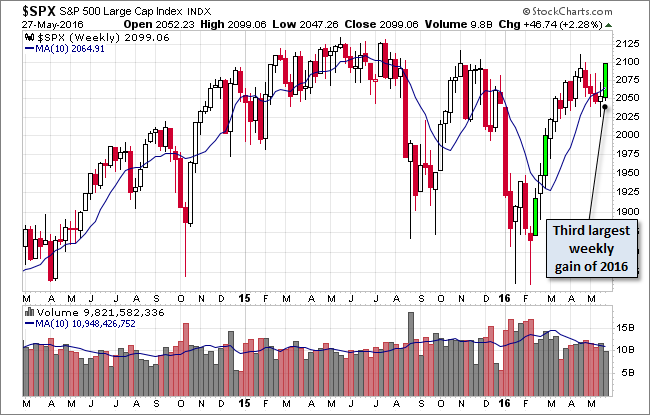

The S&P 500 opened at its intraday low and closed with a modest 0.43% gain at its intraday high. However, the week-over-week gain of 2.28% is the third largest weekly gain of the year so far, bested only by the 2.84% jump the week ending on February 19th and the 2.67% advance the week ending March 4th. This morning's 0.8% Second Estimate of Q1 GDP was a yawner, but the 5.7 point surge in the May final Michigan Consumer Sentiment was the largest increase since December 2013. The market showed no anxiety from Fed Chair Yellen's remark that a near-term rate hike would probably be appropriate.

The yield on the 10-year note closed at 1.85%, up two basis points from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

Here's a weekly chart of the index. We've highlighted the three biggest weekly gains of the year.

