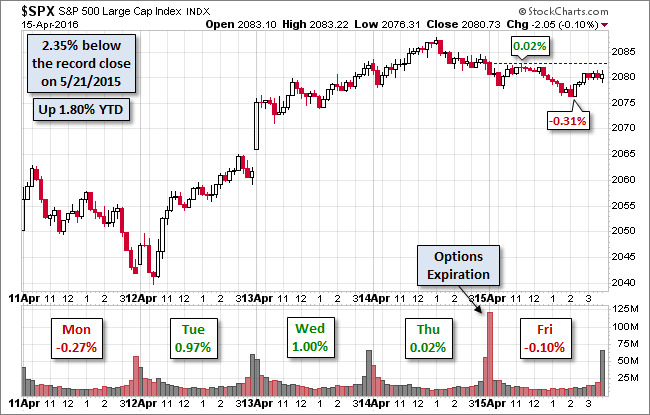

In our Thursday update, we characterized the S&P 500 action as a "zombie trade" — a flat finish to the narrowest intraday range (-0.21% to 0.26%) of 2015. Well today the zombie went catatonic ... despite options expiration, more quarterly earnings, abysmal Industrial Production data and a seven-month low in Consumer Sentiment. The 500 spent the session in an even narrower trading range from its 0.02% morning high to its -0.31% mid-afternoon low. The index closed the session with a fractional loss of -0.10%. However it rose an impressive 1.62% for the week.

The yield on the 10-year note closed at 1.76%, down four basis points from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

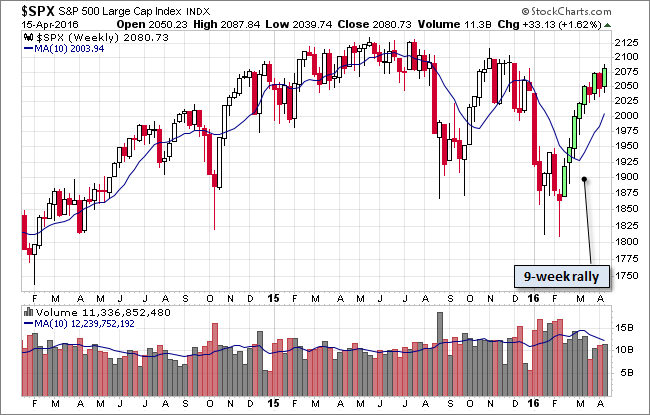

Here is a weekly chart of the S&P 500. The interim low in February occurred nine weeks ago. The subsequent rally consists of five consecutive weeks of gains followed by four alternating weeks of gains and losses, which reflects some loss of momentum. The closeout of this week with the two narrowest intraday ranges of 2016 is perhaps a clue of some near-term consolidation.

