SeaDrill Limited (NYSE:SDRL) , based in London, is one of the leading offshore drilling contractors in the world. The company’s fleet is one of the youngest and most advanced when compared to that of major contractors engaged in offshore drilling.

Today, the company’s fleet can be broadly classified into three distinct groups based on drilling capabilities: floaters (semi-submersibles and drillships), jack-up rigs and tender rigs.

Currently, SeaDrill has a Zacks Rank #3 (Hold) but that could change following its second quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank stocks here.

We have highlighted some of the key details from the just-released announcement below:

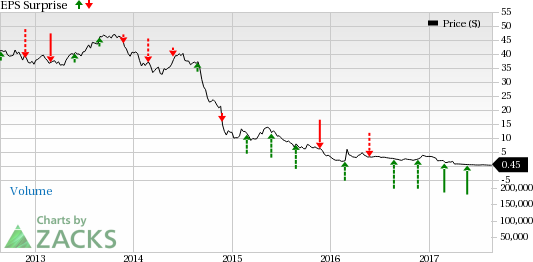

Wider than Expected Loss: Loss per share (excluding one-time items) came in at 28 cents, wider than the Zacks Consensus Estimate of a loss of 6 cents.

Revenues Decline: Revenues came in at $577 million, lower than the prior year quarter figure of $868 million.

Segmental Analysis

Floaters: This segment reported revenues of $375 million compared with $610 million in the year-ago quarter. Net operating income was $46 million as compared to the prior-year quarter figure of $270 million.

Jack-up Rigs: The segment registered revenues of $179 million as against $234 million in the prior-year quarter. The segment recorded a net operating loss of $148 million as against an operating income of $92 million in the year ago quarter.

Other: Revenues of $23 million were lower than $24 million reported in the prior-year quarter. Operating income of $2 million remained unchanged from the year ago quarter.

Check back later for our full write up on this SeaDrill earnings report later!

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Seadrill Limited (SDRL): Free Stock Analysis Report

Original post

Zacks Investment Research