Greece has been imploding through death by a thousand cuts. This has played havoc with German Bund yields and the euro. Is Greece in or out? What is in store for the future. One market does not seem to care. The French stock market is primed to move higher to new all -time highs. Sacré bleu! How can this be?

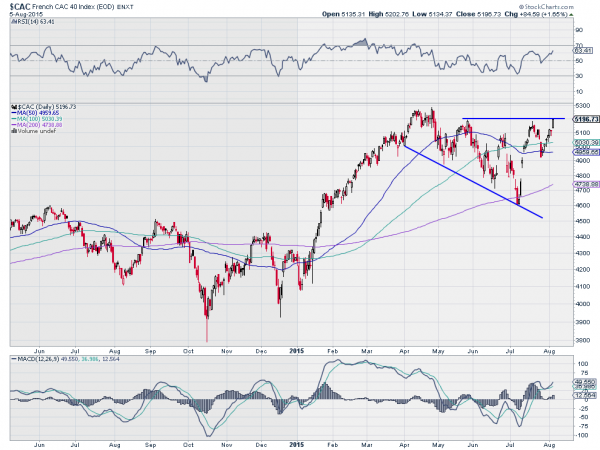

The chart above shows the French CAC 40 Index. Notice that it had a quick run higher to start 2015, nearly reaching 5300 in April. But since then, a series of lower lows against resistance at about 5200. Forming a descending triangle. Normally this is a topping pattern.

But this time may be different. The move off of the falling support and 200 day SMA that began in July ran to resistance at 5200. But the pullback halted above 4900, near the 50 day SMA. The Index then reversed higher and is back at resistance. Wednesday drove higher in a bullish Marubozu candle to a new 3 month high. Continuation above 5200 will seal the deal for new highs.

The momentum indicators are supportive of more upside. The RSI is bullish and rising. It is still far from overbought. The MACD avoided a cross down on that dip to the 50 day SMA and is moving higher as well. Looks like it is time to break out the champagne and put some brie on a baguette.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.