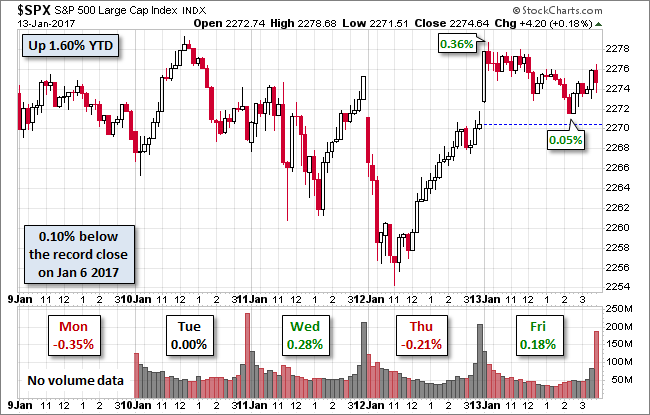

On Friday, the S&P 500 rose at the open, hitting its 0.36% intraday high about 15 minutes into the session on strong bank earnings. The index then traded in a narrow range through the morning, dipped during the lunch hour, and then sold off to its 0.05% mid-afternoon low. It then recovered to a trimmed gain of 0.18%.

Here is a snapshot of the past five sessions.

The yield on the 10-year note closed at 2.40%, up four BPs from the previous close.

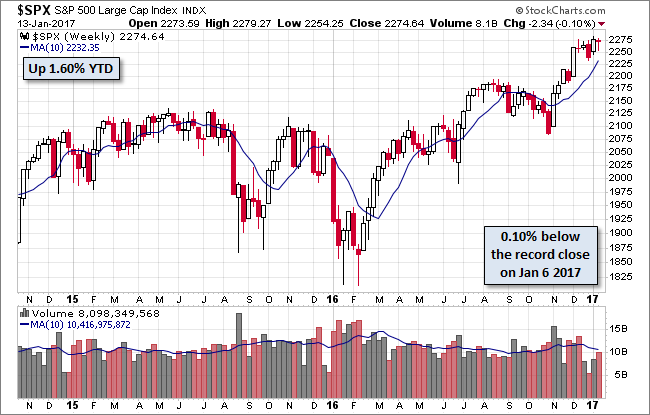

Here is a weekly chart of the index, down 0.10% from the previous Friday, which was a record close.

