Salesforce.com Inc. ( (NYSE:CRM) ) just released its second-quarter fiscal 2018 financial results, posting earnings of 33 cents per share and revenues of $2.56 billion. Currently, CRM is a Zacks Rank #2 (Buy) and is down 2.69% to $90.45 per share in trading shortly after its earnings report was released.

Salesforce:

Beat earnings estimates. The company posted earnings of 33 cents per share, beating the Zacks Consensus Estimate of 31 cents.

Beat revenue estimates. The company saw revenue figures of $2.561 billion, beating our consensus estimate $2.514 billion.

Total revenue was up 26% from the prior-year quarter, while cash generated from operations was $331 million, an increase of 32% year-over-year.

“We had a phenomenal quarter of growth, reaching a huge milestone for the company, becoming the first enterprise cloud software company to break the $10 billion revenue run rate,” said CEO Marc Benioff. “We did this faster than any other enterprise software company in history.”

Salesforce expects third-quarter revenue fall in the range of $2.64 billion to $2.65 billion, an increase of 23% to 24% year-over-year. This is also ahead of our current consensus estimate, which calls for revenue of $2.61 billion.

The company also projects on-GAAP diluted earnings per share to be $0.36 to $0.37—also slightly above our current consensus estimate of $0.35

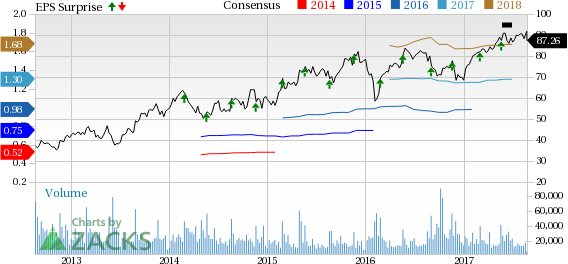

Here’s a graph that looks at Salesforce’s earnings performance history:

Salesforce.com is the market and technology leader in on-demand business services. The company's Salesforce suite of on-demand CRM applications allows customers to manage and share all of their sales, support, marketing and partner information on-demand. The Salesforce Platform, the world's first on- demand platform, enables customers, developers and partners to build powerful new on-demand applications that extend beyond CRM to deliver the benefits of multi-tenancy and The Business Web across the enterprise.

Check back later for our full analysis on CRM’s latest report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month. Learn the secret >>

Salesforce.com Inc (CRM): Free Stock Analysis Report

Original post

Zacks Investment Research