Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

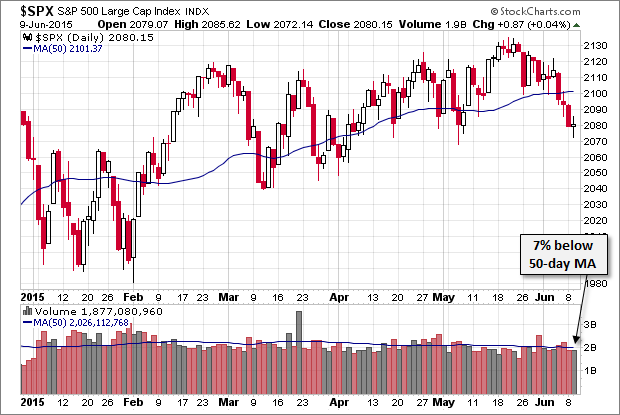

Today the S&P 500 snapped its three-day losing streak, but with a gain that can scarcely be called more than a flat finish. The most interesting economic news was the JOLTS report for April. Job Openings are at an all-time high, but Layoffs were the third highest in the past 10 months. The index spent the session trading in a relatively narrow range between its -0.34% to 0.30% intraday range. Selling in the final hour created a mini-drama over whether today would be day four of the selloff. But the close remained positive by a microscopic 0.04%.

The yield on the 10-year note rose three bps to close at 2.42%, its highest close since October 6th of last year.

Here is a 15-minute chart of the past five sessions.

Today's flat finish ended a day of close to average trading volume.

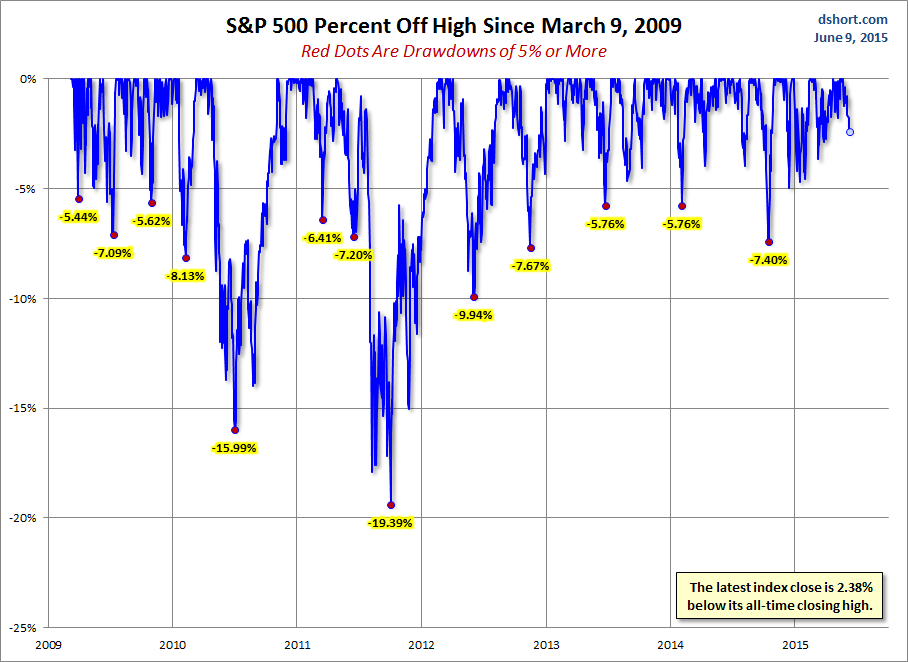

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

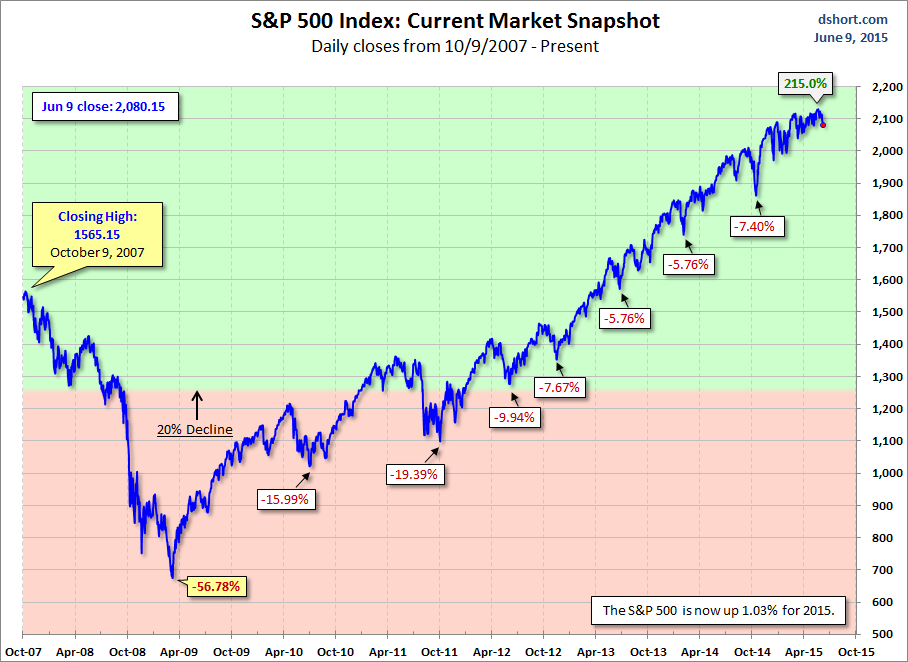

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.