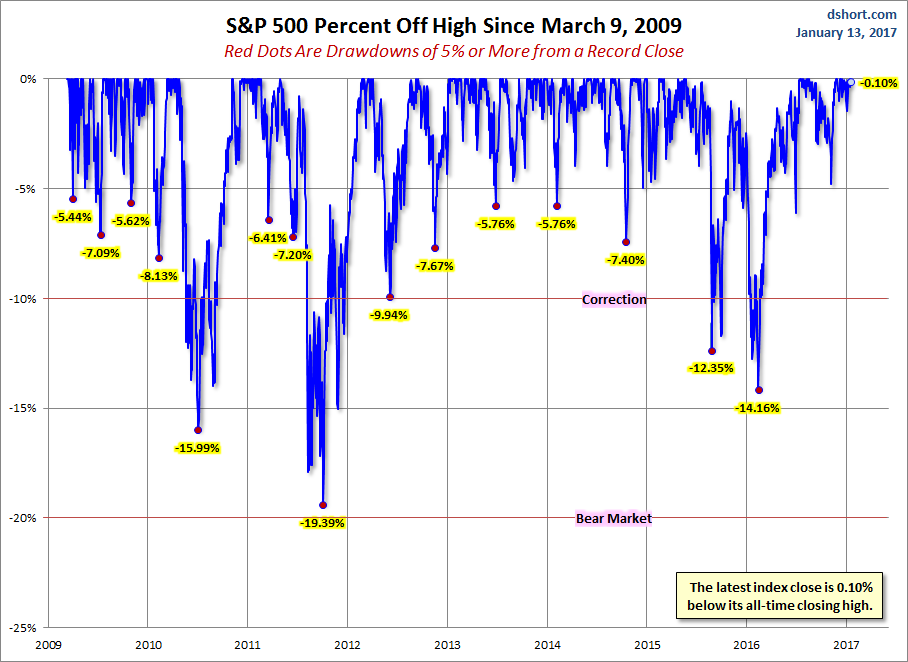

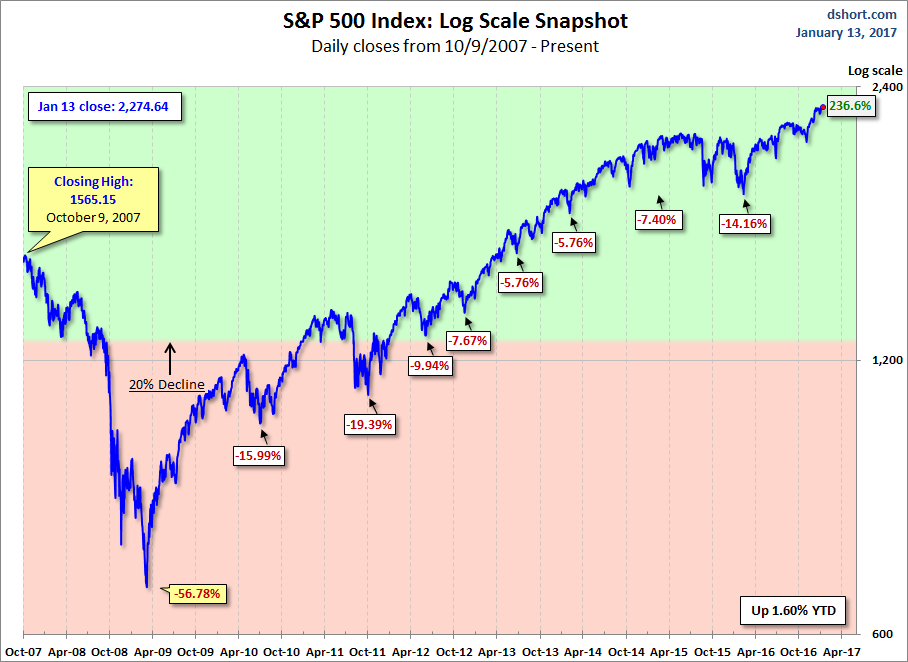

A Perspective on Drawdowns

Here's a snapshot of record highs and selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

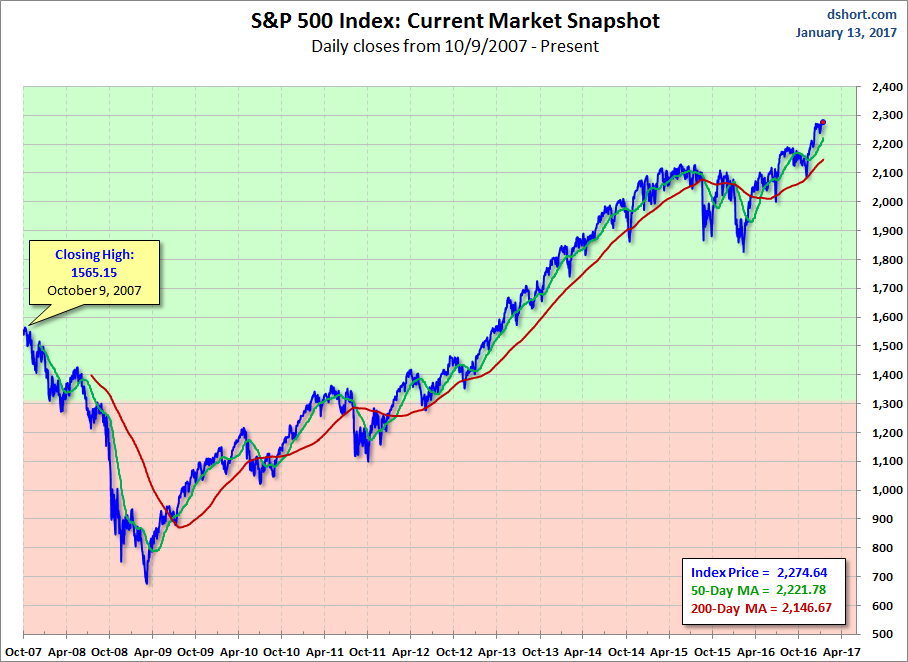

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

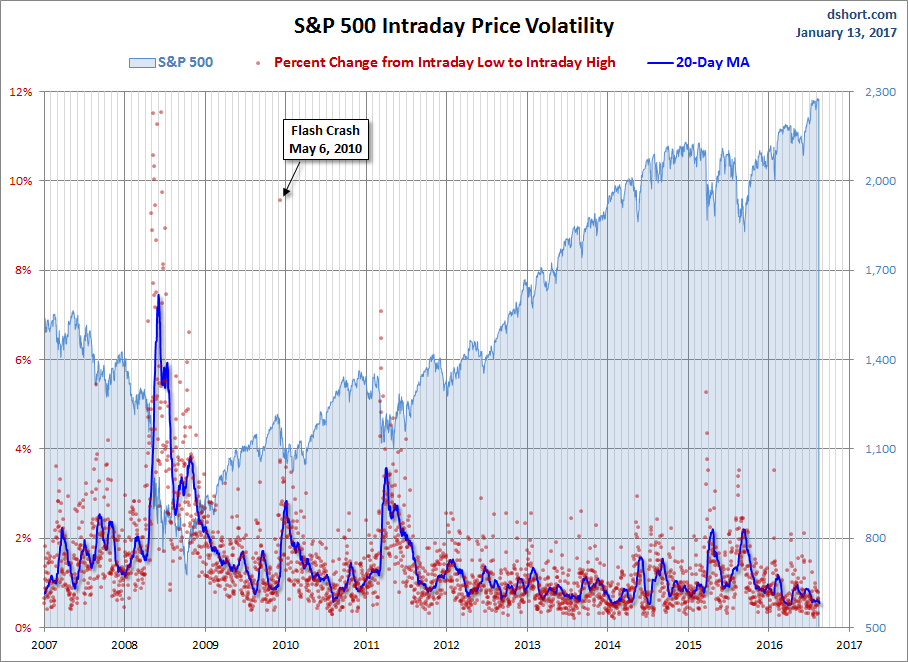

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.