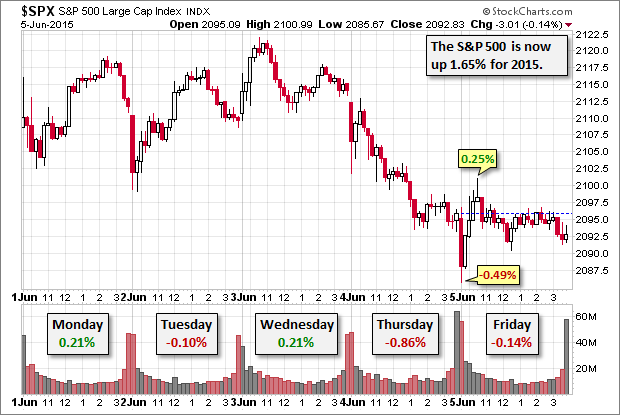

The expectation of a market-moving employment report didn't prove to be the case on Friday. The headline jobs numbers looked strong: 280K new nonfarm jobs. The uptick from 5.4% to 5.5% for the unemployment rate was the result of a 397K increase in the size of the labor force against only 125K additional unemployed. The S&P 500 dropped to its -0.49% intraday low 10 minutes after the opening bell. An hour after that it had risen to its 0.25% intraday high. The faint attempt at a rally quickly failed, and the index spent the rest of the day trading in an exceptionally narrow trading range centered in the shallow red. It ended with a fractional -0.14% decline for the day and a -0.69% decline for the week.

Why the weak performance after a good jobs report? The general pundit position is that Friday's employment report increases the odds of a Fed rate hike this fall. Meanwhile Treasuries tanked. The yield on the 10-year note closed at 2.41%, up 10 bps from yesterday's close and its highest close in eight months.

Here is a 15-minute chart of the past five sessions.

Today's wheel-spinning came on an uptick in trading volume.

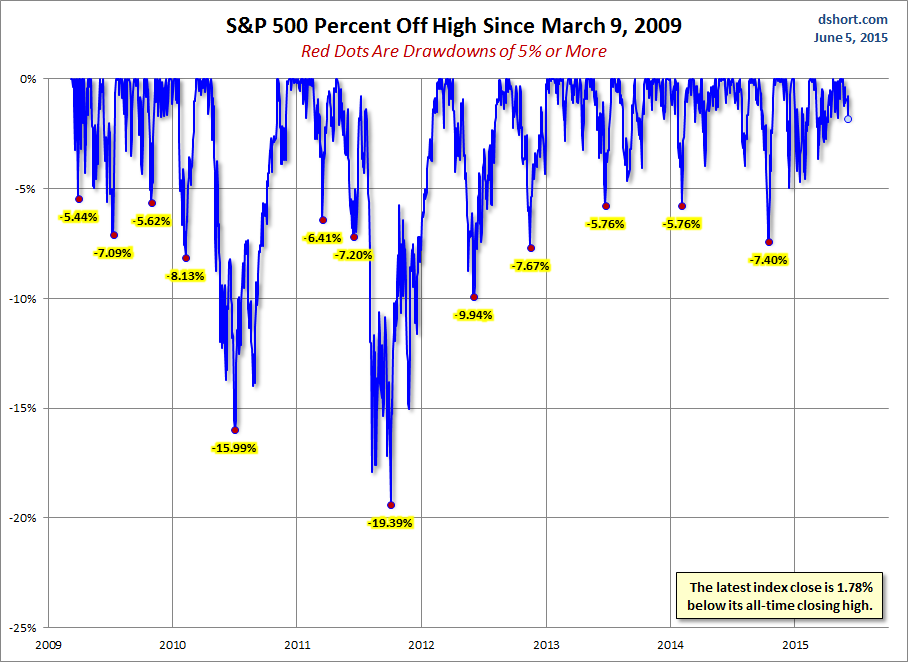

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

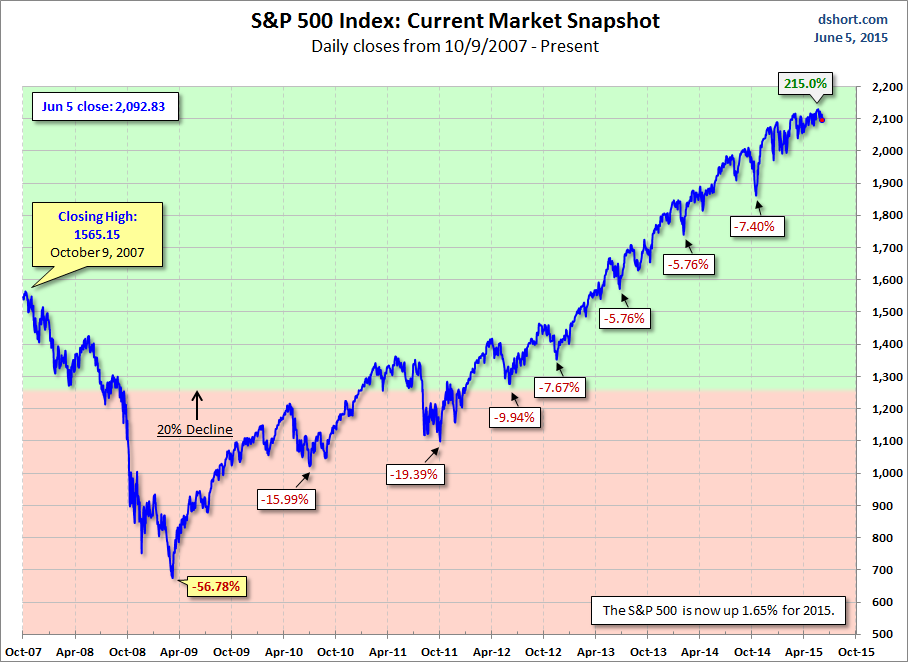

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.