With the Trump rally waning and the FOMC finally pulling the trigger on a rate hike, the US markets need only to get through Options Expiration Friday before they can focus on the event of the year. The Santa Claus Rally. Isn’t it great we need to have a name for every 2 week move in markets? Whether the Santa Claus Rally is real or not, or if it will appear his year or not I do not know.

US markets do look strong so there is a good chance for it. But today I noticed something broader than that. The Santa Claus Rally seems to be coming to Germany early this year. Yes, Santa does visit the boys and girls in Germany where everyone says Frohliche Weihnachten. The chart below shows this year the Germans have been extra good.

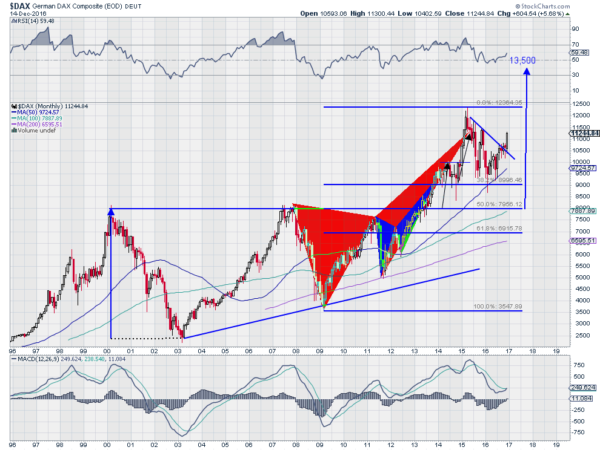

This long term chart of the German DAX paints the picture. After a major break out in 2013 the DAX continued higher reaching a top in 2015. This was short of the target out of an ascending triangle which would measure to 13500. But the run higher did complete a bearish Deep Crab harmonic pattern. After reaching the Potential Reversal Zone (PRZ) the DAX pulled back. It hit the first downside target with a spike down in February this year. This touched a 38.2% retracement of the pattern, and reconnected with the 50 month SMA.

From there it has been mostly a ride higher for the DAX. The 5 months preceding December consolidated the short term gains. This sideways action took the DAX right to short term falling trend resistance and then through it. Which brings us to December. The DAX is up 5.68% as of Wednesday’s close. And As I write this it is up another 50 points Thursday. The significance technically is that it has broken resistance and with a strong move higher.

Momentum supports this move continuing too. The RSI held at the mid line on the pull back and is now turning back higher. The MACD reset lower as well, and stayed positive. Now it is turning back higher too and about to cross up through the signal line. The next milepost to look for is a break above 11500. With that only 12000 stands in the way of a new all time high for the DAX. Come on Santa, we are pulling for you.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.