Well the “index huggers” hurled their positions quickly, didn’t they! Some bad jobs numbers. A rally in the Japanese yen. And it was sayonara, SPY.

The financial “squares” use blunt instruments. When they panic, they dump the only ETF they own. Turns out they were all short the Japanese yen heading into the weekend!

When the margin call came, they sold the only ticker they own: SPDR S&P 500 ETF Trust (ASX:SPY).

I warned you about SPY three weeks ago, just before it crashed. My problem with SPY came down to three stocks, Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT), which made up 21% of the index—and still do!

That’s right, the “S&P 3” determined the market’s entire moves! Not to mention Alphabet (NASDAQ:GOOGL), the “walking dead” search business model we picked on last week, which is another 4% of SPY. Twenty-five percent!

(If you’re watching the Olympics, you’ve probably seen the flood of commercials for Google and its AI tool, Gemini. My daughter asked me if Gemini was as cool as depicted in the commercials. Like, could it do her homework as advertised! Not quite, I replied—Gemini is better than ad-soaked Google itself! Plus, no ads. I’m having a productive and completely free side conversation with Gemini as I write this piece. Great for me, not so much for GOOGL and SPY owners.)

Now, the SPY dumpers tend not to sit in cash for long. They “rotate” to another sector, like boring old utility stocks. Three weeks ago, I wrote:

I’m most interested in them because sometimes income investing is just that simple. Utility stocks are “bond proxies” that benefit directly from falling rates. When rates drop, the ‘utes rally.

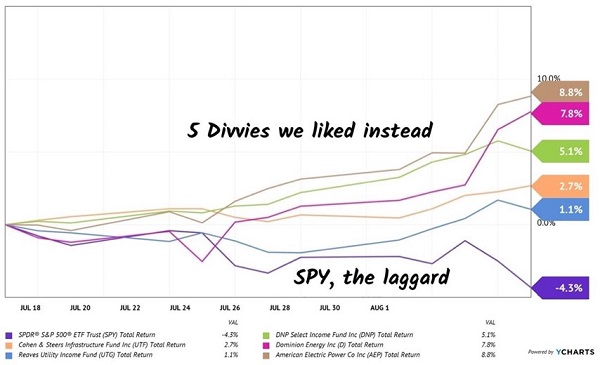

Since then, the ‘utes have indeed rallied! The five picks we discussed have been a prime destination for S&P 3 refugees:

We Told Them So!

SPY is out, the ‘utes are in. What is next as our contrarian bandwagon gains steam? Wouldn’t you know it, we’re welcoming the former “Bond King” Bill Gross to our income party.

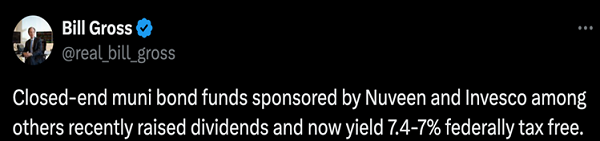

Last week, Gross tweeted about an obscure tax-advantaged subject usually reserved to us here at Contrarian Outlook. The King mused that municipal (“muni”) bond closed-end funds (CEFs) looked interesting here:

Source: X.com

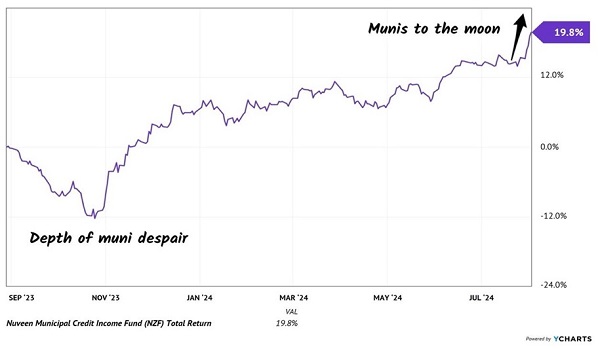

He even went on to list Nuveen Municipal Credit Income (NYSE:NZF) as one of his positions. NZF being a stock “I have owned for years and added to in recent months,” Gross said.

Gross has good taste but I hope for his sake he isn’t piling in too late. NZF is up 19.8% since we called it out as a buy a year ago. Shares yielded a tax-advantaged 4.6% then. They pay 7.5% now thanks to a big divvie increase in between.

Higher interest rates have flowed through to muni issuances. And vanilla investors are finally realizing they need to lock in these higher yields now.

As the vanilla crowd comes running, NZF’s discount is dwindling. Last August we were fawning over the fund’s 14.3% markdown to net asset value (NAV). Since then, it’s down to 8%.

