Investing.com’s stocks of the week

This is a fairly light week for economic news -- a couple of ho-hum residential real estate numbers today and tomorrow and then nothing significant until Thursday's jobless claims and August durable goods and Friday's 3rd estimate of Q2 GDP (no change expected). Meanwhile the market is at the mercy of one-off post-Fed opinions, tweets from politicians and the usual grind of the popular financial press. The S&P 500 rallied at the open and climbed to its 1.10% intraday high an hour later. It then sold off to its -0.12% intraday low during the lunch hour. A staggering afternoon recovery led to its 0.46% closing gain.

The yield on the 10 year note closed the day at 2.20%, up 7 bps from the previous close.

Here is a snapshot of past five sessions.

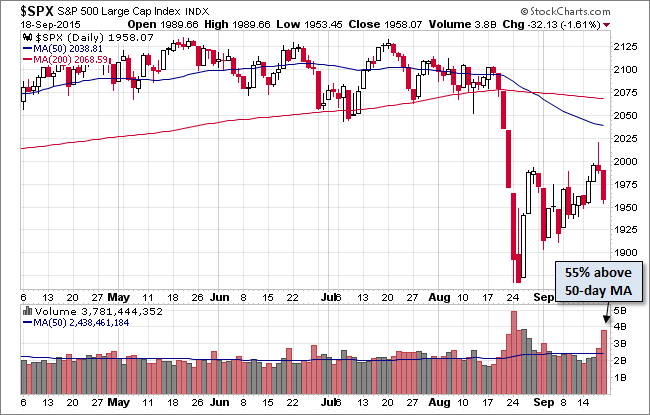

Here is a daily chart with the today's light volume highlighted.

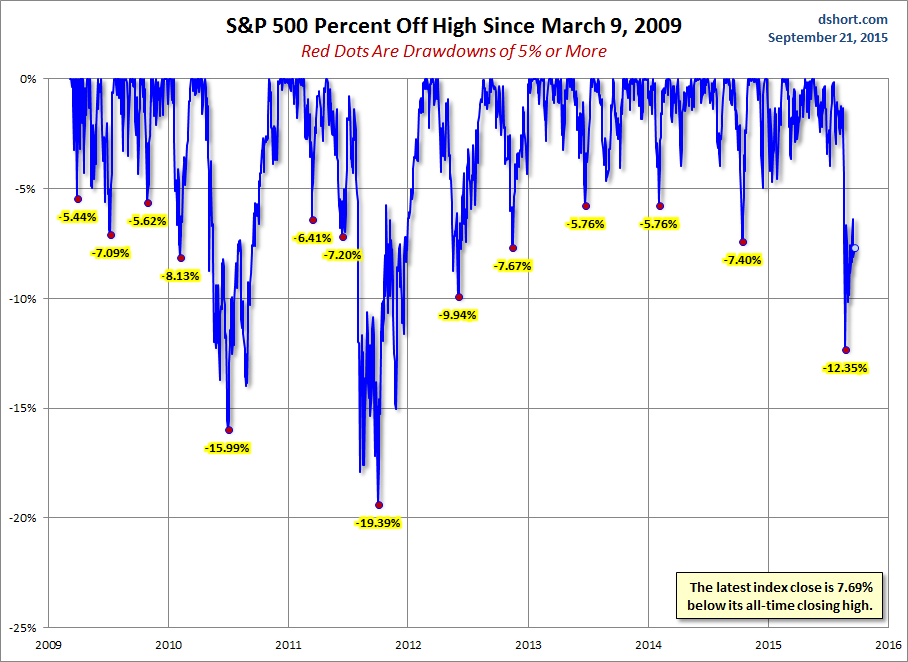

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 through.

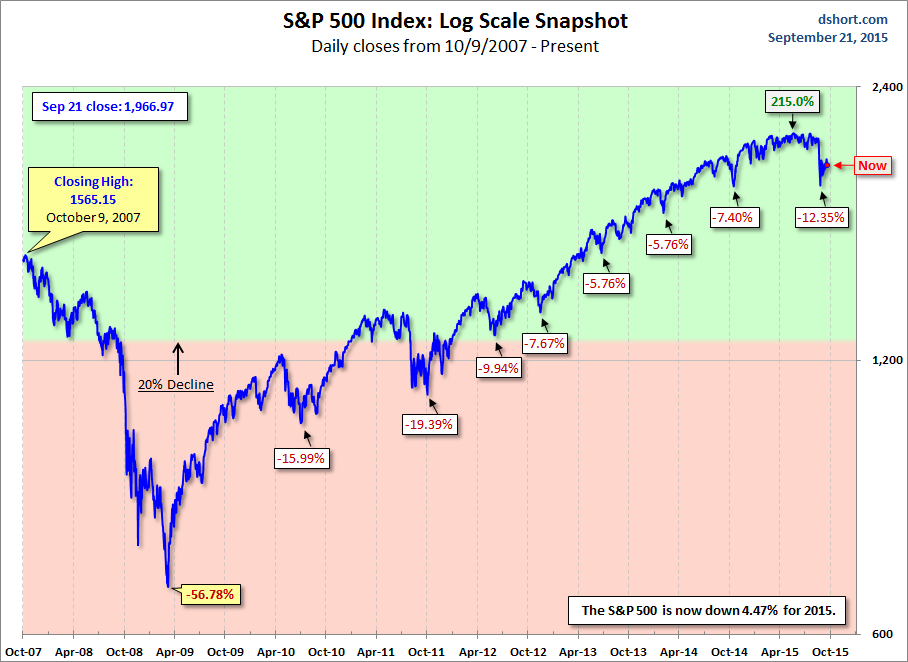

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.