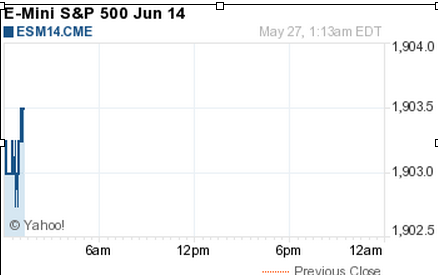

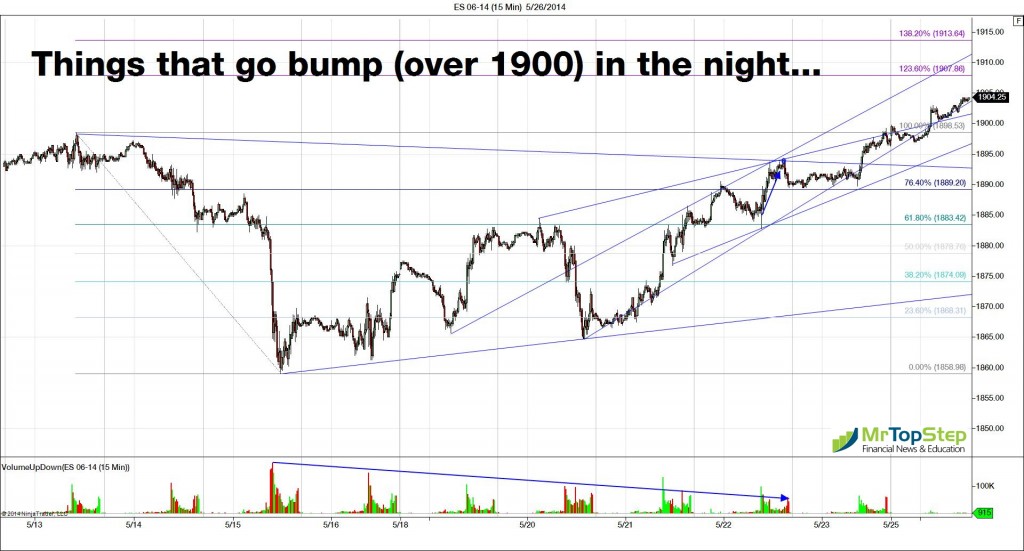

Haunted by low volume the S&P fell short of 1900.00 during Friday’s trade, but finally traded up to 1904 during Sunday night’s abbreviated Memorial Day session.

Short But Big Week Ahead

The Asian markets closed mostly higher and in Europe 10 out of 12 markets are trading higher. Despite the exchanges being closed in honor of Memorial Day the rest of the four-day week is packed with 23 economic reports, 12 T-bill and T-Bond announcements or auctions and 6 Fed governors speaking Thursday and Friday.

Straight up, we have been warning you about the ‘thin to win” environment and with the VIX this low there is a concern that the S&P may take off to 1940-1950. We’re not saying right away but we do not expect people will be hurrying back to trade on Tuesday.

When they do come back, they may find prices in the low 1900s waiting for them. The shorts will cover and exit and the longs may take profits or increase their positions. And let’s not forget the large number of buy stops sitting above 1905.

I said a few weeks ago that it’s not just 1900 the S&P is seeking and that by year end the S&P will be trading at or near 2000.00. You can take it from there…

As always please keep an eye on the 10-handle rule and please use stops when trading futures and options.

- In Asia, 7 of 11 markets closed higher: Shanghai Comp. +0.34% , Hang Seng -0.01%, Nikkei +0.79%.

- In Europe, 10 of 12 markets are trading higher : DAX +1.39%, FTSE -0.07%

- Morning headline: “S&P 500 futures trading above 1900.00”

- Fair Value: S&P -2.56, Nasdaq -1.34 , Dow -22.79

- Total volume: LOW 44k ESM and 375 SPM traded

- Economic calendar: Closed for US Memorial Day

- E-mini S&P 5001903.25+6.25 - +0.33%

- Crude102.15+0.02 - +0.02%

- Shanghai Composite0.00N/A - N/A

- Hang Seng22906.631-56.549 - -0.25%

- Nikkei 22514714.64+112.12 - +0.77%

- DAX9892.82+171.91 - +1.77%

- FTSE 1006815.75-4.81 - -0.07%

- Euro1.3652