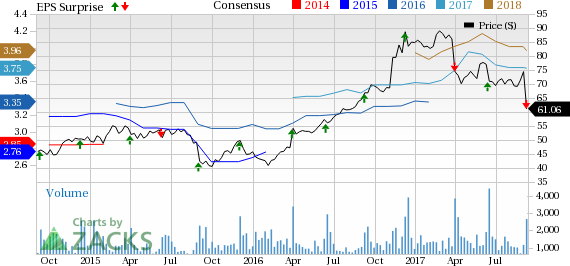

Science Applications International Corp. (NYSE:SAIC) reported second-quarter fiscal 2018 earnings of 80 cents per share, which decreased 1% from the year-ago quarter. Including 9 cents of accounting charges related to the adoption of ASU 2016-09, earnings were 89 cents per share that missed the Zacks Consensus Estimate by couple of cents.

Moreover, revenues decreased 2% from the year-ago quarter to $1.08 billion and missed the Zacks Consensus Estimate of $1.09 billion. Internal revenues declined 1.4%. Management noted that completion of contracts that include the loss of a contract with the Department of Homeland Security (DHS) and other net contract declines across its portfolio negatively impacted revenues.

Management stated that several federal civilian customers are suspending technology upgrades and IT modernization that is affecting margins. Moreover, unfavorable contract mix is hurting profitability. The company continues to witness increase in cost reimbursement type contracts as compared with fixed price contract types.

Shares have decreased almost 18.22% to close at $61.06 on Sep 9, following the results.

Science Applications has lost 28% of its value year to date versus the 22.9% increase of the industry it belongs to.

Quarter in Details

Net bookings for the quarter were approximately $2.1 billion, which reflects a book-to-bill ratio of approximately 2.0 in the quarter. At the end of the quarter, Science Applications’ estimated backlog of signed business orders was approximately $9.2 billion of which $1.8 billion was funded.

During the quarter, the company won a contract worth $621 million (if all options are exercised) from the General Services Administration (GSA) Federal Systems Integration and Management Center (FEDSIM). Moreover, the GSA, on behalf of the Army Software Engineering Directorate (SED), awarded another contract worth $404 million (if all options are exercised).

Science Applications also won contracts from the National Aeronautics and Space Administration (NASA) GSFC Omnibus Multidisciplinary Engineering Services, U.S. Navy - Space and Naval Warfare Systems Command (SPAWAR), NASA Joint Operations, and National Institute of Mental Health.

The estimated value of proposals submitted by the company is approximately $15 billion, up $1.8 billion from the previous quarter.

Adjusted EBITDA margin contracted 130 basis points (bps) on a year-over-year basis to 6.5%. Adjusted operating income margin contracted 120 bps to 5.5% in the reported quarter.

The year-over-year contraction in profitability was primarily due to lower contract profitability on programs supporting federal civilian agencies, lower profitability on re-competed supply chain management contracts and higher severance and facility expense.

Balance Sheet & Cash Flow

Science Applications ended the quarter with cash and cash equivalents of $140 million, down from $207 million reported in the previous quarter.

At the end of the quarter, the company repaid debt worth $25 million and no longer has any borrowings under the revolving credit facility.

Days sales outstanding (DSO) was 54 days, including a 4-day impact from a customer payment center delay.

Operating cash outflow was $35 million and free cash outflow was $38 million. The company delivered operating cash flow and free cash flow of $88 million and $84 million in the previous quarter, respectively.

Science Applications spent $51 million in cash dividends and repurchasing shares.

Guidance

For fiscal 2018, Science Applications expect EBITDA margin, to be in the 7% range.

For fiscal 2018, management estimates tax rate to be approximately 24% to 26%, modestly lower than the previous estimate of 26% to 28%. Science Applications anticipates the effective tax rate to be in the low 30% range for the second half of the year.

Management expects DSOs to return to the low 50%, which is within its normal operating range. The company continues to expect $240 million of free cash flow for the fiscal year 2018.

Further, Science Applications expect to pay dividends of almost $55 million and pay debts worth approximately $25 million. Remaining cash balance is expected to be in excess of $150 million available for further share repurchases and strategic mergers & acquisitions.

Zacks Rank & Stocks to Consider

Currently, Science Applications has a Zacks Rank #4 (Sell).

Better-ranked stocks in the broader sector include CSRA Inc. (NYSE:CSRA) , CoStar Group Inc. (NASDAQ:CSGP) and Nutanix Inc. (NASDAQ:NTNX) . All the three stocks have Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rates for CSRA, CoStar and Nutanix is currently projected to be 10%, 15% and 20%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

CoStar Group, Inc. (CSGP): Free Stock Analysis Report

CSRA Inc. (CSRA): Free Stock Analysis Report

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION (SAIC): Free Stock Analysis Report

Nutanix Inc. (NTNX): Free Stock Analysis Report

Original post

Zacks Investment Research