Investing.com’s stocks of the week

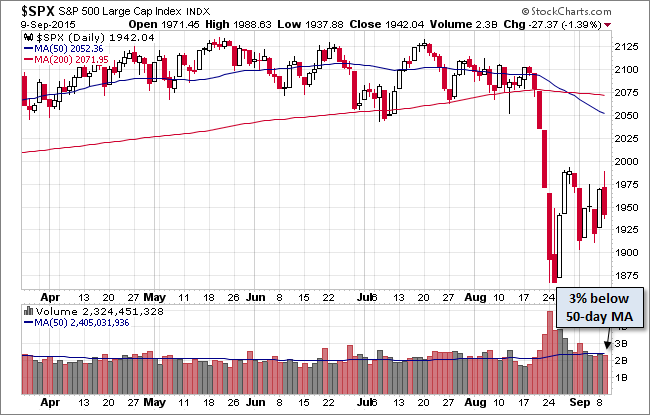

The extreme volatility that we saw last week in our benchmark S&P 500 remains in vogue. The index surged at the open to its 0.98% intraday high in the opening minutes, sold off to yesterday's close and trended sideways through the lunch hour. It then shifted into serious sell-off mode, plunging to its -1.60% intraday low shortly before the close. Some buying in the final minutes trimmed today's sell-off to -1.39%. The index remains above the -10% correction level, now at -8.86% from its record close in May.

The yield on the 10-year note closed at 2.21%, up 51 bp from yesterday's close.

Here is a snapshot of past five sessions:

On a daily chart we see that, despite the price volatility, trading volume during the past five sessions has been unremarkable.

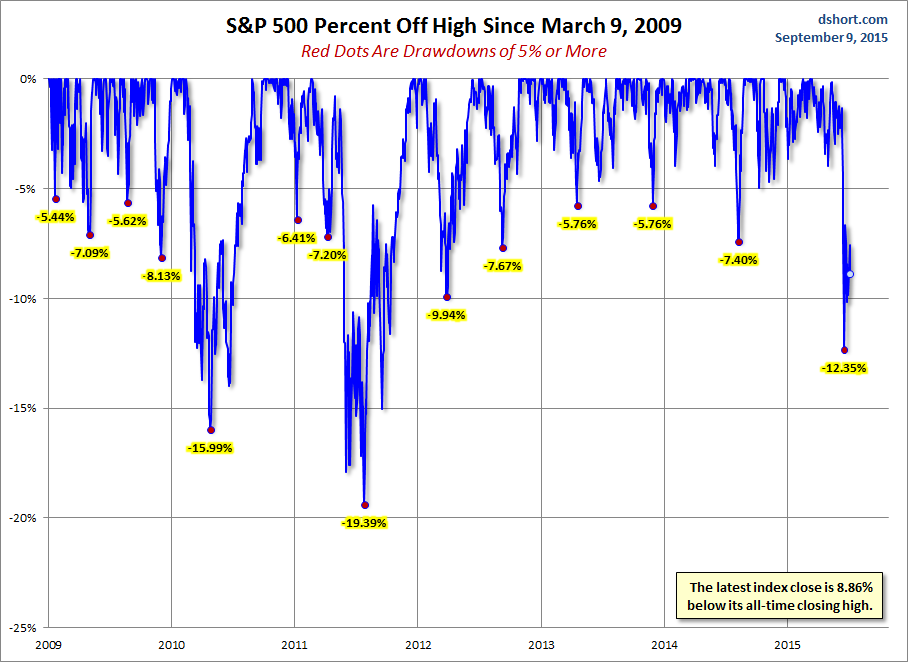

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough:

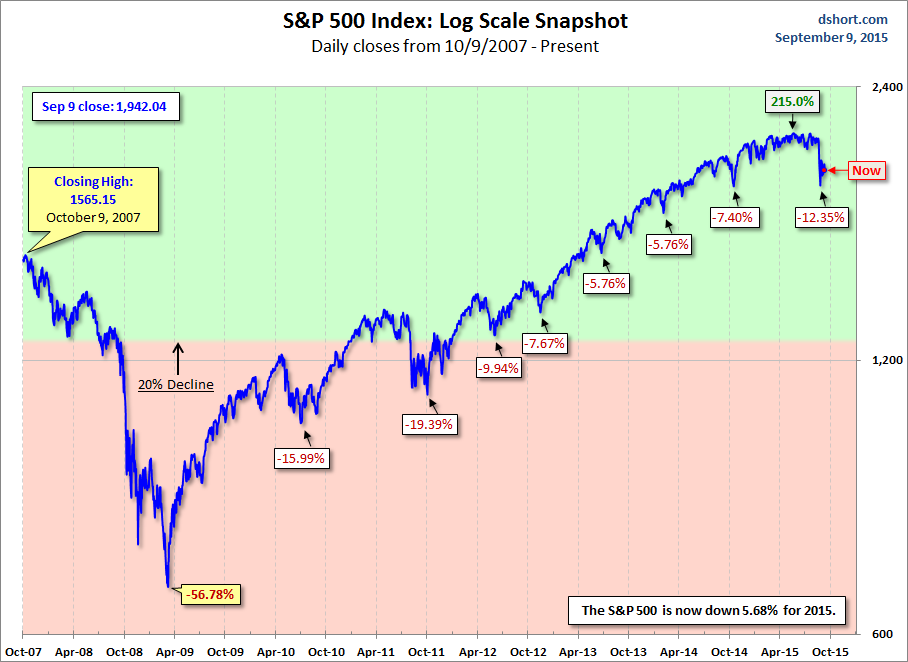

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession: