FX Week In Review

USD

The US Dollar finally slowed down after hitting highs over 95.00 in the DXY. We had conflicting influences on the Dollar, with the new looming trade war, seen as Dollar negative, but a strong NFP Print. The DXY closed at 94.16.

EUR

The Euro remained largely unchanged, with Italy finally naming a government and Spain changing PM, due to a corruption scandal. So, we see some risk in Europe and will be careful.

GBP

Mixed again for the Pound, but we managed a small rally, but it was not that inspiring, so we will have to wait and see what will happen. The Pound is trading above 1.33 in Cable and below 0.8740 in EUR/GBP.

YEN

We mostly traded sideways this week with no real data or major developments.

The Week Ahead

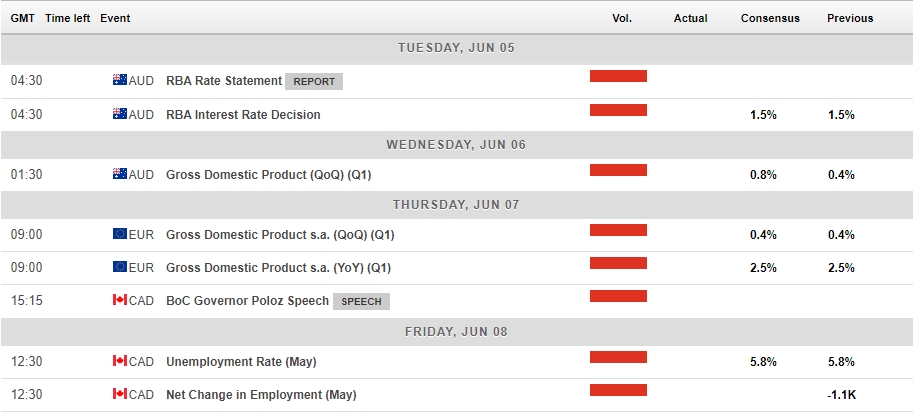

We predict more volatility, with Europe instability raising its head again, and the effect and retaliation of US trade tariffs still to be fully understood. Data wise, we have a lighter week, with some PMI’s and the RBA interest rate decision, and some Canadian data, employment, housing and PMI numbers to come this week.

Major Data Releases

(Data provided by FX Street)

Currency Pairs to Watch

We will be developing our ‘Currency Pairs to Watch’ list to have a great overview of the week to help you keep an eye on some pairs. We now have an accompanying video to show our weekly watch list. Link will be posted on Twitter.

We will be interested in the USD, EUR and GBP this week. We will be looking at the ’trade of the week’ and the EUR/USD, CAD/JPY, and USD/CAD.

Trade of the Week

So Last week we looked at the EUR/USD and we just wanted a break of the low to the target of 1.4729, we moved lower but did not reach that level, with a low of 1.1510. But even if we lost a few pips on this, a good lesson showed a bullish engulfing candle on Wednesday, which would lead us to get out of the trade. (Price always tells us what to do).

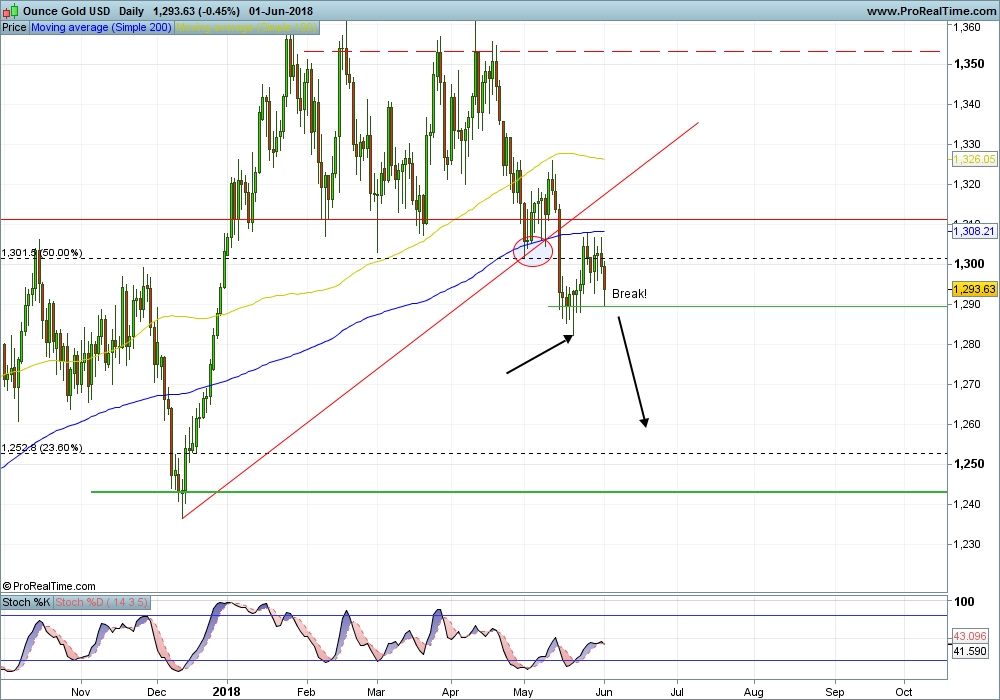

Gold

So, this week we will look at Gold, we see the break through the trendline, and the pull back, and the 200 MA has capped price around 1307.92, we have moved lower with 1289.55 being support. So, we will look for 1289.55 to break for a move to 1282.00 area and maybe 1254 area.

Happy Trading.