Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

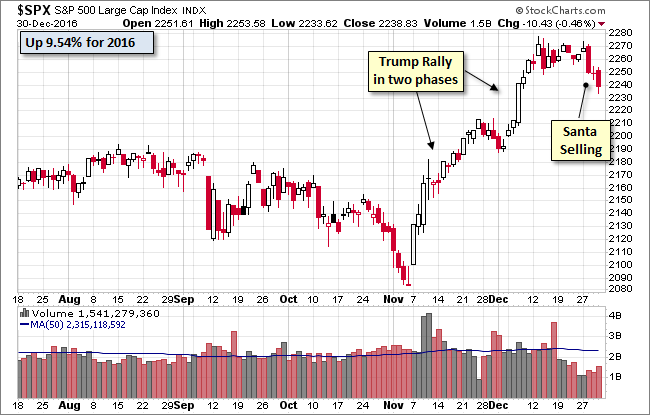

Sorry, no Santa Claus Rally for 2016. Apparently Santa was trumped by the Don, who lifted the S&P 500 6.18% from the election-day close to its latest record close on December 13th. The index then remained relatively flat for the next eight sessions, slipping a modest 0.35% from the record close to the pre-Christmas close.

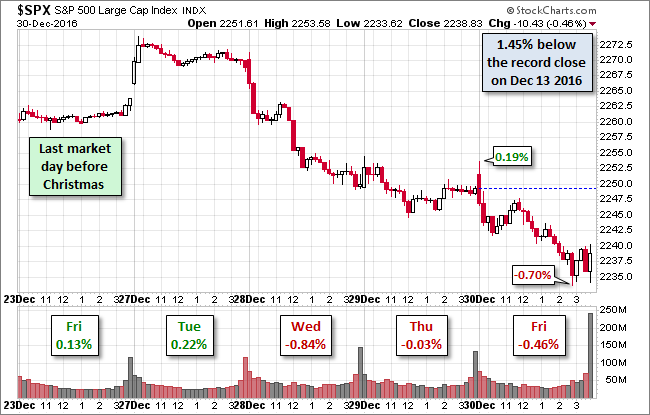

Would Santa bring a rally over the next four sessions? Alas, it was not to be. Following the holiday Monday, the 500 posted a fractional 0.22% gain on Tuesday, but then closed with losses for the next three sessions, falling 1.10% for the traditional Santa rally time frame.

Here is a snapshot of the past five sessions.

The yield on the 10-year note closed at 2.45%, down four BPs from its previous close and the lowest close in 14 sessions.

Here is daily chart of the index. We've highlighted the Trump Rally and the Santa Slump.