Who could have predicted? Well, we did:

Finally, investors have been slow to pick up on the coming “rates-down-bonds-up trend,” leaving us some terrific deals on muni CEFs. NZF, for example, trades at a 14.3% discount to net asset value (NAV, or the value of the muni bonds in its portfolio) today. That’s far below its 6.6% discount over the last five years.

In theory, NZF’s discount should continue to narrow a bit more. In practice, I don’t like to chase muni funds this hot. Check out the hockey stick at the right side of NZF’s chart. I moved the fund to a Hold in our Contrarian Income Report portfolio because I’d feel better adding to the position on a pullback:

Investors Rush to Buy Our Favorite Munis

Contrarian to a fault? Perhaps. I’m lumping Nuveen AMT-Free Muni Credit (NYSE:NVG) in the same “nice but too hot” bucket. Gross also called out NVG as a personal position. We’ve recommended NVG at opportune moments through the years and owned it in our CIR and Dividend Swing Trader portfolios.

I loved NVG and most other Nuveen muni funds in May. Now? NVG has rallied even more than NZF. I’m not sure I’d chase it here.

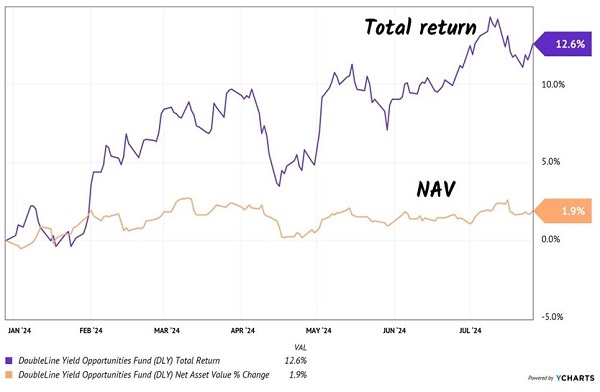

What bond funds do look timely? Gross will hate to hear this, but his old archrival “Bond God” Jeffrey Gundlach runs a great fund with Jeffrey Sherman, dumpster diving for value in Bondland. Their DoubleLine Yield Opportunities Fund (NYSE:DLY) owns the bonds that pensions are not allowed to touch.

Three-quarters of DLY’s portfolio is below investment grade or unrated altogether. The Jeffreys spice their fixed-income know-how and industry connections with a bit of leverage (18%) to dish a monthly dividend of 8.9% annually.

DLY (lovingly called “dilly” by the Jeffreys around DoubleLine HQ) has delivered sizzling total returns of 12.6% year to date. The fund’s net asset value (NAV) has gained nearly 2%. This means DoubleLine dishes DLY’s monthly dividend without depleting NAV.

That’s the DLY!

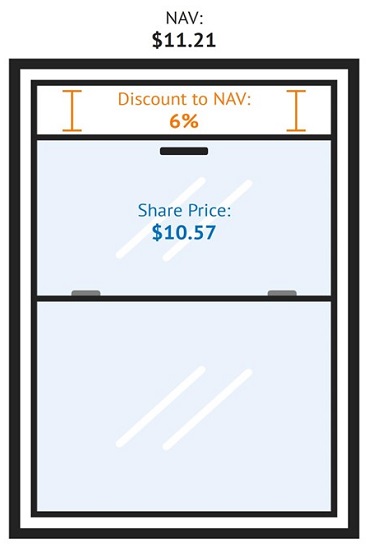

AllianceBernstein Global High Income (NYSE:AWF) is the other “not hot… yet” bond fund on the board today, trading at a 6% discount to NAV. As the AI stock bubble deflates, why wouldn’t some of the “fast money” find its way to a value bond play like AWF at 94 cents on the dollar?

AWF is a rare unlevered closed-end fund (CEF), which makes its 7.6% current yield even more impressive. The fund also plays in fixed-income’s forbidden sandbox, with only 19% of its holdings earning the vanilla “investment grade” stamp of approval.

The fund holds 1,312 bonds. AWF is a one-click way to benefit from AllianceBernstein’s industry stature. Like the Jeffreys at DoubleLine, issuers offer AB their best deals.

Did you receive the phone call about Advanced Drainage Systems’ 6.375% offering? Neither did I—the call went to AB, which stashed the bonds in AWF.

How about ERP Iron Ore LLC’s 9.04% bonds? Or Domtar (NYSE:UFS) Corp’s 6.75% paper?

I love financial analysis, but the due diligence on this gives even your nerdy analyst a headache. I’m happy to outsource the task to AB! And, even better, accept a 6% discount for the job—which means they are working for us for free.

DLY and AWF pay monthly dividends, which is ideal for income-focused retirement investors like us. And these aren’t the only 8%+ divvies, payable monthly, that are flashing buy signals today.

If you like dividends, make sure you purchase these 8%+ payers before the Bond King tweets about them!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."