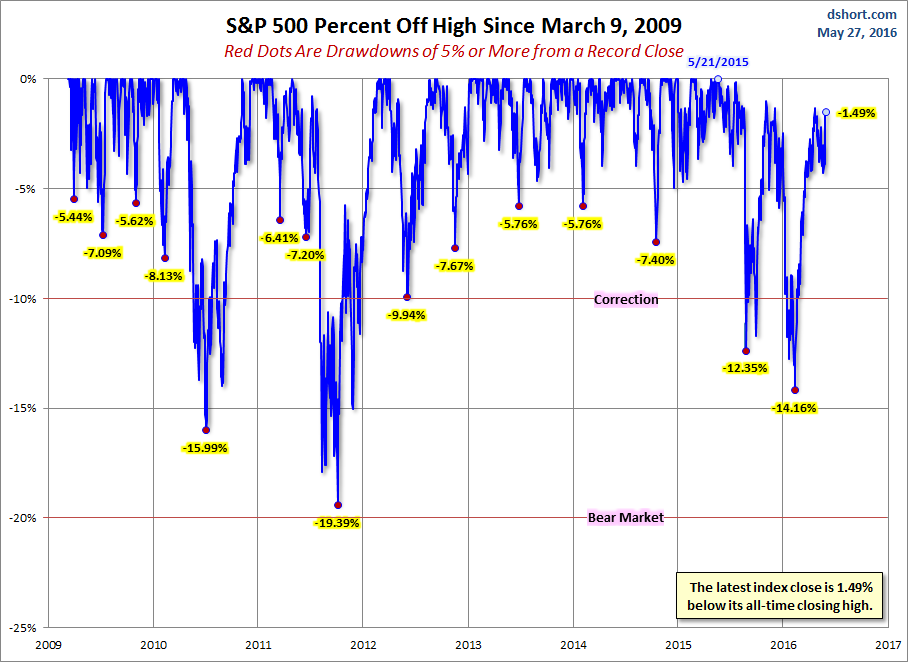

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

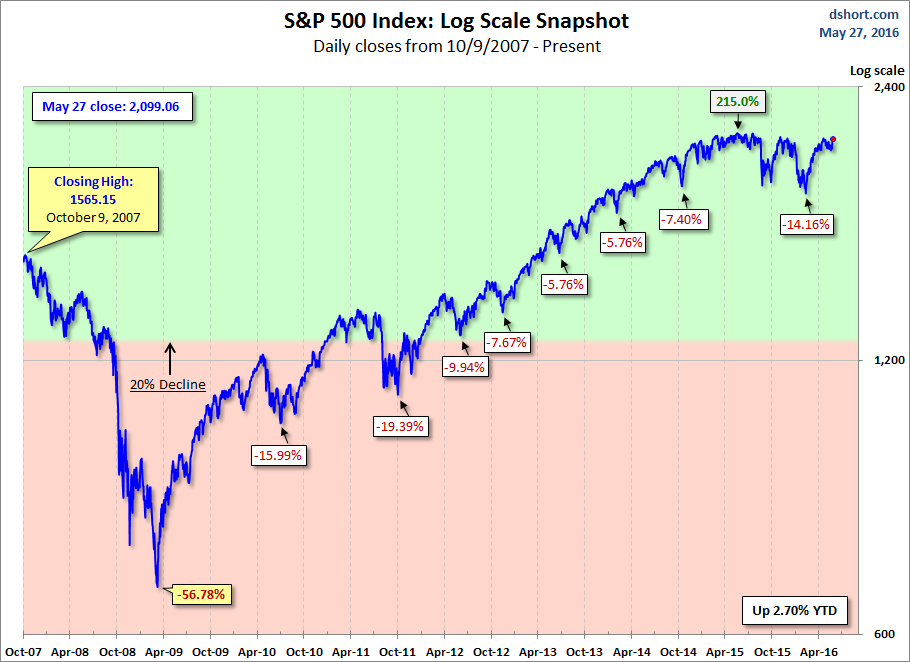

Here is a more conventional log-scale chart with drawdowns highlighted.

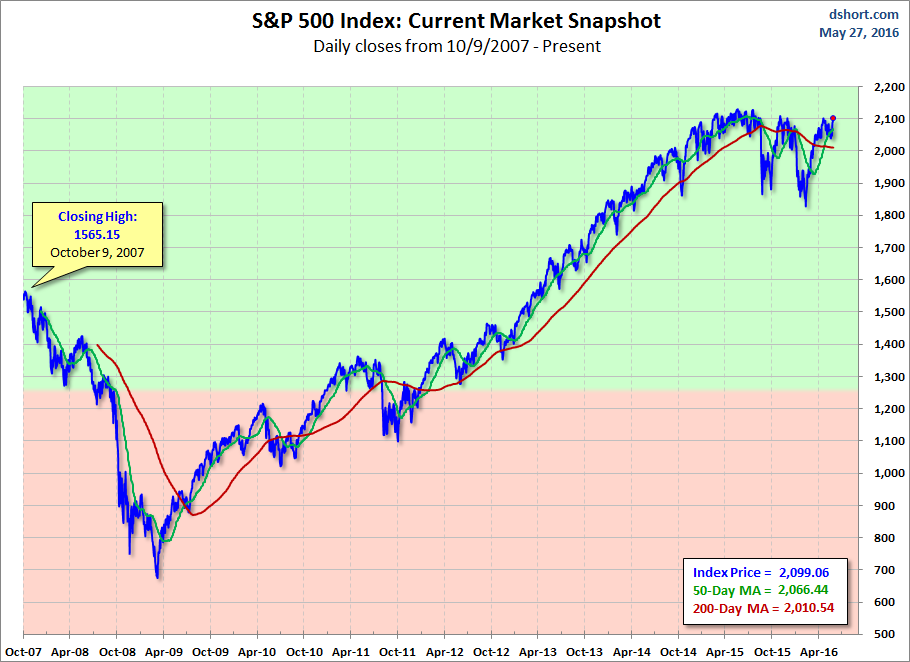

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

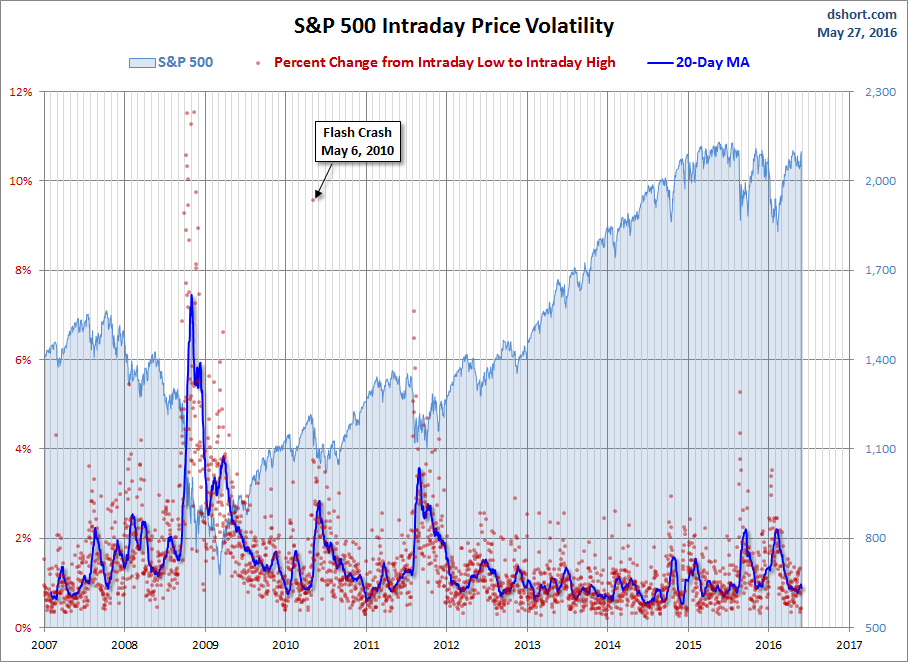

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.