The rally in the S&P 500 that began with Monday's 2.22% surge moderated Thursday in a session that was marked by indecision. The index popped at the open and hit its 0.88% intraday high about 15 minutes later. It then reversed course and traded to its -0.56% intraday low less than an hour after the high. The index then traded to a more restrained afternoon high before giving up much of its gain at its 0.20% closing tally.

The 10-year Note closed the session at 2.15%, up another eight BPs from the previous close, a rather dramatic change from its 1.37% closing low in early July.

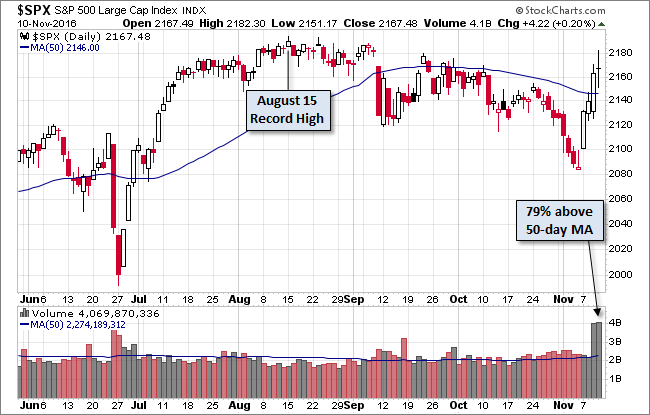

Here is a snapshot of the past five sessions.

Here's a daily chart of the index. Volume on Thursday's trade remained well above its 50-day moving average.

