Once I questioned if the market had made a larger top or not two weeks ago (see here and here), the market has been following a nice impulse structure up to new All Time Highs (ATH). I’ve therefore been able to forecast all it’s micro highs and lows to the T, which my followers who day-trade, have profited handsomely from.

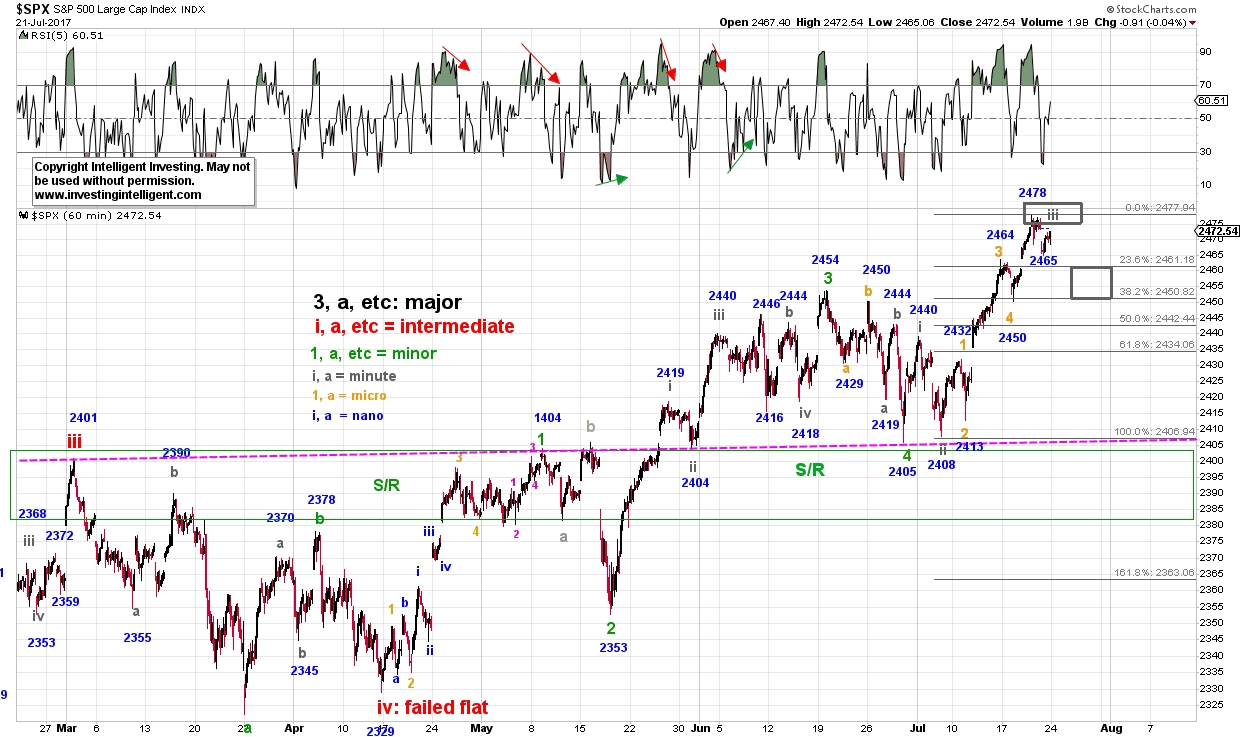

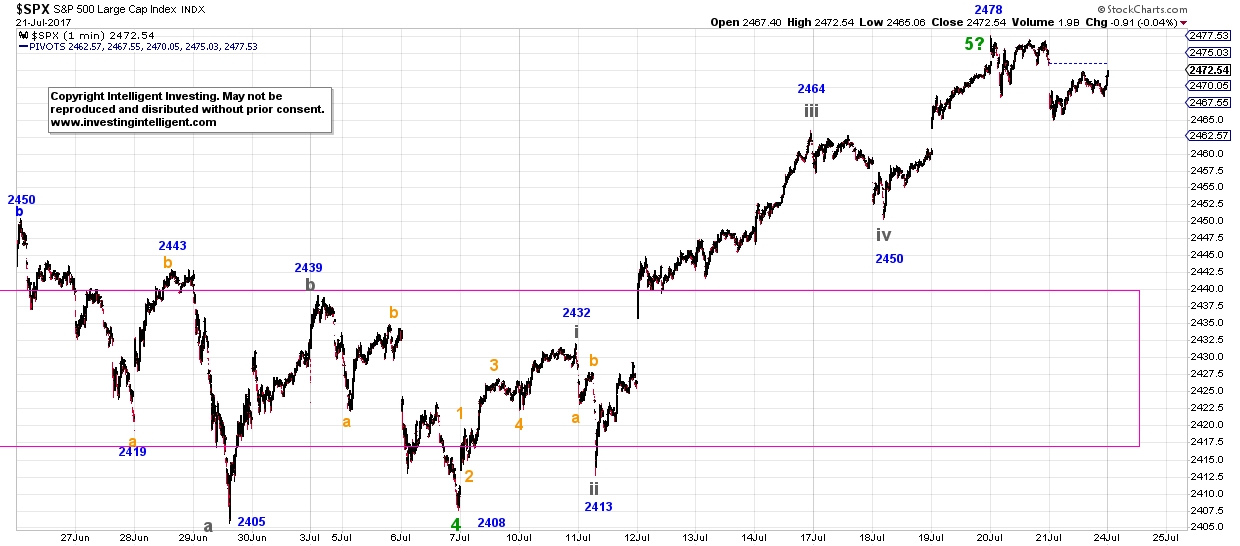

However, now it is time to become more defensive as at this stage it is unclear if all of the larger wave-3 is in, or if we’ll see one more push higher after an ideal drop to SPX 2461-2451 for a small 4th wave, to be followed by a last and final small 5th wave to our ideal SPX 2485-2505 target zone as based on Fib-extensions four (!) different wave degrees point to this zone for a larger top. The hourly and one-minute charts below show the two aforementioned counts we now track:

Figure 1: SPX hourly chart. Preferred count: minute-iv of minor-5 underway

Figure 2: SPX one-minute chart. Alternate count: minor-5 of intermediate-v of major 3 topped at SPX2478.

In fact, the largest wave degree’s 1.618x Fib-extension has an exact top at SPX 2478 for wave-3, which was struck to the T this week. Thus caution is advisable. For now, however, all charts we track are bullish, all indicators are on a buy, all Simple Moving Averages (SMA) are pointing up, price is above all (5d to 200d SMA) all Technical Indicators (TIs) are on buy and pointing up, market breadth is positive, etc. Thus, the charts tell us to continue to look up, which is perfectly in line with my preferred wave-count.

Please note there’s no need to front run anything yet as 4th waves are difficult to track and trade: they can do anything they want. Also remember this is a bull market and the minute- and micro-waves can extend: while all wave degrees point to SPX 2485-2505 the market can go beyond it. No guarantees, only probabilities of possibilities. Hence, already starting to aggressively short in anticipation of the upcoming 4th wave is not advisable, and shorting a 4th wave is not for the faint of heart with it’s many twists and turns. Once we have a confirmed larger wave-3 top, I can then determine downside targets for this 4th wave.