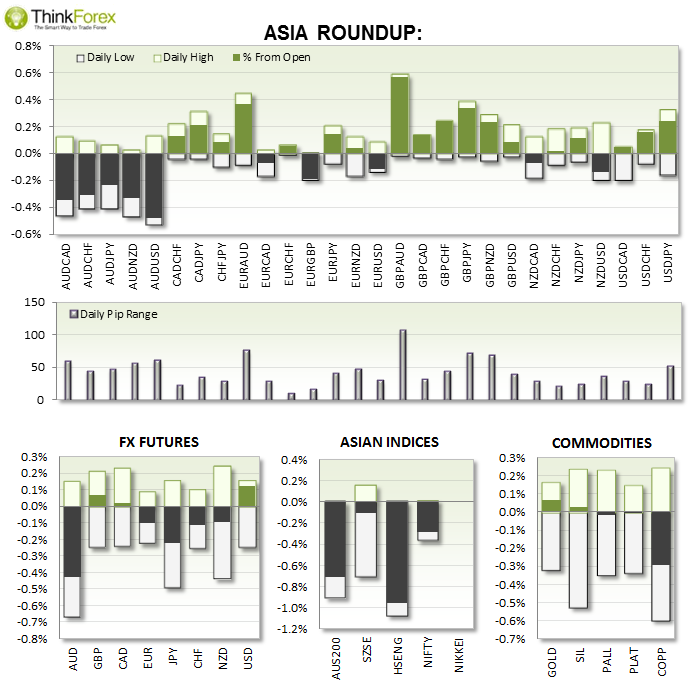

Australian Dollar and Asian Equities took the biggest hit. With Equities down in Asia and followed the theme from US yesterday there is enhance we'll see a continuation of this at European open. If stocks are dropping this tends out outline a risk-off environment, so could favour USD, CHF, JPY. Gold is also looking a little overstretched, but keep in mind that USD strength is keeping it from rising from current lows.

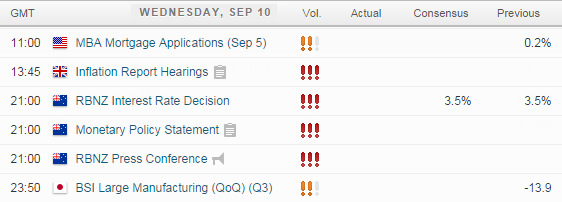

UP NEXT:

USD: Fairly light on news today from US but 'nice to know' info such as JOLTS job openings and Mortgage Approvals will be monitored by the Fed. Any high numbers here may also help with FOMC staff projections which will be the headline figures next week.

GBP: Inflation report hearings are likely to be muted affair due to the uncertainty of Scottish referendum. If Scotland votes 'yes' next week then BoE are very likely to be forced to keep interest rates on hold for longer which would continue to weigh down on GBP crosses. Therefore, regardless of how strong inflation data may be tonight it may not have the usual bullish effect on GBP crosses. However if this falls inflation looks pressured then this could bring further downside on GBP crosses.

NZD: Early Asia tomorrow will be kicked off with RBNZ rate decision.

TECHNICAL ANALYSIS:

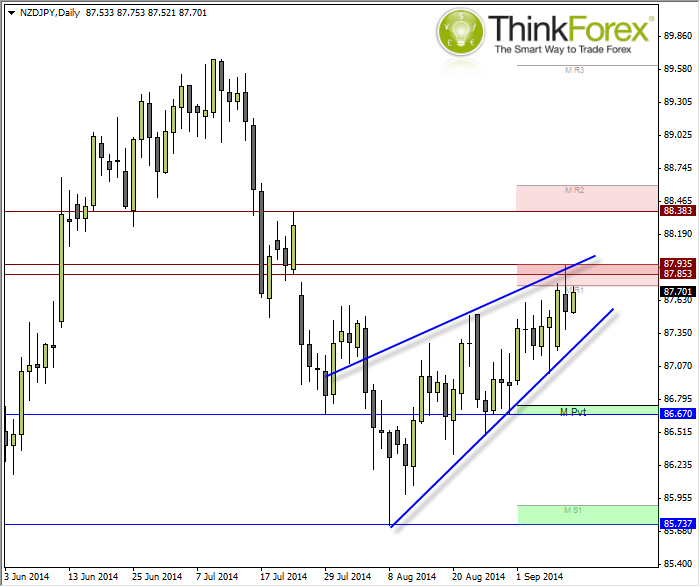

NZD/JPY: One for Early Asia

BIAS: A Dovish Wheeler tomorrow should help yesterday's high cap as resistance and confirm the bearish wedge.

COUNTER-BIAS: A break above yesterday's high invalidates the bearish wedge and would suggest a bullish channel to target 88.40

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.