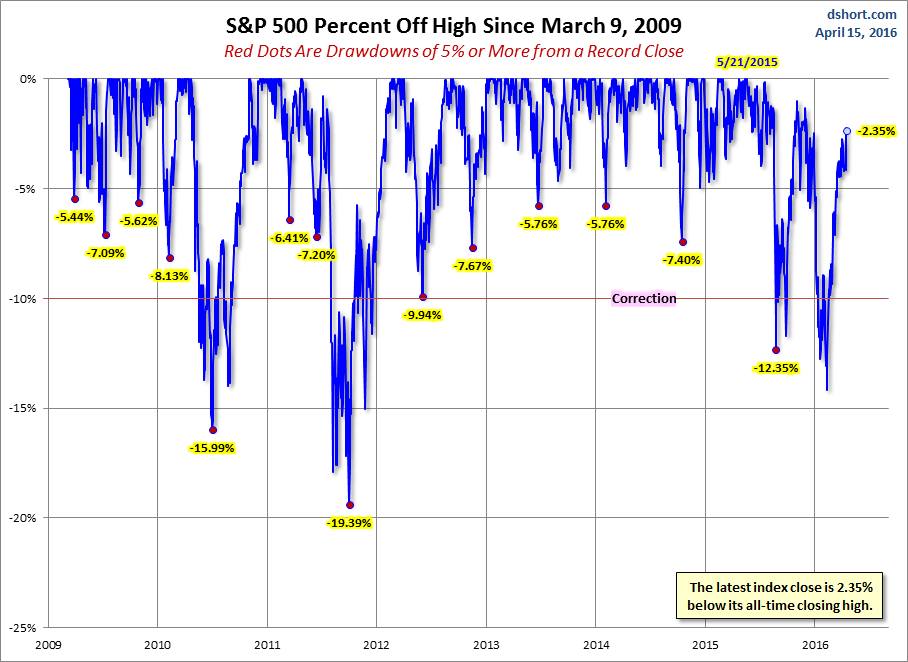

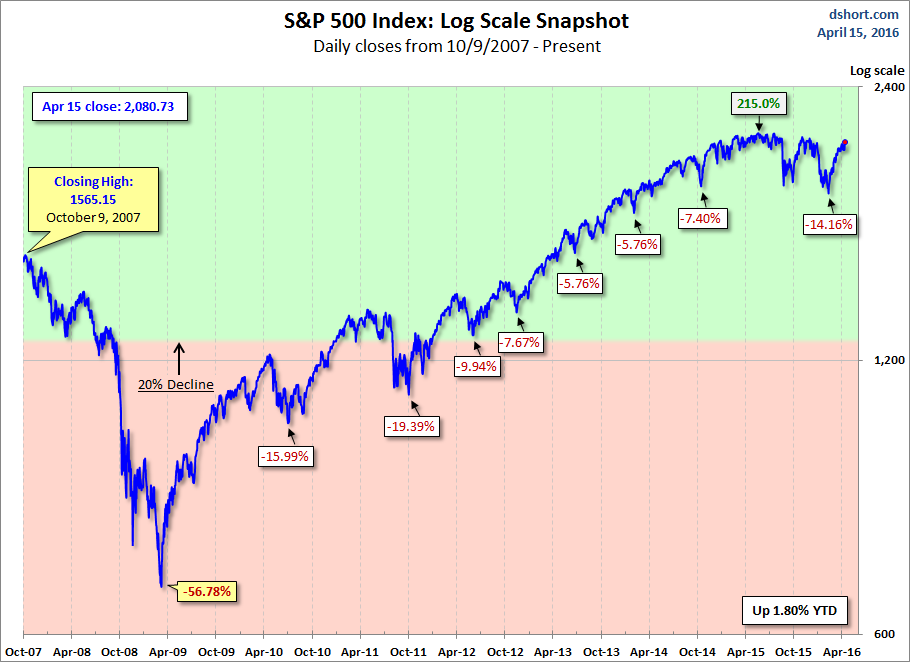

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

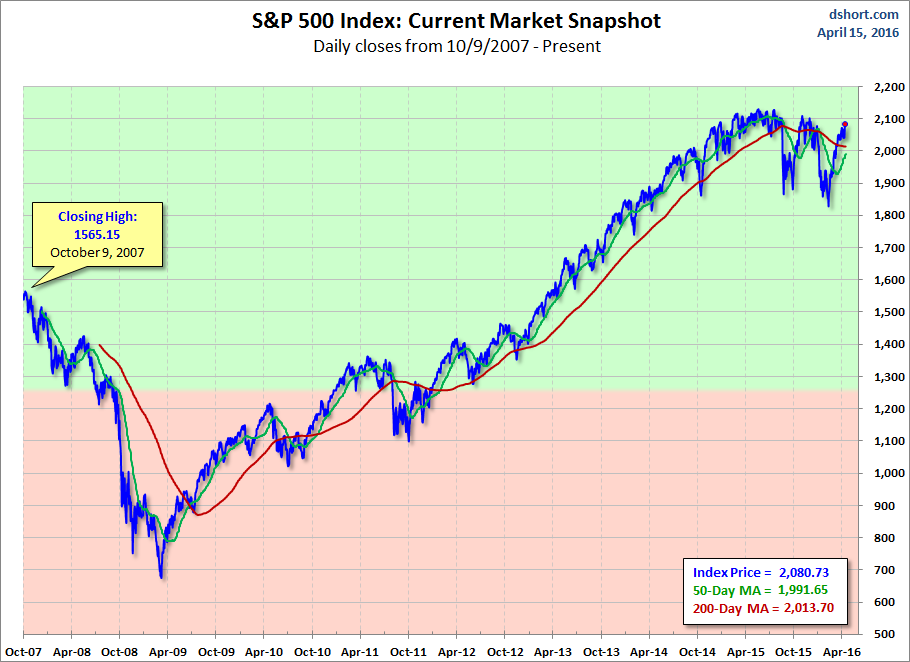

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

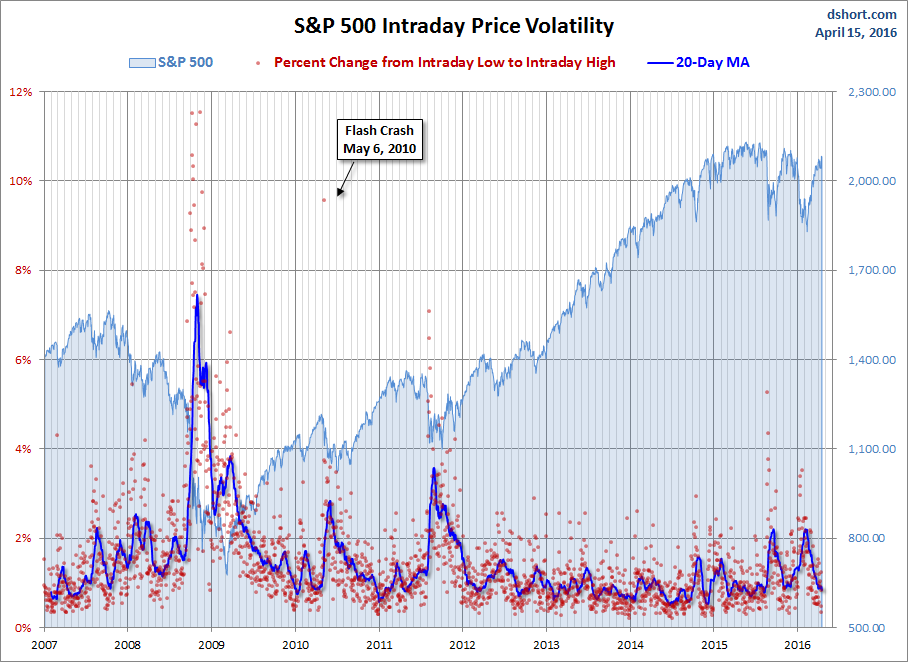

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.