In the old days when the stock market would make a new high the public would be applauding. If it were around the time of a holiday, confetti would be added. Pre-2007 credit crisis and the unraveling of the economy and the job markets, almost every stock market milestone was reason to cheer.

Lost Decade

The 1999 -2000 tech bubble was over 14 years ago. Since then the S&P 500 has has seen its share of ups and downs but none like the 666 low made during the worst of the credit crisis. In just two years between 2007 and 2009 it lost more than half its value. It then took four years to break through the 1600 mark.

The S&P 500 first topped 1500 in March of 2000, then the first minor recession of the Bush presidency dropped it to 768.50 in 2002. The return from that low to above 1500 took longer, four and a half years.

While there were traders who profited on both the long and short side, those ten years, my friends, is what long-term investors refer to as the “Lost Decade.” Stocks bought in 2000 were worth less in 2010, in some cases over 30% less. But all that changed in 2013 when the S&P 500 gained nearly 30% on the year.

Up, Up and Away

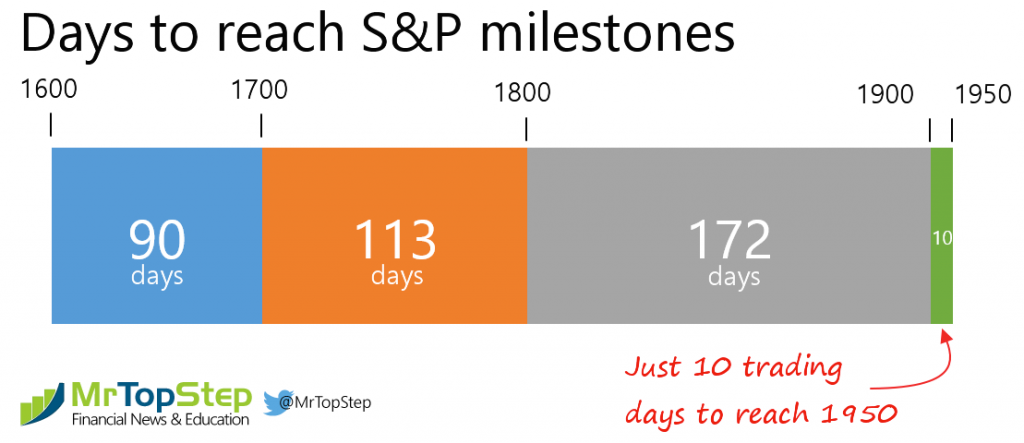

2013 was a big year by any measure for the S&P 500. In May of 2013 the S&P 500 passed thru 1600 and by August of 2013 the S&P 500 pushed above 1700.00 in only 90 days.

The next milestones were 1800, which took 113 days; 1900, which took 172 days, and as of yesterday, only 10 trading days to top 1950. So far the S&P 500 has made 19 record high closes this year, off the pace of 2013’s bullish first half, which led to 45 record closes.

A few milestone facts to consider:

- Less than a month after Lehman Brothers bankruptcy in September of 2008 the S&P 500 broke 1000.00.

- The S&P 500 made its credit crisis 676.53 cash low in March of 2009

- The S&P 500 has rallied 1,189 points from its March 2009 lows.

- The S&P 500 is up 188% from its bear-market low in March 2009.

- The S&P 500 has closed at all-time highs in 10 of the last 13 trading sessions.

- The S&P 500 is now 2½ percent short of the 2,000 level.

Thursday is “Roll” day

Our View: The September contract goes front month on Thursday. This big wheel is slowing. The VIX made a low at 10.99 and settled at 11.15.

What’s it all mean? What it means is the higher the S&P 500 goes the quieter it gets. While traders don’t want to hear it, there is not much we can do until the E-mini futures and the large-cap indices start to sell off, which we think we could be nearing.

We started quoting some S&P 500 puts yesterday and plan on buying them today. We lean to selling rallies in the ESM14.

As always, please keep an eye on the 10-handle rule and please use stops when trading futures and options.