Good morning, everyone, and welcome to the last day of what’s been a terrific month.

There are TWO fantastic new features in SlopeCharts I’m going to write about later today. I’m very excited about both of them and look forward to sharing the details. They are free for EVERYONE to use.

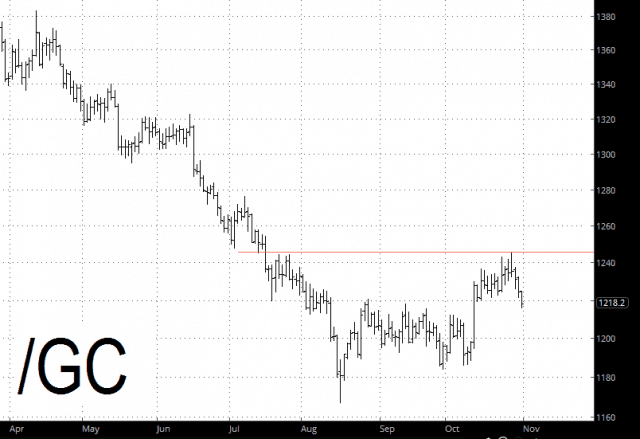

I’ve got puts on a couple of markets that were the “flight-to-quality” trades during the big selloff. One of them is gold, which is down nearly $9 this morning. Precious metals can’t seem to get off the mat, no matter what the other markets are doing.

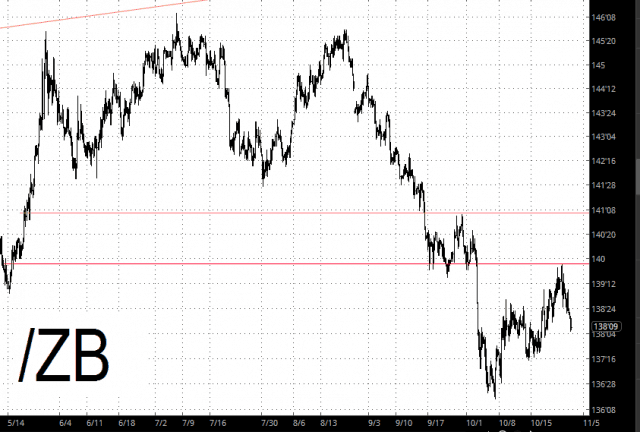

Far more interesting to me for a multitude of reasons are the zb, which are down about half a percent as I’m typing this. The pattern is much more significant and well-formed.

I’m still in “semi-wait-and-see” mode. I’m closing out an absolutely dynamite month, and as of this moment I’m only “half-in” with 150% of my buying power committed to 54 short positions. Given the strength this morning, I imagine I’ll get stop out in a few places, but I want to see if things look like they’re stalling out intraday.

The Main Event, of course, is tomorrow’s Apple's (NASDAQ:AAPL) announcement after the close. I think that’ll be psychologically important, just as FB was yesterday evening.