As a result of the four-day growth, the S&P 500 index fully recovered losses suffered earlier amid renewed hype around the US president. With the opening of today's trading day, the S&P 500 index is trading in a narrow range, pending the publication of the minutes from the May meeting of the Fed.

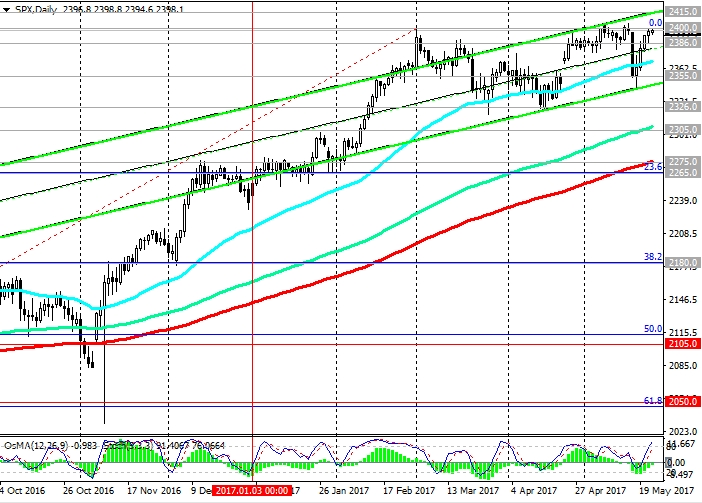

The positive dynamics of the S&P 500 index is preserved. Since February 2016, the S&P 500 index has been growing steadily and is in the ascending channels on the daily and weekly charts.

At the moment, the S&P 500 again tests the resistance level of 2400.0, reached in early March, for breakdown.

The indicators OsMA and Stochastics on the daily chart again turned to long positions. In case of resumption of growth, the nearest target will be level 2415.0 (the upper limit of the uplink on the daily chart).

The reverse scenario will be associated with breakdown of the short-term support level 2386.0 (EMA200 on the 1-hour chart) and a decrease with the nearest targets near the levels 2355.0 (bottom line of the uplink on the daily chart), 2326.0 (April lows). Only the breakdown of support levels of 2275.0 (EMA200 on the daily chart), 2265.0 (Fibonacci level of 23.6% correction to growth since February 2016) will cancel the bullish trend of the index.

Support levels: 2386.0, 2375.0, 2355.0, 2326.0, 2305.0, 2275.0, 2265.0

Resistance levels: 2400.0, 2415.0

Trading Recommendations

Sell Stop 2385.0. Stop-Loss 2405.0. Objectives 2375.0, 2355.0, 2326.0, 2275.0, 2265.0

Buy Stop 2405.0. Stop-Loss 2385.0. Objectives 2415.0, 2450.0, 2500.00