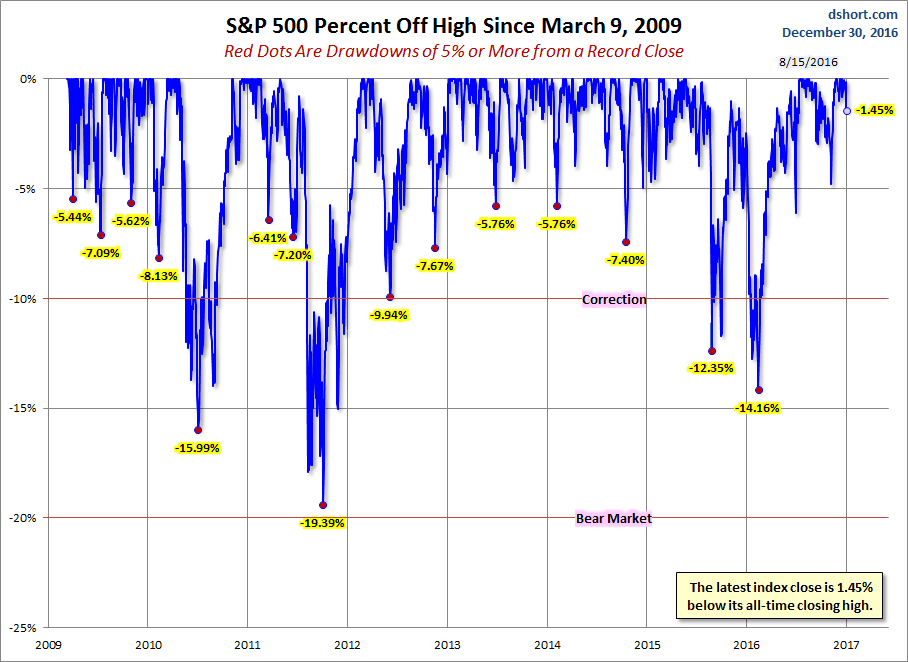

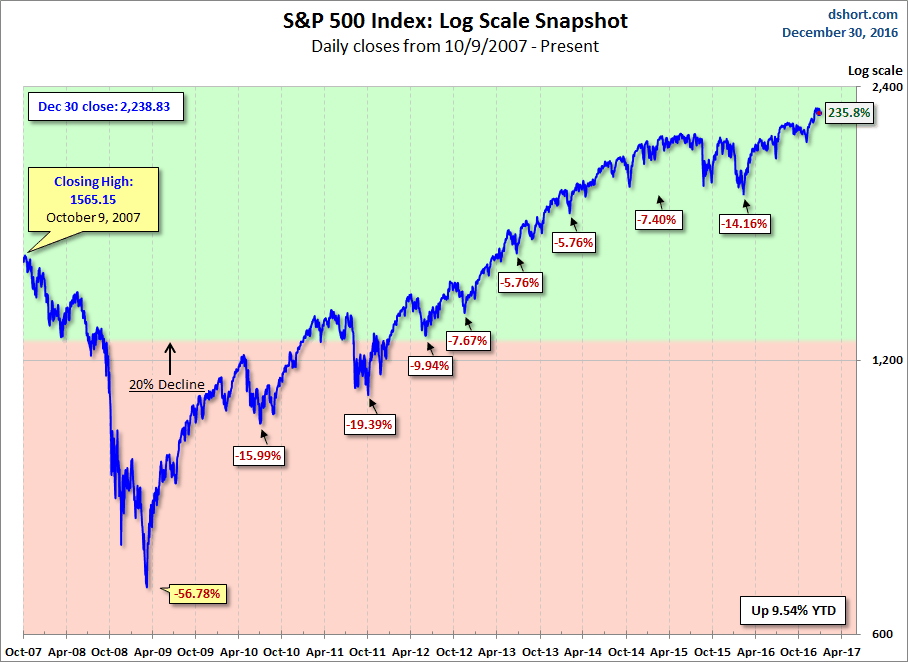

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

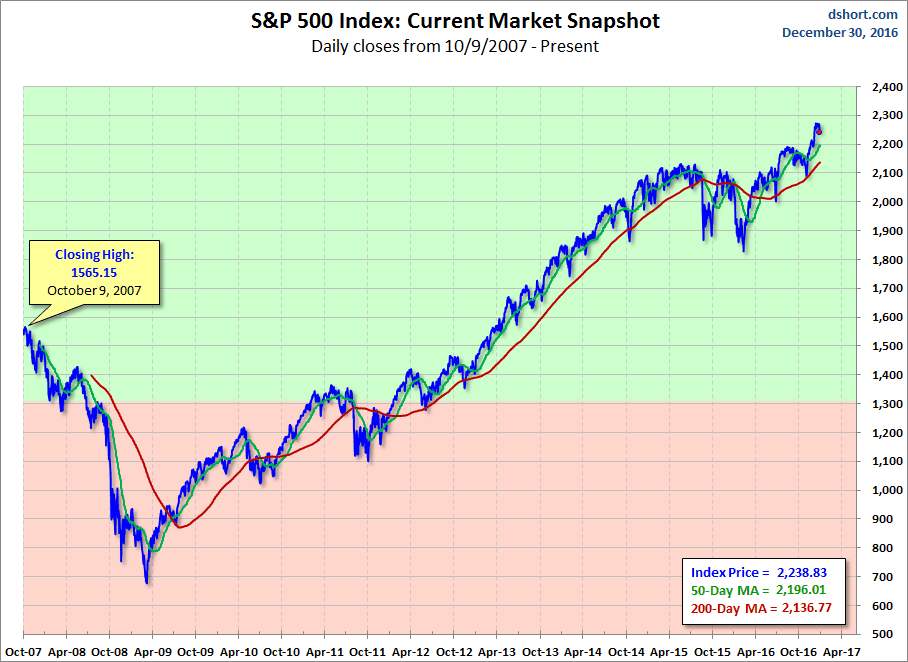

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

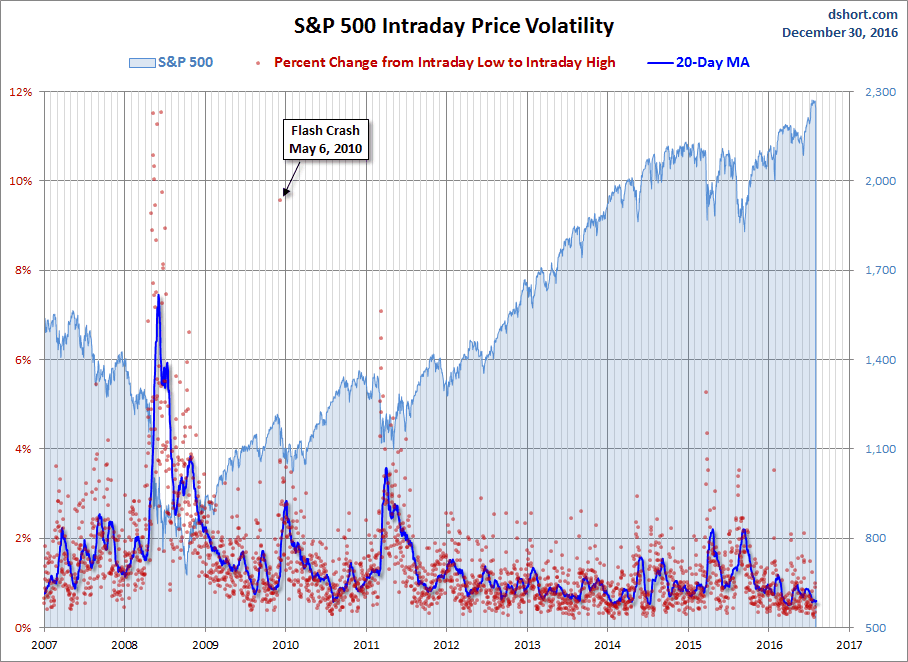

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.