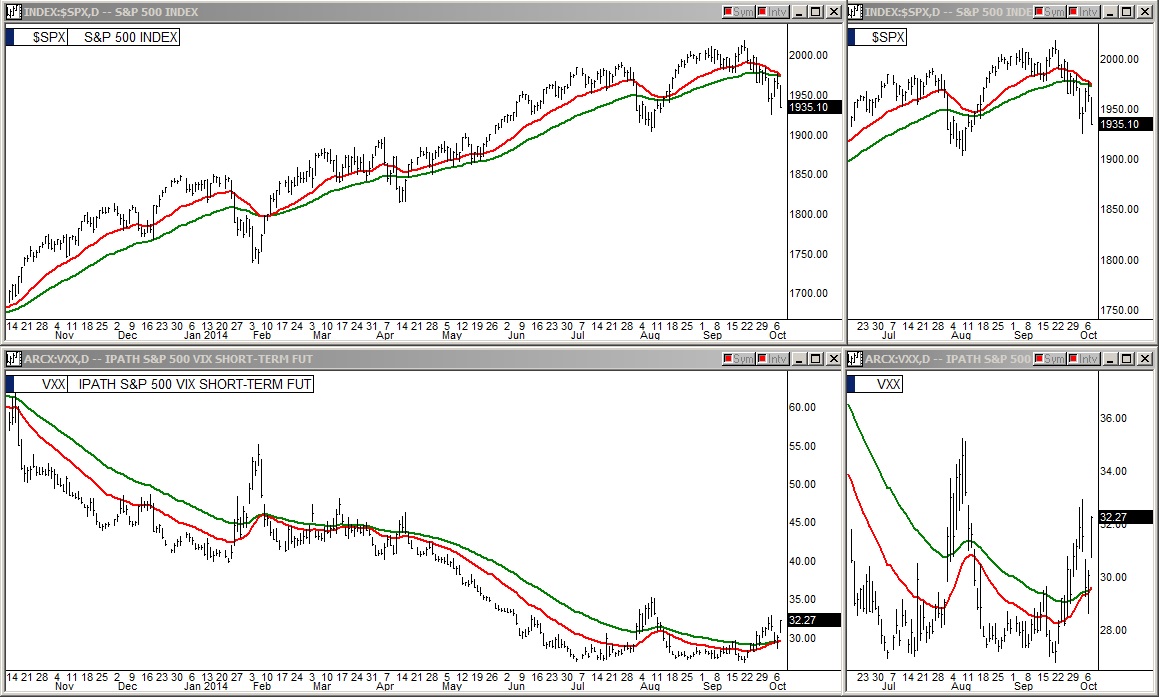

The whipsaw action continued today on the iPath S&P 500 Vix Short Term Fut (ARCA:VXX) pivot chart (shown in the lower charts above). Monday morning the bulls took their swing at getting the VXX red EMA line to push down from the green EMA line and for a awhile it looked like they would succeed but then completely lost control of it in the afternoon.

On Tuesday, the bears stepped up to take their turn and they may have achieved at least partial success. If you look closely at the VXX 1-year wide regular view chart, it still shows as a perfect merge. However, when we zoom in on the small, stretched out chart on the right we can see that at Tuesday's close the tip of the red line has started to peek above the green line. Once again, these are EMA lines and if we were to somehow have a huge up day in the market Wednesday it would probably pull the tip of the red line completely back down to the underside of the green line. It would take a huge up day, really huge. If tomorrow is negative or even flat at the close the tip of the red line should be too far above the green to be reversible. Wednesday's close could be a historical marker in the stock market's big picture.

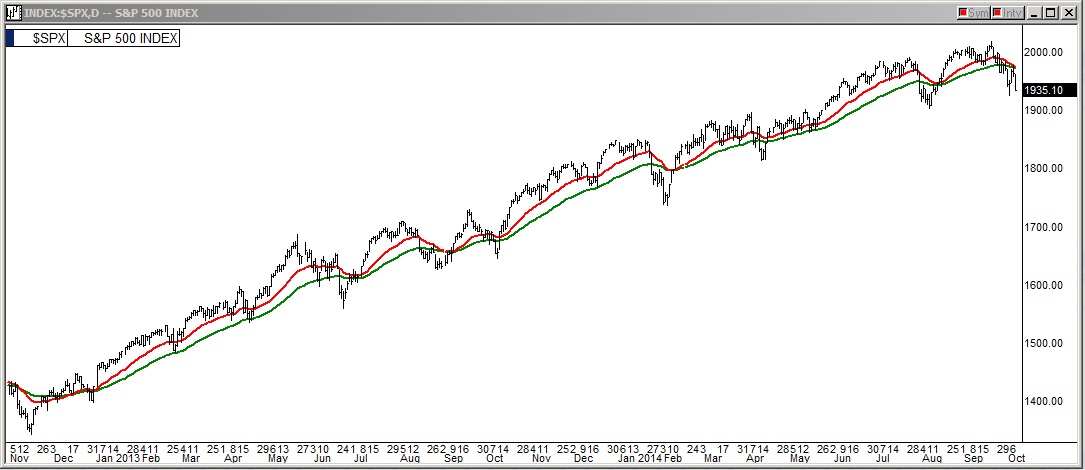

Also, the S&P 500 will be put to the same EMA test on Wednesday (shown in the top chart). Looking at that chart you can see where Team Yellen has fiercely defended the S&P right down to the very hour that the red line started to down cross the green line. Wednesday or Thursday should be the historical moment of truth for that same juncture in the S&P.

Looking at the top right zoomed in chart of the S&P above, we can see that even after today's sell off the S&P has not started a down cross. If we close well into the negative on Wednesday, however, we would probably see the red tip start to peek through below the green likely triggering an even bigger wave of selling.

In summary, the VXX is already calling the outcome of the S&P election without the majority of the votes tallied. Wednesday's close or at the latest Thursday's close we should have all the votes in and learn if the two-year S&P bull run has finally down crossed or if the S&P surprises all and starts reversing back up instead for the mother of all short squeezes.