surge to record highs fizzled and reversed. The closer we get to Tax Reform, the more uncertain the market becomes about what comes next.

A big chunk of this rally has been built on hopes of Tax Reform. Now that is about to become a reality, what is the market going to hang its hat on? What do we have to look forward to? Some market pundits speculate corporate tax cuts will lead to a surge of reinvestment and hiring. That argument claims economic growth will pay for the tax cuts, but I’m suspicious. Over the last few years we have seen record amounts of corporate profits given back to shareholders in the form of dividends and stock buybacks. If these companies already have more money than they need for reinvestment, giving them even more isn’t going to change anything. Of course new dividends and stock buybacks will boost the stock market and as stock traders, that is what we care about. But as far as stimulating economic growth, I wouldn’t count on it.

At this point it seems like most of the Tax Reform upside has already been priced in. We will see a pop when the final deal is struck between the House and Senate, but we are talking about a handful of a percent, not tens of percent of upside. And maybe a lot less if recent weakness devolves into a sell-the-news event. Risk is a function of height and at these record highs, the market has never been riskier. Tread carefully.