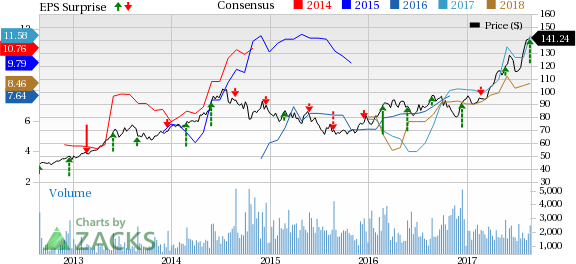

Sanderson Farms, Inc. (NASDAQ:SAFM) reported better-than-expected results for third-quarter fiscal 2017 (ended Jul 31, 2017).

Shares of this Zacks Rank #2 (Buy) stock were up 3.3% to $141.24 per share, following the release of the quarterly results on Aug 24. We view the company’s robust fiscal third-quarter results as the primary reason responsible for this positive sentiment.

Inside the Headlines

Earnings and Revenues

Quarterly earnings came in at $5.09 per share, comfortably surpassing the Zacks Consensus Estimate of $3.90. The bottom line also came in higher than the year-ago tally of $2.42 per share.

Net sales during the quarter were $931.9 million, handily beating the Zacks Consensus Estimate of $903 million. In addition, the top line came in higher than the year-ago tally of $728 million.

Sanderson Farms noted that the stellar top- and bottom-line performance in the reported quarter was primarily driven by elevated market prices of fresh chicken products such as bulk leg quarters, boneless breast meat and jumbo wings.

Costs and Margins

Cost of sales in the quarter was $692.6 million, up 15.7% year over year. Selling, general and administrative expenses were $62 million, up from $44.6 million incurred in the year-ago period.

Operating margin in the fiscal third quarter came in at 19%, expanding 730 basis points (bps) year over year.

Balance Sheet and Cash Flow

Exiting the quarter, the company had cash and cash equivalents of $398.3 million, up from $234.1 million recorded as of Oct 31, 2016.

In the first nine months of fiscal 2017, Sanderson Farms generated $310.1 million cash from operating activities, as against $195 million recorded in the year-ago quarter. Capital expenditure was $130.6 million compared to $126.1 million incurred in the first nine months of fiscal 2016.

Outlook

Sanderson Farms intends to boost its near-term financials on the back of increased productivity. The company announced that its new North Carolina facilities will deliver maximum production in January 2018. In addition, it noted that the construction of the new facility in Texas is slated to commence this September and will further reinforce the company’s aggregate productivity in the upcoming quarters. Sanderson Farms anticipates to begin processing at the Texas plant from the opening calendar quarter of 2019.

Other Stocks to Consider

Some other top-ranked stocks in the industry are listed below:

Nu Skin Enterprises, Inc. (NYSE:NUS) has an average positive earnings surprise of 10.83% for the last four quarters and currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The New York Times Company (NYSE:NYT) holds a Zacks Rank #2 and generated an average positive earnings surprise of 43.06% over the trailing four quarters.

Inter Parfums, Inc. (NASDAQ:IPAR) also holds a Zacks Rank #2 and pulled off an average positive earnings surprise of 18.08% during the same time frame.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM): Free Stock Analysis Report

New York Times Company (The) (NYT): Free Stock Analysis Report

Original post

Zacks Investment Research