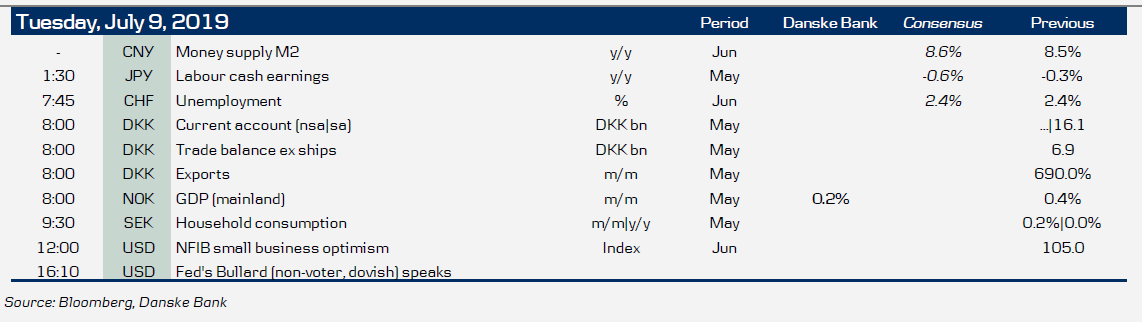

Market movers today

- Today we get mainland GDP out of Norway. The figure will be important when gauging the potential for further rate hikes from Norges Bank. The aggregated output index in Norges Bank's regional survey corresponds to growth in mainland GDP of around 3% over the remainder of the year. The monthly figure is difficult to predict, however, due to the large weather component in power and agriculture.

- We also get export figures out of Denmark. Goods export has been looking good lately despite the global downturn, whereas the service sector, on the other hand, has slowed. This is not least due to the shipping fleet as growth in global trade has almost evaporated.

- In Sweden, the May household consumption indicator is out. Declining retail sales and plunging car registrations yoy suggest a high risk for a negative print in the indicator. This could possibly be the worst since the great financial crisis.

- Finally, Fed's Bullard speaks tomorrow, which is the first in a string of important statements from the Fed this week.

Selected market news

Asian stock markets are generally down this morning, as was broad American indices yesterday, as markets continue to look forward to Powell and the FOMC minutes the coming days shedding light on the Fed's upcoming policy actions. However, Nikkei is slightly up this morning partly due to stronger than expected labour cash earnings (May), which came in at -0.2% yoy (-0.6% expected). Although better than expected, Japanese cash earnings have now been falling for five months in a row; the longest streak since 2013.

In rates markets US treasuries bear flattened as 2y treasuries were up 3bp by close and 30y fells slightly by 1bp. The shorter end thus persisted despite a general risk-off move following the continued focus on Middle East tensions and Erdogan's dismissal of the central bank governor. The NY Fed survey of consumer expectations also showed a pickup in inflation expectations, which further added to the yield advance in the short end of the curve.

The Eurozone yesterday warned Greece not to breach the 3.5% primary budget surplus target set under the terms of Greece's bailout programme. Newly elected Greek Prime Minister Kyriakos Mitsotakis has previously argued that lowering the target would stimulate private sector growth by lowering the tax burden.

The effective fed funds rate is once again seeing large advances (+1bp to 2.42%) as the Fed's balance sheet roll-off continues, though the overnight GC rate did fall substantially, not indicating imminent funding pressures. However, the spread between the interest on excess reserves (2.35%) and the effective fed funds is now at 7bp, which is the largest since 2008. The Fed previously lowered the IOER earlier this year in an attempt to increase the supply of overnight funds.

Key figures and events