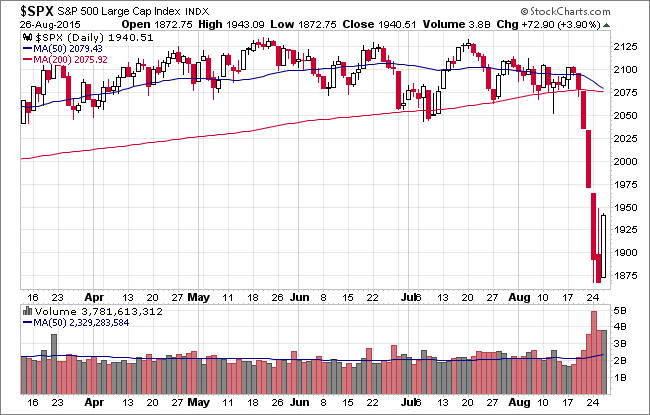

The benchmark S&P 500 broke its massive six-day selloff yesterday with a strong bounce. The index surged at the opening bell, gave back about half of its gains and then began a steady rally during the lunch hour to its 3.90% gain, just a hair below its intraday high.

The yield on the 10-year note closed at 2.18%, up 6 bps from yesterday.

Here is a snapshot of past five sessions.

On a daily chart we see that volume today was above its 50-day moving average and about the same as on yesterday's end to the six-day selloff. The 50-day and 200-day moving averages are close to a cross-over.

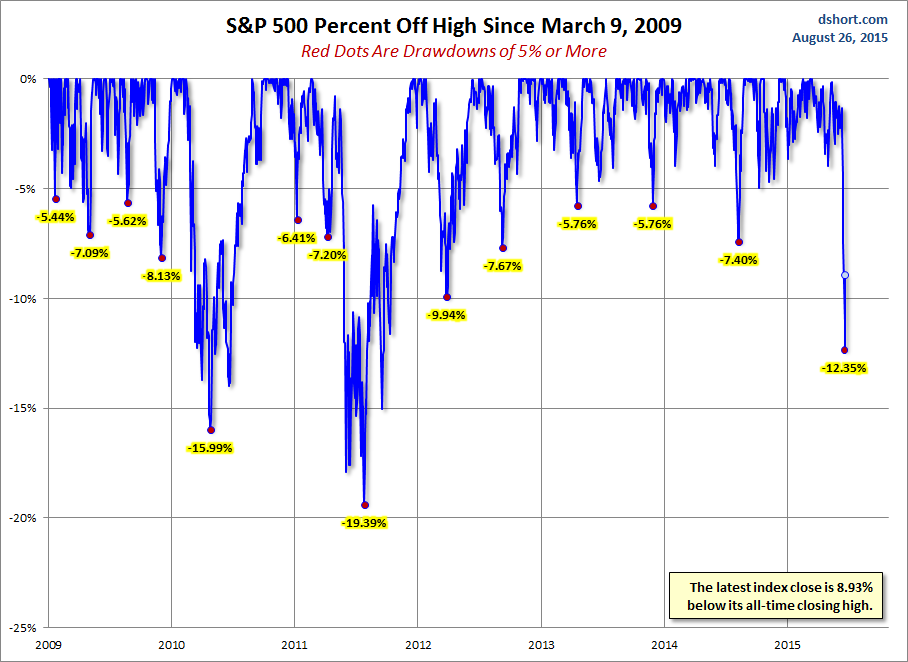

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

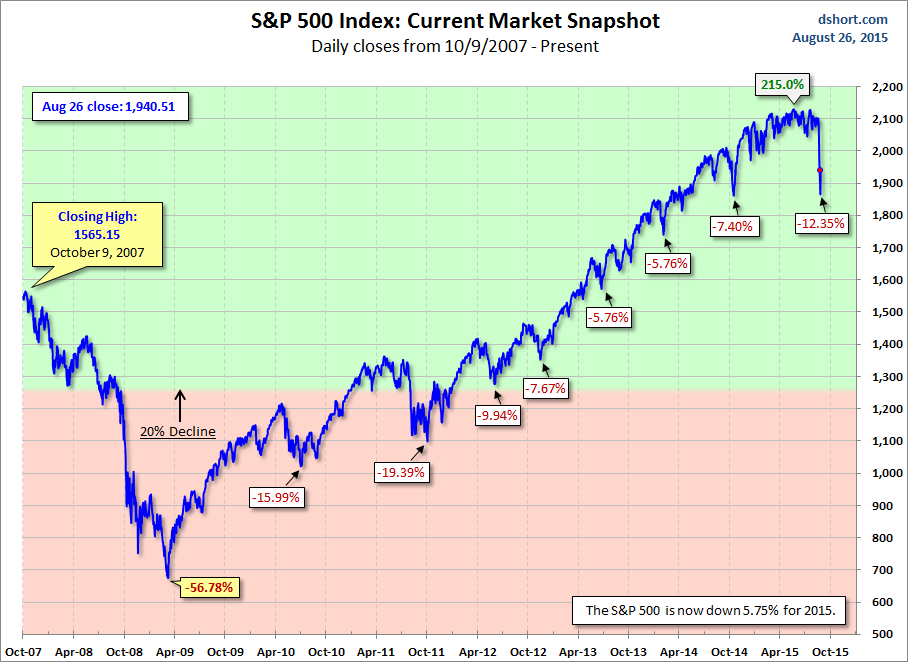

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.