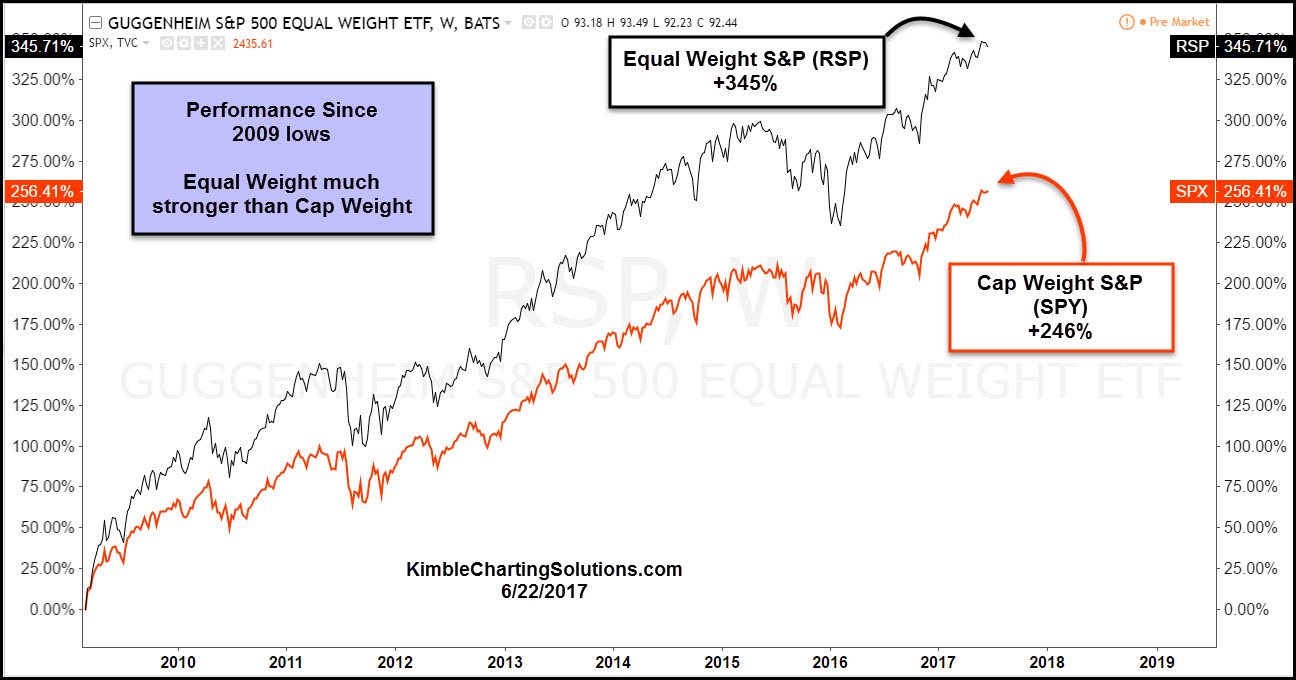

When it comes to S&P 500 ETFs, they may be equal (comprised of the same stocks), yet they can vary when it comes to performance. Below compares the equal-weighted RSP to the cap-weighted SPY since the 2009 lows. Which ETF would you rather own, RSP or SPY?

RSP may own the same stocks at SPY, yet the performance is drastically different, due to how much of each stock each ETF owns. RSP has done much better since the lows in 2009, up almost 90% more than the S&P.

Below looks at the RSP/SPY ratio over the past 15 months.

The RSP/SPY ratio in the long term remains in an uptrend, as RSP has been much stronger than SPY. Yet during the last 6 months, that hasn't been the case, as the ratio peaked late last year at (1) and continues to create a series of lower highs inside new short-term falling channel (2). This week, the ratio is hitting the lowest level in the past year.

Historically, bulls want to see this ratio heading higher. The short-term weakness does not send a bearish message, it does send a message that the broad market is not as strong as a few big players in the index.

One ratio does not make a trend, please keep that in mind. Keep an eye on this ratio over the next couple of months, as it could send an important message to bulls or bears going forward.