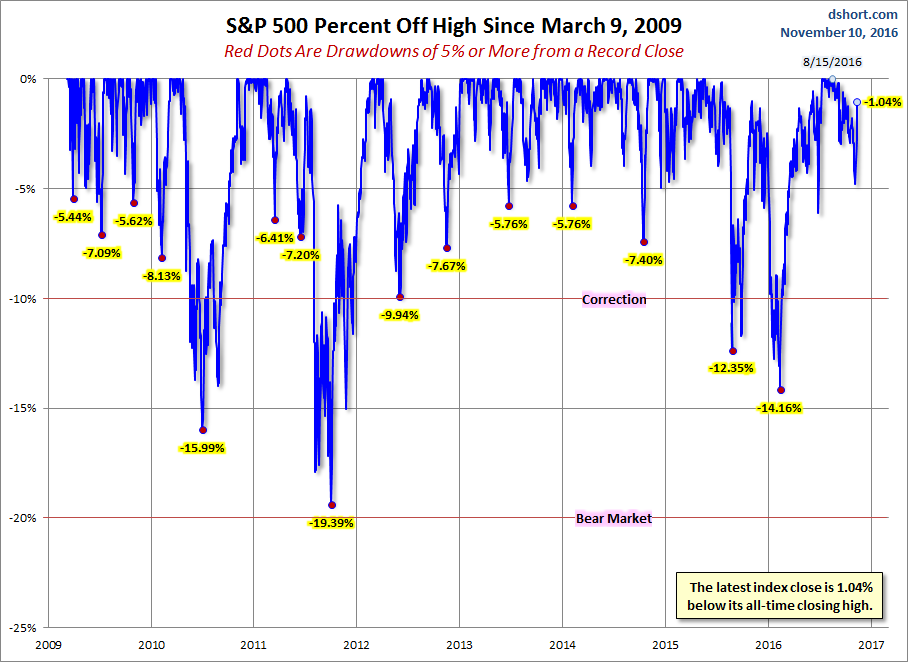

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

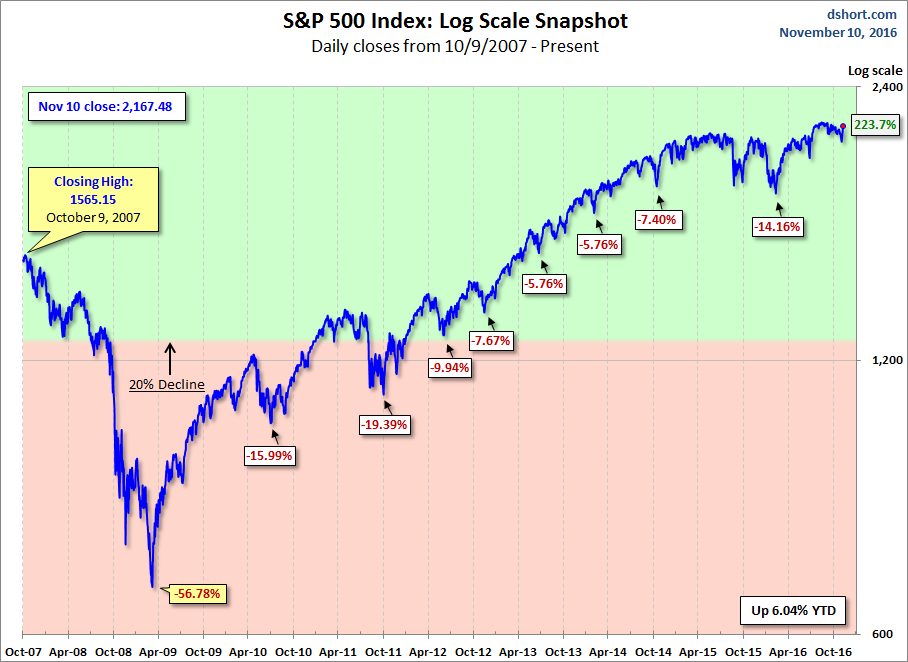

Here is a more conventional log-scale chart with drawdowns highlighted.

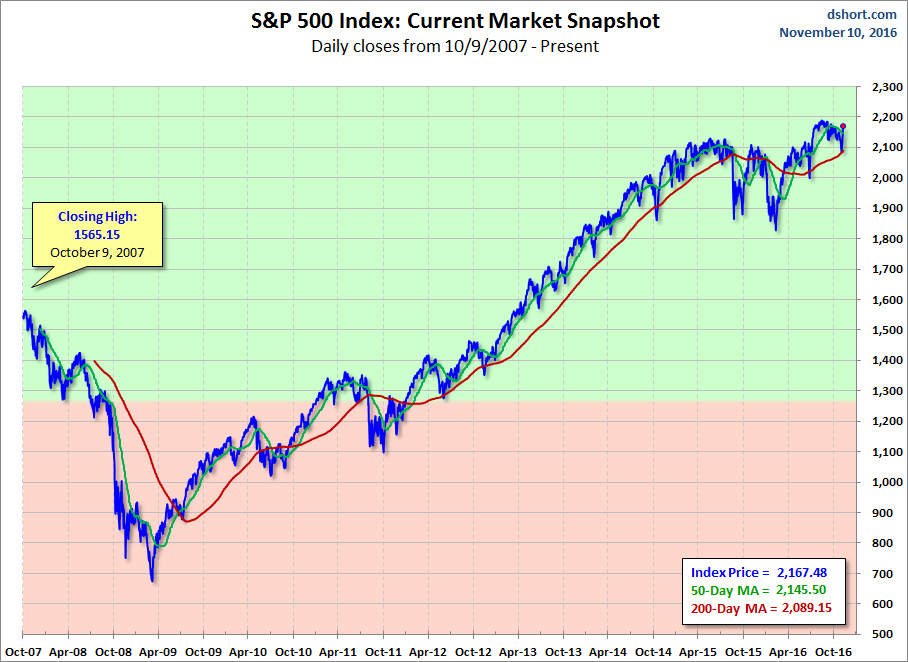

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

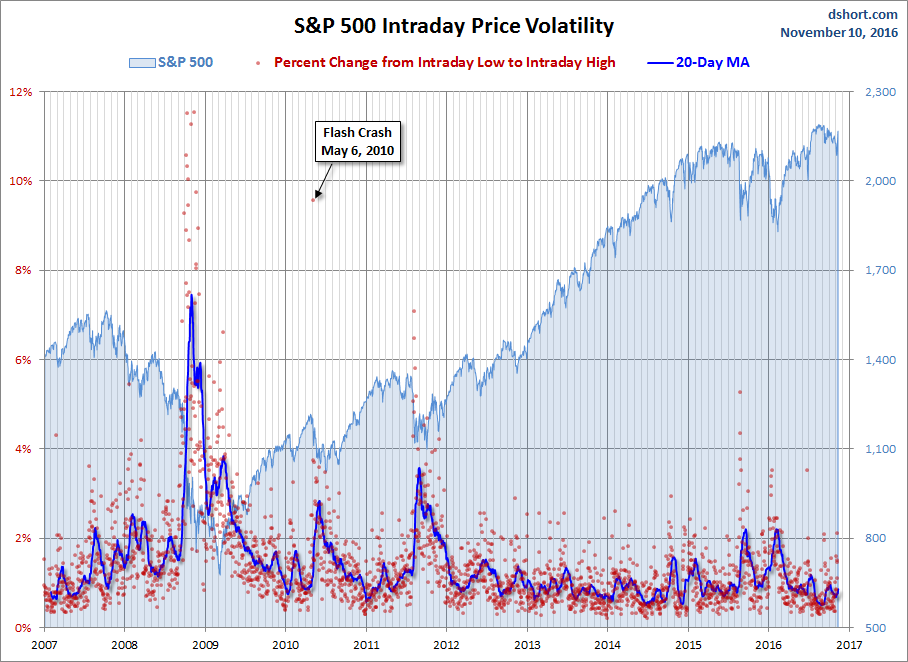

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.